Concept explainers

FIFO method, assigning costs (continuation of 18-23).

Required

For the data in Exercise 18-21, use the FIFO method to summarize the total costs to account for; calculate the cost per equivalent unit for direct materials and conversion costs; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process.

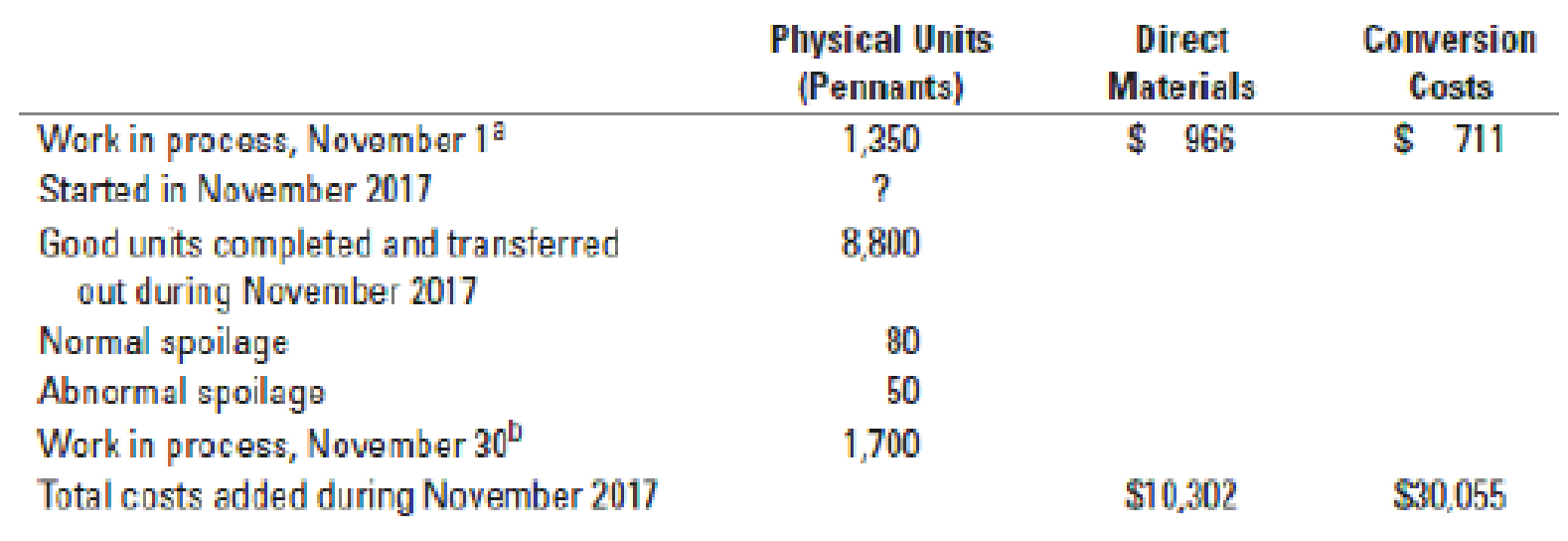

18-21 Weighted-average method, spoilage, equivalent units. (CMA, adapted) Consider the following data for November 2017 from MacLean Manufacturing Company, which makes silk pennants and uses a process-costing system. All direct materials are added at the beginning of the process, and conversion costs are added evenly during the process. Spoilage is detected upon inspection at the completion of the process. Spoiled units are disposed of at zero net disposal value. MacLean Manufacturing Company uses the weighted-average method of

a Degree of completion: direct materials, 100%; conversion costs, 45%.

b Degree of completion: direct materials, 100%; conversion costs, 35%.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

Additional Business Textbook Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Managerial Accounting (5th Edition)

Macroeconomics

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Financial Accounting: Tools for Business Decision Making, 8th Edition

- Calculate the business return on assets? General accountingarrow_forwardUltimate Production manufactures radon detectors. The standard for materials for each detector is 2 pounds of acrylic at a standard cost of $4.30 per pound. During May, the company purchased 890 pounds and used 830 pounds of acrylic, and made 410 radon detectors. The company paid $4.45 per pound for the acrylic. There were 400 detectors budgeted for May. How much is the material quantity variance? A) $134 unfavorable B) $43 unfavorable C) $177 unfavorable D) $263 unfavorablearrow_forwardTrendy T's Corporation manufactures t-shirts, which is its only product. The standards for t-shirts are as follows: Standard direct materials cost per yard $9 Standard direct materials quantity per t-shirt (yards) 2 During the month of May, the company produced 1,550 t-shirts. Related production data for the month follows: Actual yards of direct material purchased Actual direct materials total cost 1,200 $ 20,800 What is the direct materials quantity variance for the month? A. $17,100 favorable B. $10,000 favorable C. $17,100 unfavorable D. $10,000 unfavorablearrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning