Concept explainers

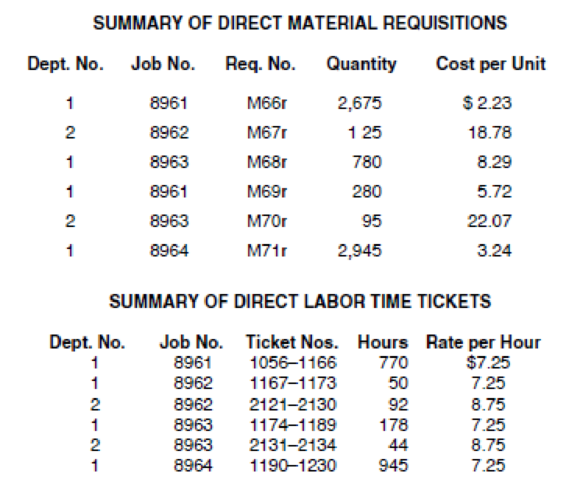

Nutt Products manufactures screws and bolts made to customer specifications. During August, Nutt incurred the following

The overhead application rates are $4 per direct labor hour for Dept. 1 and 175% of direct labor cost for Dept. 2.

Nutt had no beginning work in process for August. Job 8958, which cost $14,190.18 to manufacture, was completed in July and was sold on account in August for $19,000. The

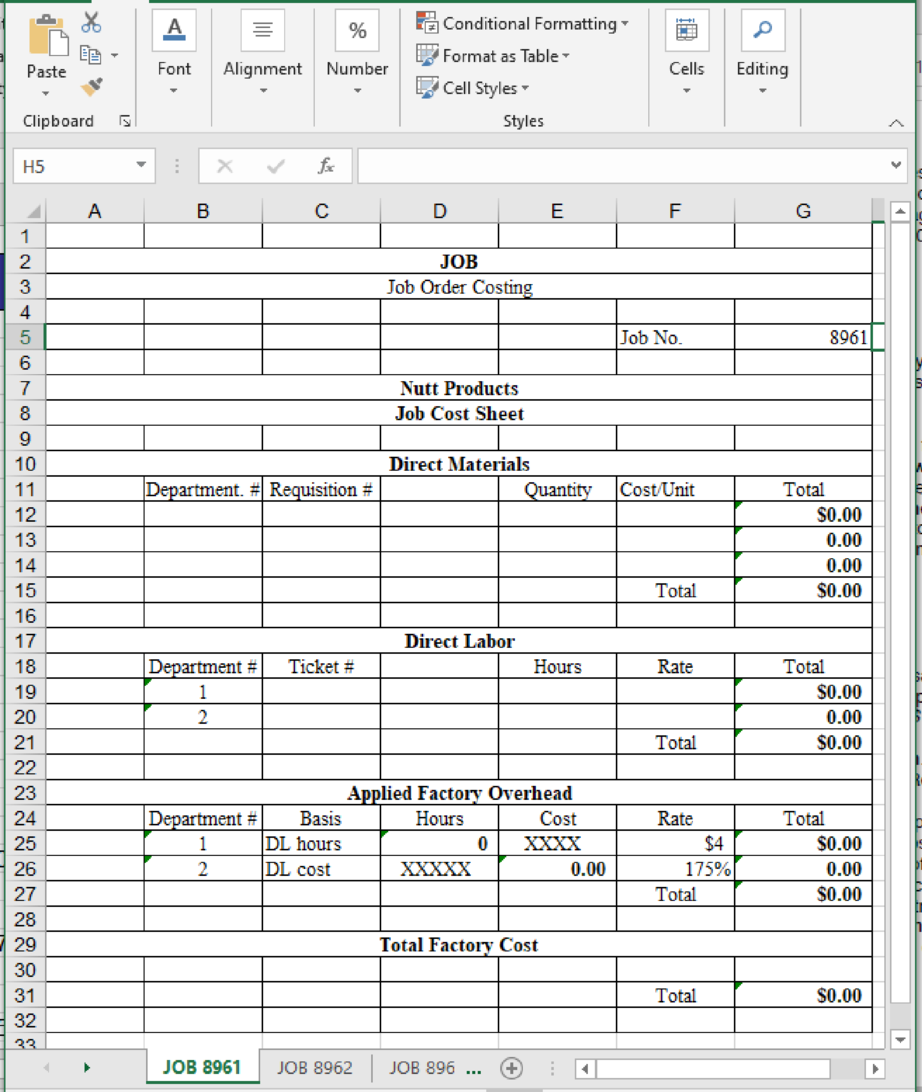

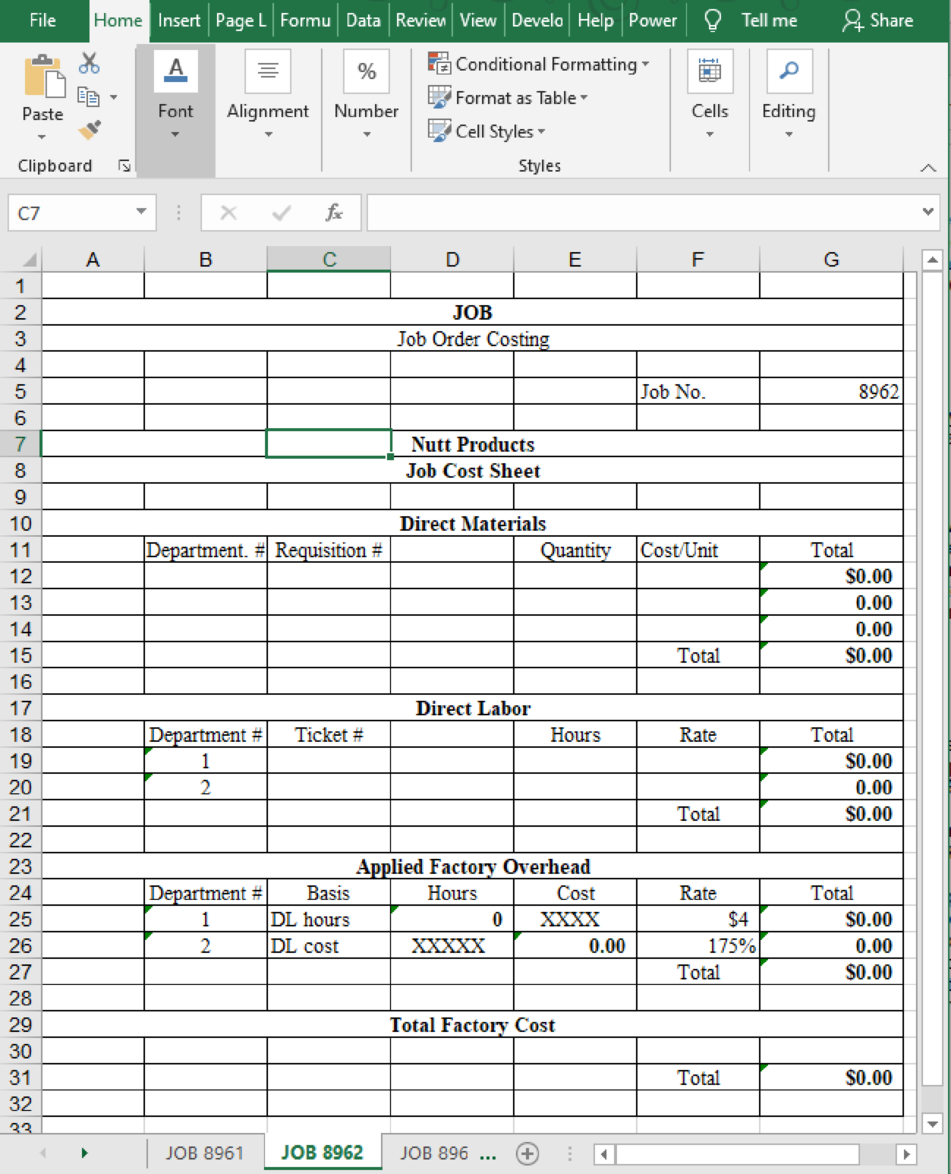

As cost accountant for this company, you have been asked to prepare job cost sheets for each of the four jobs started in August. Review the printed worksheet called JOB that follows these requirements.

