Concept explainers

You are on your way to an important budget meeting. In the elevator, you review the project valuation analysis you had your summer associate prepare for one of the projects to be discussed:

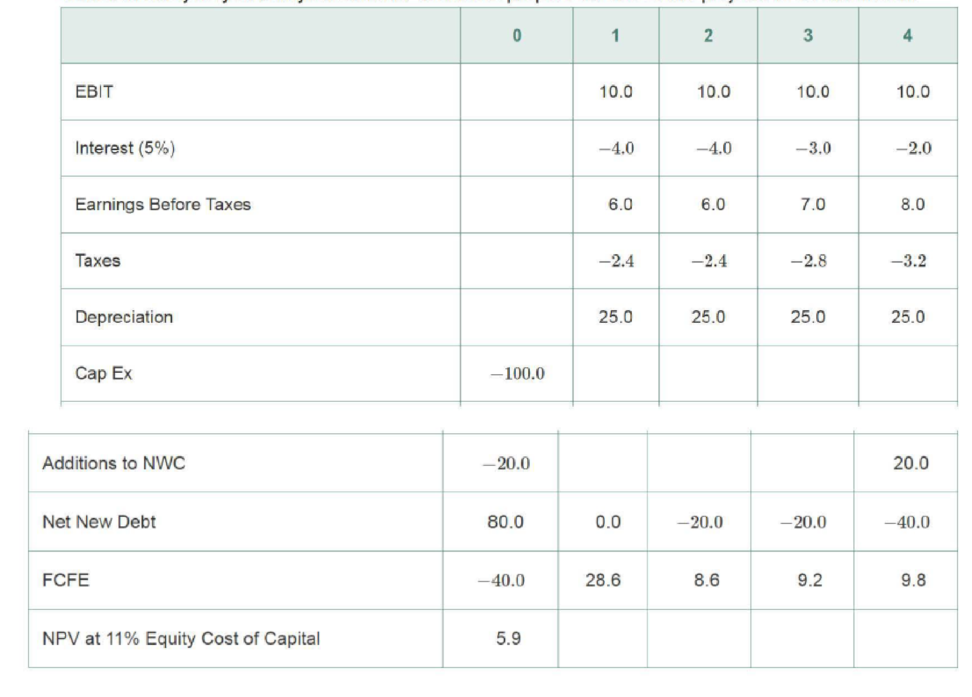

Looking over the spreadsheet, you realize that while all of the cash flow estimates are correct, your associate used the flow-to-equity valuation method and discounted the cash flows using the company’s equity cost of capital of 11%. While the project's risk is similar to the firm’s, the project’s incremental leverage is very different from the company's historical debt-equity ratio of 0.20: For this project, the company will instead borrow $80 million upfront and repay $20 million in year 2, $20 million in year 3, and $40 million in year 4. Thus, the project's equity cost of capital is likely to be higher than the firm’s, not constant over time-invalidating your associate’s calculation.

Clearly, the FTE approach is not the best way to analyze this project. Fortunately, you have your calculator with you, and with any luck you can use a better method before the meeting starts.

- a. What is the

present value of the interest tax shield associated with this project? - b. What are the

free cash flows of the project? - c. What is the best estimate of the project’s value from the information given?

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

- After analysing the financial data of Q-Constructions, you notice that they are trending in the right direction. A new 12-month construction proposal has come to the company worth $1,000,000 and an important question is whether it will be financially viable. They want you to analyse the proposal, in particular, the recommended cash flow schedule and to understand the key financial points during the construction project. The following cash flow schedule is summarised below. To ensure that all upfront and on-going outlay costs are covered in advance, Q-Constructions incur an initial start-up cost of $200,000. The proposal states that they will receive a deposit from the client of 10% of the total project price at the beginning. They then receive four equal instalment payments of 20% of the total project price associated to project milestones from the client at the end of the 2nd, 6th, 8th and 10th month. Finally, they receive the last 10% project milestone on lock-up which occurs at the…arrow_forwardAfter analysing the financial data of Q-Constructions, you notice that they are trending in the right direction. A new 12-month construction proposal has come to the company worth $1,000,000 and an important question is whether it will be financially viable. They want you to analyse the proposal, in particular, the recommended cash flow schedule and to understand the key financial points during the construction project. The following cash flow schedule is summarised below. To ensure that all upfront and on-going outlay costs are covered in advance, Q-Constructions incur an initial start-up cost of $200,000. The proposal states that they will receive a deposit from the client of 10% of the total project price at the beginning. They then receive four equal instalment payments of 20% of the total project price associated to project milestones from the client at the end of the 2nd, 6th, 8th and 10th month. Finally, they receive the last 10% project milestone on lock-up which occurs at the…arrow_forwardAfter analysing the financial data of Q-Constructions, you notice that they are trending in the right direction. A new 12-month construction proposal has come to the company worth $1,000,000 and an important question is whether it will be financially viable. They want you to analyse the proposal, in particular, the recommended cash flow schedule and to understand the key financial points during the construction project. The following cash flow schedule is summarised below. To ensure that all upfront and on-going outlay costs are covered in advance, Q-Constructions incur an initial start-up cost of $200,000. The proposal states that they will receive a deposit from the client of 10% of the total project cost at the beginning. They then receive four equal instalment payments of 20% of the total project cost associated to project milestones from the client at the end of the 2nd, 6th, 8th and 10th month. Finally, they receive the last 10% project milestone on lock-up which occurs at the…arrow_forward

- As a recent graduate of the UWIOC, The General Manager of the company has hired you to work alongside the Financial Controller of the company to help determine whether the company should invest in the new product line. He has provided you with the following questions to guide you in your assessment of the project and to present your findings to the Company. 1. Determine the weighted average cost of capital (WACC) for Vigour Pharmaceuticals. (Formula to be used is attached)arrow_forwardPlease Answer sub-parts D,E & F Thnak you.arrow_forwardAs a recent graduate of the UWIOC, The General Manager of the company has hired you to work alongside the Financial Controller of the company to help determine whether the company should invest in the new product line. He has provided you with the following questions to guide you in your assessment of the project and to present your findings to the Company. 1. Determine the weighted average cost of capital (WACC) for Vigour Pharmaceuticals. (Formula to be used below)arrow_forward

- Please show all work on excel. You just got hired by McKinsey & Company as a financial consultant and they’re paying you an egregious amount of money. Accordingly, they have you working on the tough projects – like this one… Consider the following two mutually exclusive projects available to the firm. Free cash flows for Projects A and B are provided below. Assume the two projects have essentially the same level of riskiness, and your prior analysis indicates that the appropriate risk-adjusted hurdle rate (i.e., the WACC) is 7.45% for both projects. Perform the analysis below and make a recommendation as to which project to pursue. Year 0 1 2 3 4 5 6 Project A -$3,200 $700 $700 $700 $700 $700 $700 Project B -$600 $58 $58 $695 B. Compute the NPV for both projects using the crossover rate as the discount rate. What do you find? c. Compute the NPV for each project (using the WACC of 7.45% as the discount rate). Based on NPV, which project should be selected? Note:-…arrow_forwardAs a financial analyst, you are tasked with evaluating a capital-budgeting project. You were instructed to use the IRR method, and you need to determine an appropriate hurdle rate. The risk-free rate is 4%, and the expected market rate of return is 11%. Your company has a beta of 0.75, and the project that you are evaluating is considered to have risk equal to the average project that the company has accepted in the past. According to CAPM, the appropriate hurdle rate would be A. 15%. B. 9.25%. C. 4%. D. 11%. E. 0.75%arrow_forwardA company manager asked you to evaluate an investment opportunity. Select and explain two (2) investment criteria you will use to make a decision as to whether to accept or reject the opportunity. You are the CFO of Midas Mining Ltd and the company is looking to expand its mining operations. Your staff have narrowed it down to two (2) projects, with the cash flows presented in the table below. However, given the substantial cash outlay, your company can only choose one of the projects (A or B). Information Project A Project B Cost $5 550 000 $6 640 000 Required: a) Perform a project evaluation, using the Net Present Value (NPV) The prevailing discount rate is 12%. b) Identify which project (if any) should be accepted by Midas Mining Ltd.arrow_forward

- A company puts together a set of cash flow projections and calculates an IRR of 25% for the project. The firm's cost of capital is about 10%. The CEO maintains that the favorability of the calculated IRR relative to the cost of capital makes the project an easy choice for acceptance and urges management to move forward immediately. i. Should this project be evaluated using different standards? ii. How does the possibility of bankruptcy as a result of the project affect the analysis? iii. Are capital budgeting rules still appropriate?arrow_forwardTravellers Inn (Millions of Dollars) Cash $ 10 Accounts payable $ 10 Accounts 20 Accruals 15 receivable Inventories 20 Short-term debt Current assets $ 50 Current liabilities $ 25 Net fixed assets 50 Long-term debt 30 Preferred stock (50,000 shares) 5 Common equity Common stock (3,800,000 shares) $ 10 Retained earnings 30 Total common equity $ 40 Total assets $100 Total liabilities and equity $100 The following facts also apply to TII: 1. The long-term debt consists of 29,412 bonds, each having a 20-year maturity, semiannual payments, a coupon rate of 7.8%, and a face value of $1,000. Currently, these bonds provide investors with a yield to maturity of 11.8%. If new bonds were sold, they would have an 11.8% yield to maturity. 2. TII's perpetual preferred stock has a $100 par value, pays a quarterly dividend per share of $2, and has a yield to investors of 8%. New perpetual preferred stock would have to provide the same yield to investors, and the company would incur a 3.55% flotation…arrow_forwardYour firm is evaluating a capital budgeting project. The estimated cash flows appear below. The board of directors wants to know the expected impact on shareholder wealth. Knowing that the estimated impact on shareholder wealth equates to net present value (NPV), you use your handy calculator to compute the value. What is the project's NPV? Assume that the cash flows occur at the end of each year. The discount rate (i.e., required rate of return, hurdle rate) is 15.1%. (Round to nearest penny) Year 0 cash flow -118,000 Year 1 cash flow 52,000 Year 2 cash flow 44,000 Year 3 cash flow 60,000 O Year 4 cash flow 47,000 Year 5 cash flow 28,000arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning