Concept explainers

Nuttʼs management is very concerned about the cost of

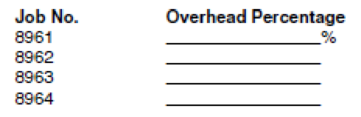

Did Nutt maintain good cost control on all its jobs? Explain.

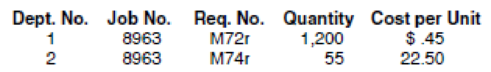

Worksheet. During September, Job 8963 required two additional material requisitions to complete the job. Open JOB8963 and modify the

Preview the printout to make sure it will print neatly on one page, and then print the worksheet. Save the completed worksheet as JOBT.

Chart. Open JOB8964 and click the Chart sheet tab. Prepare a bar chart for JOB8964 showing the amount of material, labor, and overhead required to complete the job. Use the Chart Data Table found in rows 42–46 as a basis for preparing the chart. Enter your name somewhere on the chart. Save the file again as J0B8964. Print the chart.

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Excel Applications for Accounting Principles

- Direct materials used totaled $65,750; direct labor incurred totaled $199,400; manufacturing overhead totaled $344,800; Work in Process Inventory on January 1, 2004, was $186,100; and Work in Process Inventory on December 31, 2004, was $191,600. What is the cost of goods manufactured for the year ended December 31, 2004?arrow_forwardhelp me to solve this questionsarrow_forwardTyson manufacturing company produces and sells 120,000 units of a single product. Variable costs total $340,000 and fixed costs total $480,000. If each unit is sold for $12, what markup percentage is the company using?arrow_forward

- 3 pointsarrow_forwardCrescent Manufacturing produces a single product. Last year, the company had a net operating income of $102,400 using absorption costing and $94,100 using variable costing. The fixed manufacturing overhead cost was $5 per unit. There were no beginning inventories. If 32,000 units were produced last year, then sales last year were_. (a) 21,750 units (b) 29,820 units (c) 30,440 units (d) 35,600 unitsarrow_forwardI don't need ai answer general accounting questionarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub