The weekly demand (in cases) for a particular brand of automatic dishwasher detergent for a chain of grocery stores located in Columbus, Ohio, follows.

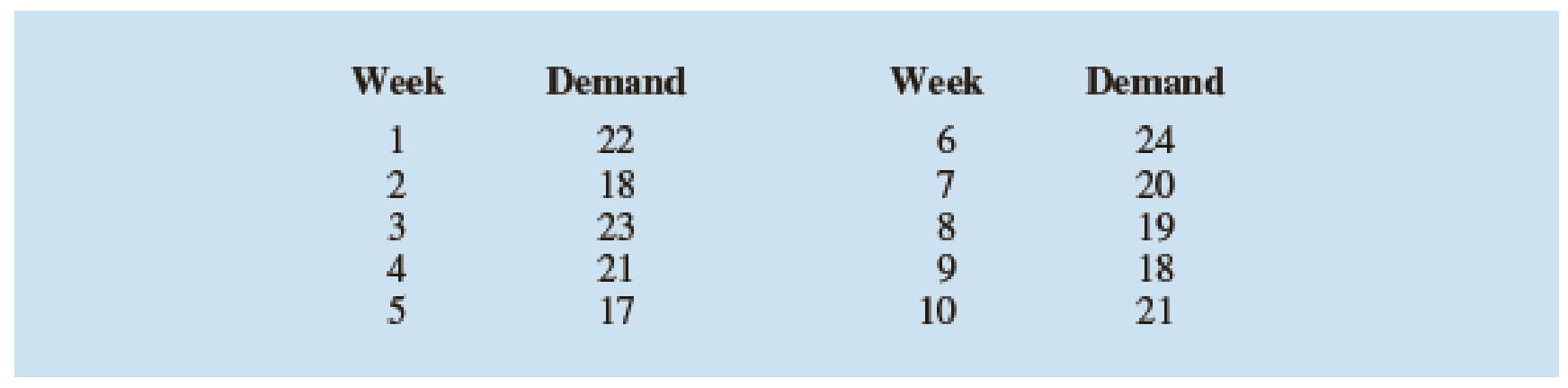

- a. Construct a time series plot. What type of pattern exists in the data?

- b. Use a three-week moving average to develop a forecast for week 11.

- c. Use exponential smoothing with a smoothing constant of α = .2 to develop a forecast for week 11.

- d. Which of the two methods do you prefer? Why?

a.

Construct the time series plot.

Explain the type of pattern.

Answer to Problem 41SE

The time series plot is given below:

The pattern that appears in the graph is a horizontal pattern.

Explanation of Solution

Calculation:

The given data represent the weekly demand for automatic dishwasher detergent.

Software procedure:

Step-by-step software procedure to draw the time series plot using EXCEL:

- Open an EXCEL file.

- In column A, enter the data of Week, and in column B, enter the corresponding values of Demand.

- Select the data that are to be displayed.

- Click on the Insert Tab > select Scatter icon.

- Choose a Scatter with Straight Lines and Markers.

- Click on the chart > select Layout from the Chart Tools.

- Select Chart Title > Above Chart and enter Time Series Plot.

- Select Axis Title > Primary Horizontal Axis Title > Title Below Axis.

- Enter Week in the dialog box.

- Select Axis Title > Primary Vertical Axis Title > Rotated Title.

- Enter Demand in the dialog box.

From the output, the pattern that appears in the graph is a horizontal pattern.