Prepare job cost sheets for each of the four jobs started in the month of August.

Explanation of Solution

Prepare job cost sheets for Job 8961.

Table (1)

Prepare job cost sheets for Job 8962.

Table (2)

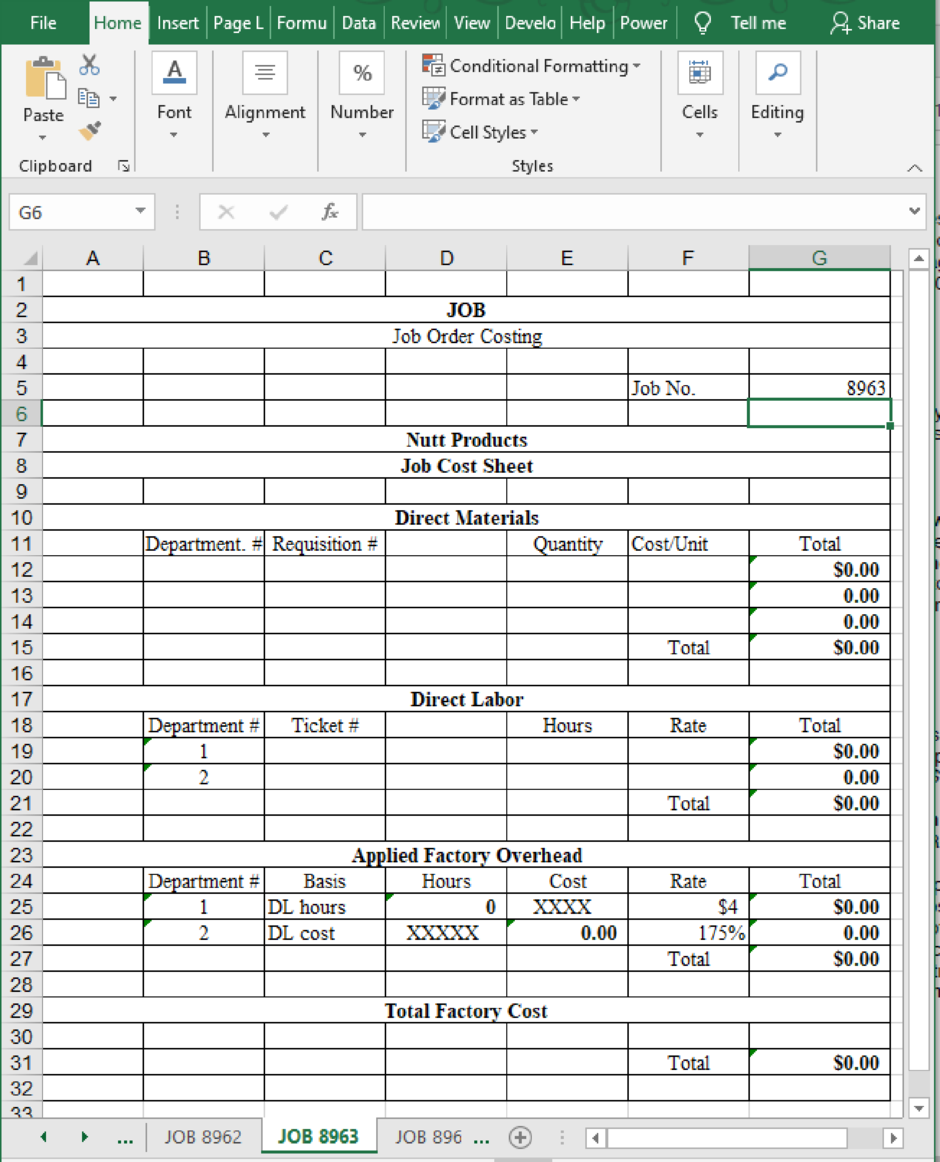

Prepare job cost sheets for Job 8963.

Table (3)

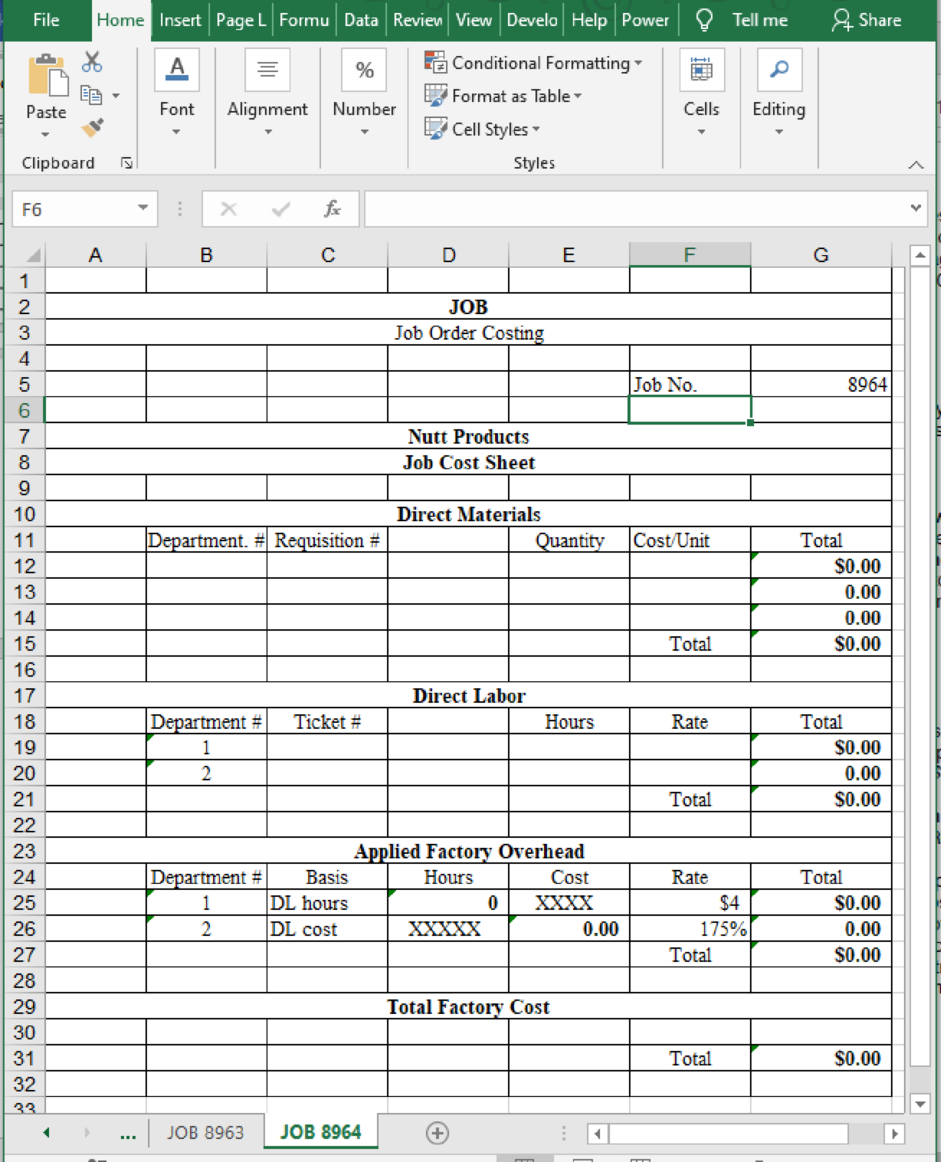

Prepare job cost sheets for Job 8964.

Table (4)

Want to see more full solutions like this?

Chapter 17 Solutions

Excel Applications for Accounting Principles

- Kindly help me with this question general accountingarrow_forwardNeed Answer of this General Accounting Question solutionarrow_forwardHow does stewardship accounting differ from traditional ownership accounting? a) Management decisions have no impact b) Legal ownership determines all treatments c) Resource management priorities supersede ownership rights d) Only shareholders matterarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning