Concept explainers

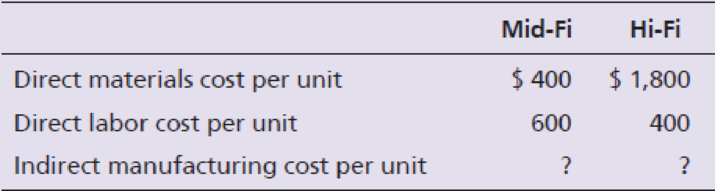

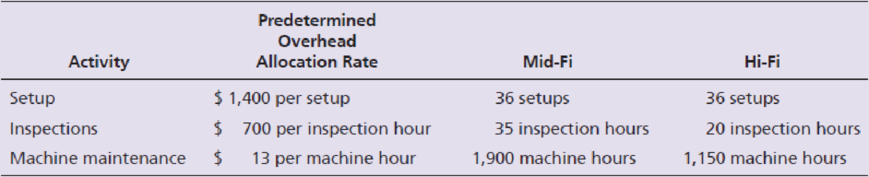

Jaunkas Corp. manufactures mid-fi and hi-fi stereo receivers. The following data have been summarized:

Indirect

The company plans to manufacture 125 units of the mid-fi receivers and 250 units of the hi-fi receivers. Calculate the product cost per unit for both products using activity-based costing.

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

PRIN.OF CORPORATE FINANCE

Engineering Economy (17th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

Principles of Economics (MindTap Course List)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College