Concept explainers

FIFO method (continuation of 17-36).

- 1. Do Problem 17-36 using the FIFO method of

process costing . Explain any difference between the cost per equivalent unit in the assembly department under the weighted-average method and the FIFO method. - 2. Should Hoffman’s managers choose the weighted-average method or the FIFO method? Explain briefly.

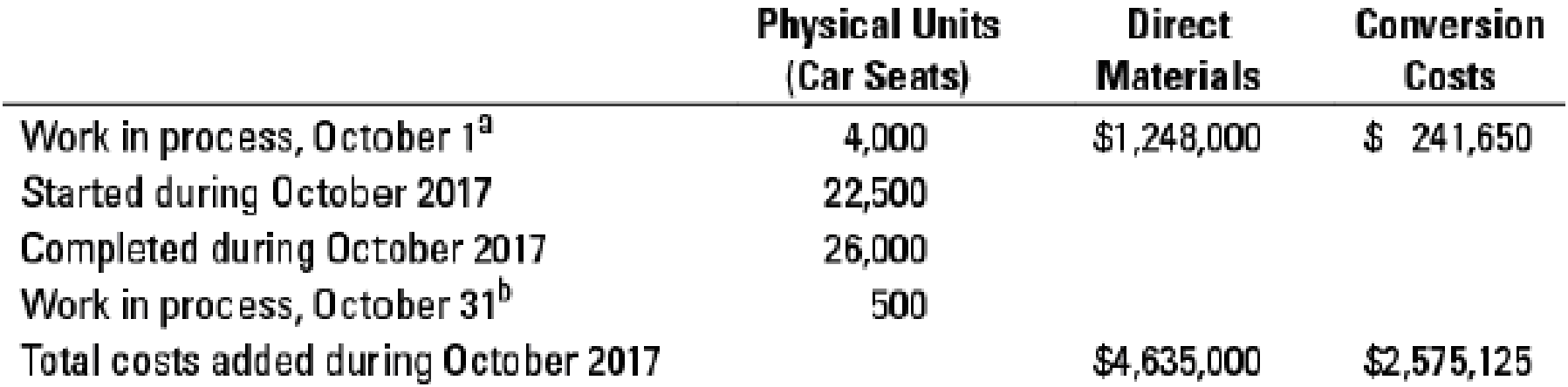

17-36 Weighted-average method. Hoffman Company manufactures car seats in its Boise plant. Each car seat passes through the assembly department and the testing department. This problem focuses on the assembly department. The process-costing system at Hoffman Company has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the process. Conversion costs are added evenly during the process. When the assembly department finishes work on each car seat, it is immediately transferred to testing.

Hoffman Company uses the weighted-average method of process costing. Data for the assembly department for October 2017 are as follows:

a Degree of completion: direct materials, ?%; conversion costs, 45%.

b Degree of completion: direct materials, ?%; conversion costs, 65%.

- 1. For each cost category, compute equivalent units in the assembly department. Show physical units in the first column of your schedule.

Required

- 2. What issues should the manager focus on when reviewing the equivalent-unit calculations?

- 3. For each cost category, summarize total assembly department costs for October 2017 and calculate the cost per equivalent unit.

- 4. Assign costs to units completed and transferred out and to units in ending work in process.

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

Additional Business Textbook Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Microeconomics

Engineering Economy (17th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Macroeconomics

- Sun Electronics operates a periodic inventory system. At the beginning of 2022, its inventory was $95,750. During the year, inventory purchases totaled $375,000, and its ending inventory was $110,500. What was the cost of goods sold (COGS) for Sun Electronics in 2022?arrow_forwardi want to this question answer of this general accountingarrow_forwardA clothing retailer provides the following financial data for the year. Determine the cost of goods sold (COGS): ⚫Total Sales: $800,000 • Purchases: $500,000 • Sales Returns: $30,000 • Purchases Returns: $40,000 • Opening Stock Value: $60,000 • Closing Stock Value: $70,000 Administrative Expenses: $250,000arrow_forward

- subject : general accounting questionarrow_forwardBrightTech Inc. had stockholders' equity of $1,200,000 at the beginning of June 2023. During the month, the company reported a net income of $300,000 and declared dividends of $175,000. What was BrightTech Inc.. s stockholders' equity at the end of June 2023?arrow_forwardQuestion 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year: Net Sales $100,000 Debtor's turnover ratio (based on net sales) 2 Inventory turnover ratio 1.25 fixed assets turnover ratio 0.8 Debt to assets ratio 0.6 Net profit margin 5% gross profit margin 25% return on investments 2% Use the given information to fill out the templates for incomestatement and balance sheet given below: Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $) Sales 100,000 Cost of goods sold gross profit other expenses earnings before tax tax @ 50% Earnings after tax Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $) Liabilities Amount Assets Amount Equity Net fixed assets long term debt 50,000 Inventory short term debt debtors cash Total Totalarrow_forward

- stockholders' equity for Summit Enterprises isarrow_forwardFinancial Accountingarrow_forwardQuestion 4Waterfront Inc. wishes to borrow on a short-term basis withoutreducing its current ratio below 1.25. At present its current assetsand current liabilities are $1,600 and $1,000 respectively. How muchcan Waterfront Inc. borrow?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning