Concept explainers

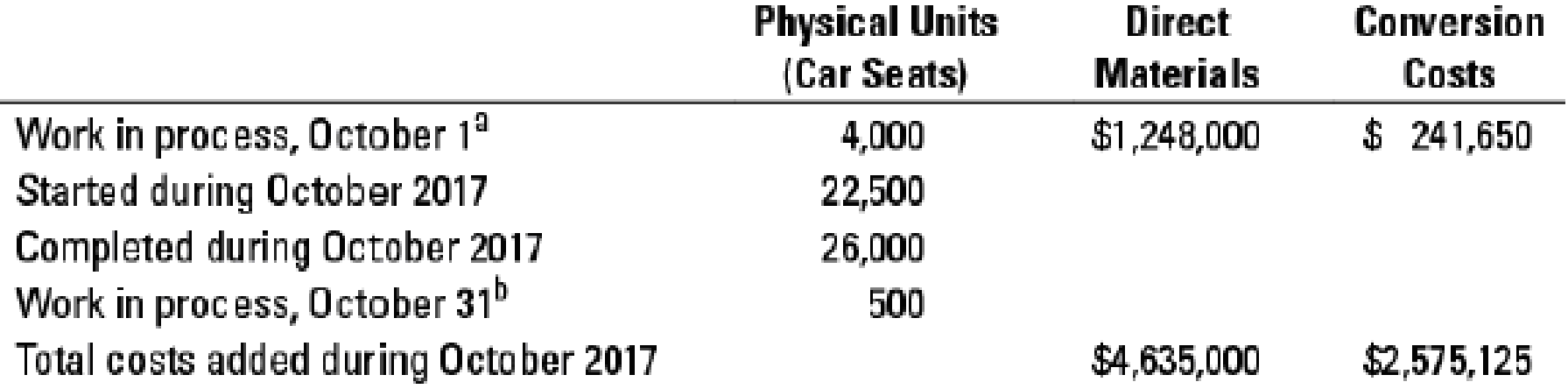

Weighted-average method. Hoffman Company manufactures car seats in its Boise plant. Each car seat passes through the assembly department and the testing department. This problem focuses on the assembly department. The process-costing system at Hoffman Company has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the process. Conversion costs are added evenly during the process. When the assembly department finishes work on each car seat, it is immediately transferred to testing.

Hoffman Company uses the weighted-average method of

a Degree of completion: direct materials, ?%; conversion costs, 45%.

b Degree of completion: direct materials, ?%; conversion costs, 65%.

- 1. For each cost category, compute equivalent units in the assembly department. Show physical units in the first column of your schedule.

Required

- 2. What issues should the manager focus on when reviewing the equivalent-unit calculations?

- 3. For each cost category, summarize total assembly department costs for October 2017 and calculate the cost per equivalent unit.

- 4. Assign costs to units completed and transferred out and to units in ending work in process.

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

COST ACCOUNTING

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Financial Accounting, Student Value Edition (5th Edition)

Principles of Economics (MindTap Course List)

Fundamentals of Management (10th Edition)

Operations Management

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

- Financial Accountingarrow_forwardMason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $184,500 salary working full time for Angels Corporation. Angels Corporation reported $418,000 of taxable business income for the year. Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $184,500 (all salary from Angels Corporation). Mason claims $59,000 in itemized deductions. Answer the following questions for Mason. c. b. Assuming the business income allocated to Mason is income from a specified service trade or business, except that Angels Corporation reported $168,000 of taxable business income for the year. What is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning