Concept explainers

FIFO method (continuation of 17-41).

- 1. Complete Problem 17-41 using the FIFO method of

process costing .

Required

- 2. If you did Problem 17-41, explain any difference between the cost of work completed and transferred out and the cost of ending work in process in the assembly department under the weighted-average method and the FIFO method. Should McKnight’s managers choose the weighted-average method or the FIFO method? Explain briefly.

17-41 Weighted-average method. McKnight Handcraft is a manufacturer of picture frames for large retailers. Every picture frame passes through two departments: the assembly department and the finishing department. This problem focuses on the assembly department. The process-costing system at McKnight has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added when the assembly department process is 10% complete. Conversion costs are added evenly during the assembly department’s process.

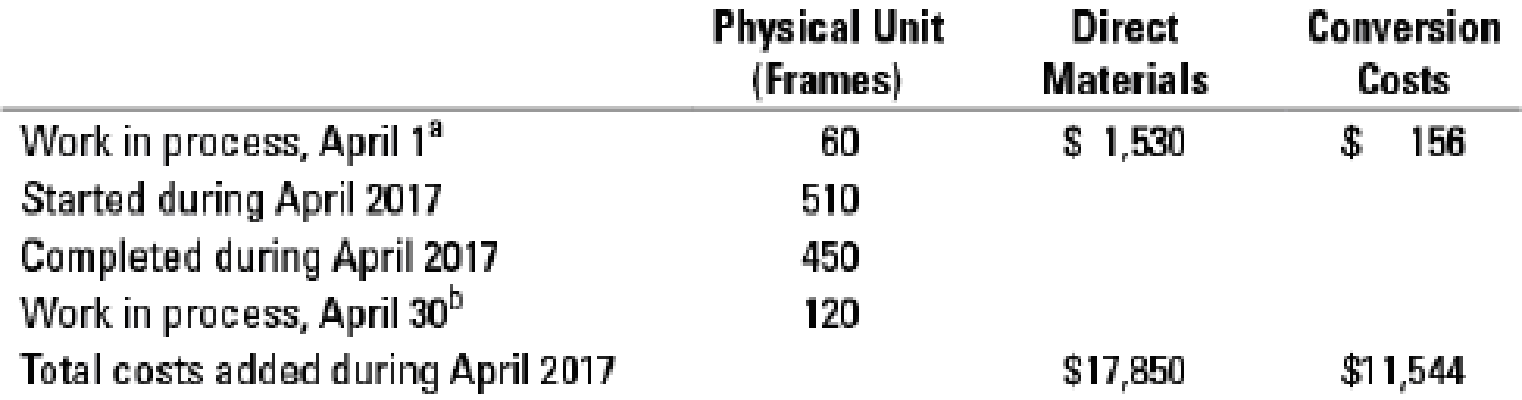

McKnight uses the weighted-average method of process costing. Consider the following data for the assembly department in April 2017:

a Degree of completion: direct materials, 100%; conversion costs, 40%.

b Degree of completion: direct materials, 100%; conversion costs, 15%.

- 1. Summarize the total assembly department costs for April 2017, and assign them to units completed (and transferred out) and to units in ending work in process.

Required

- 2. What issues should a manager focus on when reviewing the equivalent units calculation?

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

COST ACCOUNTING

- The industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.only typing .arrow_forwardCash flow cyclearrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College