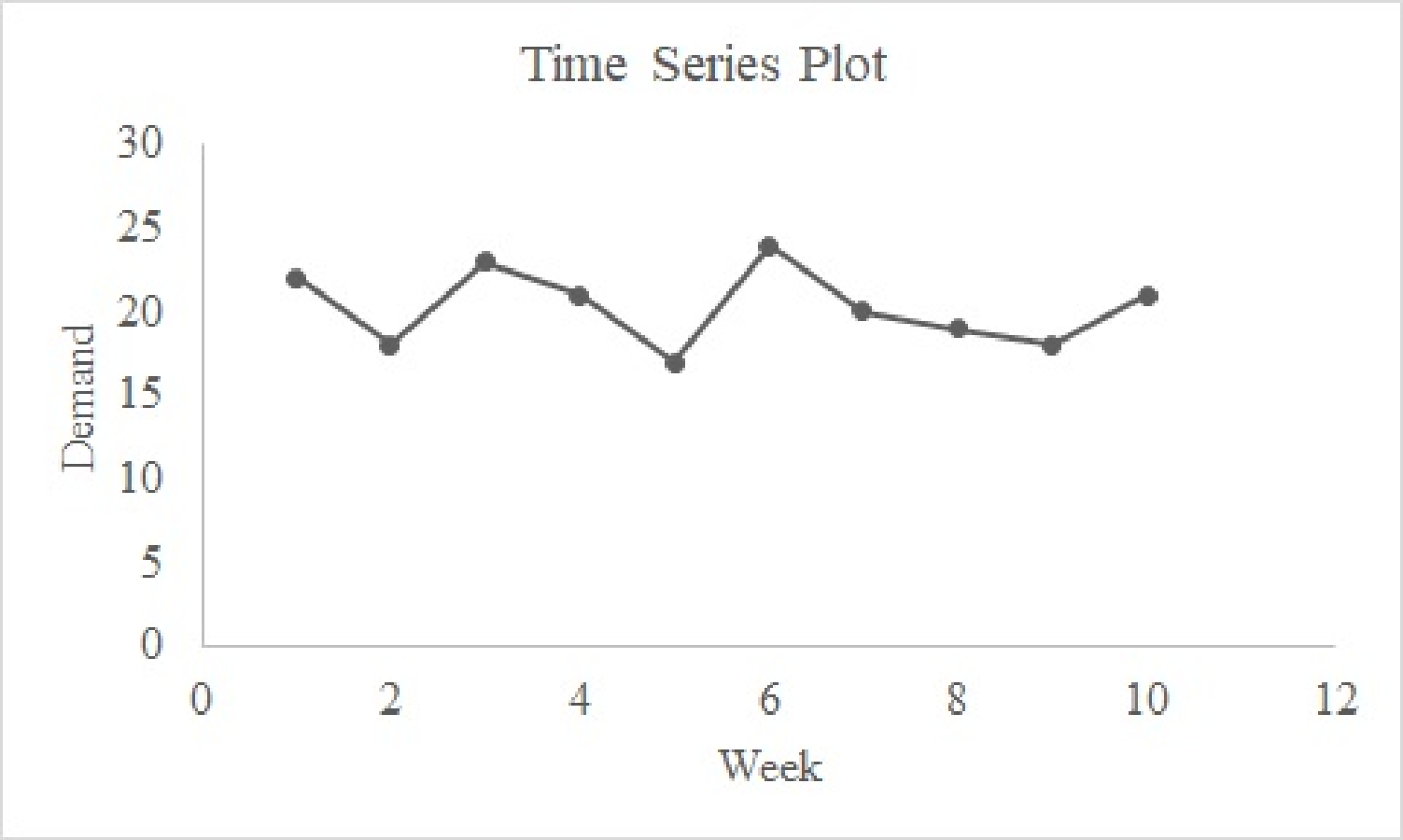

b.

Calculate the forecast for week 11 using three-week moving averages.

Answer to Problem 41SE

The forecast for week 11 using three-week moving averages is 19.33.

Explanation of Solution

Calculation:

The forecast for week 11 using three-week moving averages is to be obtained.

Software procedure:

Step-by-step procedure to obtain the forecasts using EXCEL:

- In column A, enter the data of Month, and in column B, enter the corresponding values of Demand.

- In Data, select Data Analysis and choose Moving Average.

- In Input Range, select Demand.

- Select Label in First Row.

- In Interval, enter 3.

- In Output Range, select C3.

- Click OK.

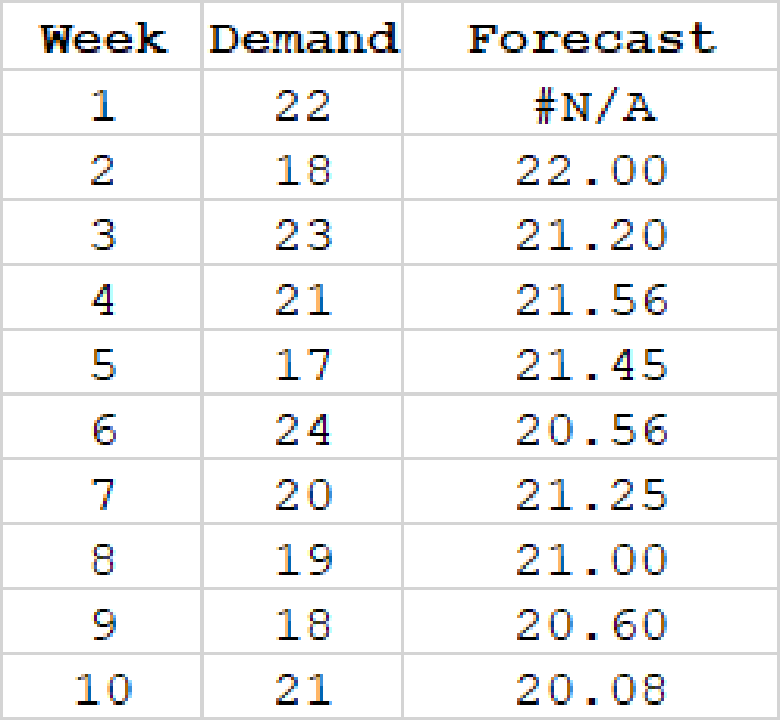

Output using the EXCEL software is given below:

From the output, the forecast value for week 11 is 19.33.

c.

Calculate the forecast for week 11 using the exponential smoothing with constant 0.2.

Answer to Problem 41SE

The forecast for week 11 using the exponential smoothing with constant 0.2 is 20.14.

Explanation of Solution

Calculation:

It is given that

Software procedure:

Step-by-step procedure to obtain the forecasts using EXCEL:

- In column A, enter the data of Week, and in column B, enter the corresponding values of Demand.

- Select Data Analysis and choose Exponential Smoothing.

- In Input Range, select Demand.

- In Damping factor, enter 0.8.

- Select Label in First Row.

- In Output Range, select C2.

- Click OK.

Output using the EXCEL software is given below:

The forecast value for week 11 using exponential smoothing method is obtained as follows:

Here,

Thus, the forecast value for week 11 is 20.26.

d.

Identify the most preferable method between three-week moving averages and exponential smoothing. Explain the reason.

Answer to Problem 41SE

The three-week moving average gives the most accurate forecast because MSE for three-week moving averages is lesser when compared to the MSE for exponential smoothing.

Explanation of Solution

The formula for finding the forecast error2 is as follows:

For Week 3:

The forecast error2 for week 4 for 3-week moving average is obtained as follows:

The remaining forecasts errors2 for exponential smoothing averages are obtained as follows:

| Week | Demand | Forecast (Ft) for 3-Week Moving Average | (Forecast Error)2 | Forecast (Ft) for | (Forecast Error)2 |

| 1 | 7.35 | - | - | - | - |

| 2 | 7.4 | - | - | 22.00 | 16.00 |

| 3 | 7.55 | - | - | 21.20 | 3.24 |

| 4 | 7.56 | 21.00 | 0.00 | 21.56 | 0.31 |

| 5 | 7.6 | 20.67 | 13.44 | 21.45 | 19.78 |

| 6 | 7.52 | 20.33 | 13.44 | 20.56 | 11.84 |

| 7 | 7.52 | 20.67 | 0.44 | 21.25 | 1.55 |

| 8 | 7.7 | 20.33 | 1.78 | 21.00 | 3.99 |

| 9 | 7.62 | 21.00 | 9.00 | 20.60 | 6.75 |

| 10 | 7.55 | 19.00 | 4.00 | 20.08 | 0.85 |

| Total | 42.11 | 64.33 |

The MSE for 3-week moving average is obtained as follows:

Thus, the value of MSE for 3-week moving average is 6.02.

The MSE for exponential smoothing averages for

Thus, the value of MSE for exponential smoothing averages for

Here, it is observed that the MSE for three-week moving averages is lesser when compared to the MSE for exponential smoothing. Thus, the three-week moving average gives the most accurate forecast.

Want to see more full solutions like this?

Chapter 17 Solutions

Modern Business Statistics with Microsoft Office Excel (with XLSTAT Education Edition Printed Access Card) (MindTap Course List)

- 2PM Tue Mar 4 7 Dashboard Calendar To Do Notifications Inbox File Details a 25/SP-CIT-105-02 Statics for Technicians Q-7 Determine the resultant of the load system shown. Locate where the resultant intersects grade with respect to point A at the base of the structure. 40 N/m 2 m 1.5 m 50 N 100 N/m Fig.- Problem-7 4 m Gradearrow_forwardNsjsjsjarrow_forwardA smallish urn contains 16 small plastic bunnies - 9 of which are pink and 7 of which are white. 10 bunnies are drawn from the urn at random with replacement, and X is the number of pink bunnies that are drawn. (a) P(X=6)[Select] (b) P(X>7) ≈ [Select]arrow_forward

