Major Fund Tests

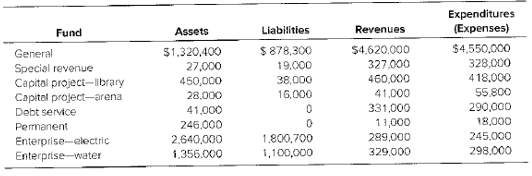

The City of Somerset has the following fund information:

Required

Apply the criteria specified in GASB 34 to determine which of these funds meets the major fund reporting criteria.

Introduction: GASB statement 34 requires governmental agencies to furnish two financial statements, governmental statements of revenues, expenditures, and changes in fund balance, and the governmental fund balance sheet. The fund based governmental entities only report major funds, to determine major funds, 10 percent criteria is used which says total assets, liabilities, revenues, or expenditures of the individual fund must be at least 10 percent, and 5 percent test which says that the total assets, liabilities, revenues or expenditures of the individual fund must be at least 5 percent of the corresponding total for all governmental plus enterprise funds combined.

The major fund for reporting using criteria specified in GASB 34.

Explanation of Solution

10 percent criterion test

| Funds | Assets $ | % | Liabilities$ | % | Revenues$ | % | Expenditures$ | % |

| Governmental fund | ||||||||

| General fund | 1,320,400 | 878,300 | 4,620,000 | 4,550,000 | ||||

| Special revenue | 27,000 | 1.3 | 19,000 | 2 | 327,000 | 5.65 | 328,000 | 5.8 |

| Library | 450,000 | 21.3 | 38,000 | 3.99 | 460,000 | 7.94 | 418,000 | 7.39 |

| Arena | 28,000 | 1.33 | 16,000 | 1.68 | 41,000 | 0.71 | 55,800 | 0.99 |

| Debt service | 41,000 | 1.94 | 0 | 0 | 331,000 | 5.72 | 290,000 | 5.12 |

| Permanent | 246,000 | 11.65 | 0 | 0 | 11,000 | 0.19 | 18,000 | 0.32 |

| Total | 2,112,400 | 100 | 951,300 | 100 | 5,790,000 | 100 | 5,659,800 | 100 |

| Funds | Assets $ | % | Liabilities$ | % | Revenues$ | % | Expenditures$ | % |

| Enterprise fund | ||||||||

| Enterprise − Electric | 2,640,000 | 66.1 | 1,800,700 | 62.1 | 289,000 | 47.8 | 245,000 | 45.1 |

| Enterprise − water | 1,355,000 | 33.9 | 1,100,000 | 37.9 | 329,000 | 53.2 | 298,000 | 54.9 |

| Total | 3,996,000 | 100 | 2,900,700 | 100 | 618,000 | 100 | 543,000 | 100 |

- General fund is always major fund.

- Funds percentage above 10 percent are major funds:

- Capital project fund − library and permanent fund is above 10 percent hence a major fund

- Both enterprise funds, electric and water are major funds as both the funds qualify 10 percent test

5 percent test:

| Funds | Assets $ | % | Liabilities$ | % | Revenues$ | % | Expenditures$ | % |

| Governmental fund | ||||||||

| General fund | 1,320,400 | 878,300 | 4,620,000 | 4,550,000 | ||||

| Special revenue | 27,000 | 0.44 | 19,000 | 0.5 | 327,000 | 5 | 328,000 | 5 |

| Library | 450,000 | 7.37 | 38,000 | 0.99 | 460,000 | 7.18 | 418,000 | 6.74 |

| Arena | 28,000 | 0.45 | 16,000 | 0.4 | 41,000 | 0.6 | 55,800 | 0.9 |

| Debt service | 41,000 | 0.7 | 0 | 0 | 331,000 | 5.16 | 290,000 | 4.7 |

| Permanent | 246,000 | 4.03 | 0 | 0 | 11,000 | 0.17 | 18,000 | 0.29 |

| Enterprise − Electric | 2,640,000 | 43.22 | 1,800,700 | 46.7 | 289,000 | 4.51 | 245,000 | 3.95 |

| Enterprise − water | 1,355,000 | 22.2 | 1,100,000 | 28.6 | 329,000 | 5.13 | 298,000 | 4.8 |

| Total | 6,108,400 | 100 | 3852,000 | 100 | 6,408,000 | 100 | 6,202,800 | 100 |

- General fund is always major fund.

- Funds percentage above 5 percent are major funds:

- Capital project fund − library and permanent fund is above 5 percent hence a major fund

- Both enterprise funds, electric and water are major funds as both the funds qualify 5 percent test

Want to see more full solutions like this?

Chapter 18 Solutions

Advanced Financial Accounting

Additional Business Textbook Solutions

Marketing: An Introduction (13th Edition)

Essentials of MIS (13th Edition)

Microeconomics

MARKETING:REAL PEOPLE,REAL CHOICES

Foundations of Financial Management

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardDepreciation is recorded in the books to:A. Increase asset valueB. Reflect fair market valueC. Allocate asset cost over timeD. Improve cash flow correct solarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education