Concept explainers

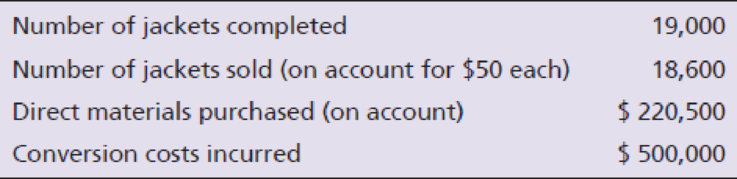

High Mountain produces fleece jackets. The company uses JIT costing for its JIT production system.

High Mountain has two inventory accounts: Raw and In-Process Inventory and Finished Goods Inventory. On April 1, 2018, the account balances were Raw and In-Process Inventory, $10,000; Finished Goods Inventory, $2,100.

The

Requirements

- 1. What are the major features of a JIT production system such as that of High Mountain?

- 2. Prepare summary

journal entries for April. Underallocated or overallocated conversion costs are adjusted to Cost of Goods Sold monthly. - 3. Use a T-account to determine the April 30, 2018, balance of Raw and In-Process Inventory.

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Principles of Microeconomics (MindTap Course List)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Marketing: An Introduction (13th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

- Need answerarrow_forwardHarvey’s Home Decor common stock is currently selling at $72.50 per share. The company follows a 65% dividend payout ratio and has a P/E ratio of 22. There are 50,000 shares of stock outstanding. What is the amount of the annual net income for the firm?arrow_forwardActual variable overhead ratearrow_forward

- In a certain standard costing system, the following results occurred last period: total labor variance, 3200 F; labor efficiency variance, 4,300 F; and the actual labor rate was $0.35 more per hour than the standard labor rate. The number of direct labor hours used last period was __.arrow_forwardThe annual fixed overhead is 250000, variable overhead:35arrow_forwardneed help this questionsarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,