- A smallish urn contains 25 small plastic bunnies - 7 of which are pink and 18 of which are white. 10 bunnies are drawn from the urn at random with replacement, and X is the number of pink bunnies that are drawn. (a) P(X = 5)=[Select] (b) P(X<6) [Select]arrow_forwardElementary StatisticsBase on the same given data uploaded in module 4, will you conclude that the number of bathroom of houses is a significant factor for house sellprice? I your answer is affirmative, you need to explain how the number of bathroom influences the house price, using a post hoc procedure. (Please treat number of bathrooms as a categorical variable in this analysis)Base on the same given data, conduct an analysis for the variable sellprice to see if sale price is influenced by living area. Summarize your finding including all regular steps (learned in this module) for your method. Also, will you conclude that larger house corresponding to higher price (justify)?Each question need to include a spss or sas output. Instructions: You have to use SAS or SPSS to perform appropriate procedure: ANOVA or Regression based on the project data (provided in the module 4) and research question in the project file. Attach the computer output of all key steps (number) quoted in…arrow_forwardElementary StatsBase on the given data uploaded in module 4, change the variable sale price into two categories: abovethe mean price or not; and change the living area into two categories: above the median living area ornot ( your two group should have close number of houses in each group). Using the resulting variables,will you conclude that larger house corresponding to higher price?Note: Need computer output, Ho and Ha, P and decision. If p is small, you need to explain what type ofdependency (association) we have using an appropriate pair of percentages. Please include how to use the data in SPSS and interpretation of data.arrow_forward

- An environmental research team is studying the daily rainfall (in millimeters) in a region over 100 days. The data is grouped into the following histogram bins: Rainfall Range (mm) Frequency 0-9.9 15 10 19.9 25 20-29.9 30 30-39.9 20 ||40-49.9 10 a) If a random day is selected, what is the probability that the rainfall was at least 20 mm but less than 40 mm? b) Estimate the mean daily rainfall, assuming the rainfall in each bin is uniformly distributed and the midpoint of each bin represents the average rainfall for that range. c) Construct the cumulative frequency distribution and determine the rainfall level below which 75% of the days fall. d) Calculate the estimated variance and standard deviation of the daily rainfall based on the histogram data.arrow_forwardAn electronics company manufactures batches of n circuit boards. Before a batch is approved for shipment, m boards are randomly selected from the batch and tested. The batch is rejected if more than d boards in the sample are found to be faulty. a) A batch actually contains six faulty circuit boards. Find the probability that the batch is rejected when n = 20, m = 5, and d = 1. b) A batch actually contains nine faulty circuit boards. Find the probability that the batch is rejected when n = 30, m = 10, and d = 1.arrow_forwardTwenty-eight applicants interested in working for the Food Stamp program took an examination designed to measure their aptitude for social work. A stem-and-leaf plot of the 28 scores appears below, where the first column is the count per branch, the second column is the stem value, and the remaining digits are the leaves. a) List all the values. Count 1 Stems Leaves 4 6 1 4 6 567 9 3688 026799 9 8 145667788 7 9 1234788 b) Calculate the first quartile (Q1) and the third Quartile (Q3). c) Calculate the interquartile range. d) Construct a boxplot for this data.arrow_forward

- Pam, Rob and Sam get a cake that is one-third chocolate, one-third vanilla, and one-third strawberry as shown below. They wish to fairly divide the cake using the lone chooser method. Pam likes strawberry twice as much as chocolate or vanilla. Rob only likes chocolate. Sam, the chooser, likes vanilla and strawberry twice as much as chocolate. In the first division, Pam cuts the strawberry piece off and lets Rob choose his favorite piece. Based on that, Rob chooses the chocolate and vanilla parts. Note: All cuts made to the cake shown below are vertical.Which is a second division that Rob would make of his share of the cake?arrow_forwardThree players (one divider and two choosers) are going to divide a cake fairly using the lone divider method. The divider cuts the cake into three slices (s1, s2, and s3). If the choosers' declarations are Chooser 1: {s1 , s2} and Chooser 2: {s2 , s3}. Using the lone-divider method, how many different fair divisions of this cake are possible?arrow_forwardTheorem 2.6 (The Minkowski inequality) Let p≥1. Suppose that X and Y are random variables, such that E|X|P <∞ and E|Y P <00. Then X+YpX+Yparrow_forward

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Algebra and Trigonometry (MindTap Course List)AlgebraISBN:9781305071742Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

Algebra and Trigonometry (MindTap Course List)AlgebraISBN:9781305071742Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning