Concept explainers

Problem 19-5B

Production transactions, subsidiary records, and source documents

P1 P2 P3 P4

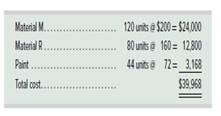

King Company produces variations of its product, a megaton, in response to custom orders from its customers, On June 1, the company had no inventories of work in process or finished goods but held the following raw materials.

On June 3, the company began working on two megatons: Job 450 for Encinita Company and Job 451 for Fargo, Inc.

Required

Using Exhibit 19.3 as a guide, prepare

a. Purchased raw materials on credit and recorded the following information from receiving reports and invoices.

Instructions: Record these purchases with a single

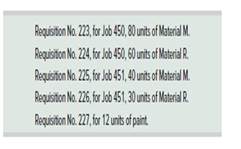

b. Requisitioned the following raw materials for production.

Instructions: Enter amounts for direct materials requisitions on the materials ledger cards and the job cost sheets. Enter the indirect materials amount on the materials ledger card. Do not record a journal entry at this time.

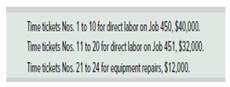

c. Received the following employee time tickets for work in June.

Instructions: Record direct labor from the time tickets on the job cost sheets. Do not record a journal entry at this time.

d. Paid cash for the Mowing items during the month: factory payroll, $84,000, and miscellaneous

Instructions: Record these payments with journal entries.

e. Finished Job 450 and transferred it to the warehouse. The company assigns overhead to each job with a predetermined overhead rate equal to 70% of direct labor cost.

Instructions: Enter the applied overhead on the cost sheet for Job 450, fill in the cost summary section of the cost sheet, and then mark the cost sheet "Finished." Prepare a journal entry to record the job's completion and its transfer to Finished Goods. f. Delivered Job 450 and accepted the customer's promise to pay $290,000 within 30 days,

Instructions: Prepare journal entries to record the sale of Job 450 and the cost of goods sold, g. Applied overhead cost to Job 451 based on the job's direct labor used to date,

Instructions: Enter overhead on the job cost sheet but do not mate a journal entry at tins time. h. Recorded the total direct and indirect materials costs as reported on all the requisitions for the month.

Instructions: Prepare a journal entry to record these. i. Recorded the total overhead costs applied to jobs. Instructions: Prepare a journal entry to record the allocation of these overhead costs. j. Compute the balance in the Factory Overhead account as of the end of June.

Check (h) Dr. Work in Process Inventory, $38,400

(j) Balance in Factory Overhead, $736 Cr., overapplied

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

Connect Access Card For Fundamental Accounting Principles

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardCan you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning