Concept explainers

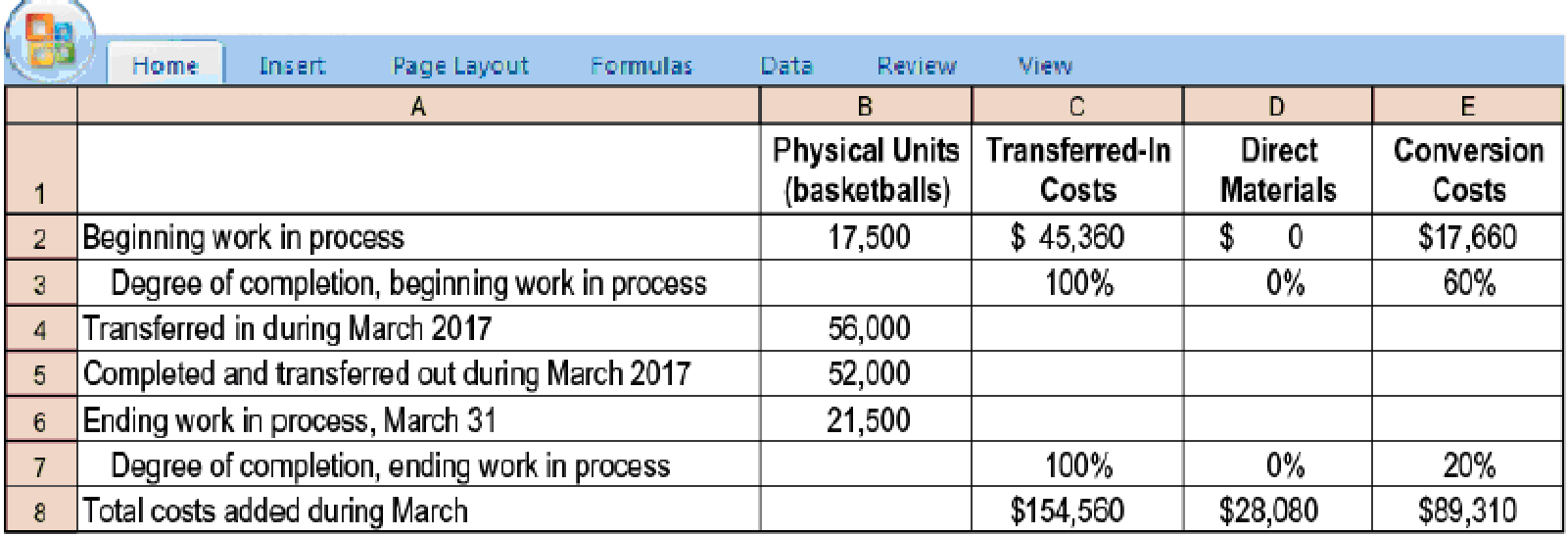

Transferred-in costs, weighted-average method. Spelling Sports, which produces basketballs, has two departments: cutting and stitching. Each department has one direct-cost category (direct materials) and one indirect-cost category (conversion costs). This problem focuses on the stitching department.

Basketballs that have undergone the cutting process are immediately transferred to the stitching department. Direct material is added when the stitching process is 70% complete. Conversion costs are added evenly during stitching operations. When those operations are done, the basketballs are immediately transferred to Finished Goods.

Spelling Sports uses the weighted-average method of

- 1. Summarize total stitching department costs for March 2017, and assign these costs to units completed (and transferred out) and to units in ending work in process.

Required

- 2. Prepare

journal entries for March transfers from the cutting department to the stitching department and from the stitching department to Finished Goods.

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

- return on equity (ROE)?arrow_forwardWhat is the likely price of the stockarrow_forwardSummit Corporation is considering acquiring Everest Inc. The balance sheet of Everest Inc. as of December 31, 2022, is as follows: Cash: $50,000 Accounts receivable: $85,000 Inventory: $120,000 Property, plant, and equipment (net): $650,000 Current liabilities: $75,000 Bonds payable: $190,000 Common stock: $280,000 Retained earnings: $360,000 During due diligence, Summit Corporation finds: An allowance for doubtful accounts of $6,500 is necessary. Inventory should be adjusted to FIFO, increasing its value to $150,000. The fair value of property, plant, and equipment is $720,000. There is an unrecorded patent valued at $90,000. Current liabilities and bonds payable are at fair value. Summit pays $1,400,000 for Everest Inc. Calculate the goodwill.arrow_forward

- Active Gear Inc. reported earnings per share (EPS) of $10.00 last year when its stock price was $200.00. This year, its earnings increased by 15%. If the P/E ratio remains constant, what is the likely price of the stock?arrow_forwardExpert need your helparrow_forwardasset turnover ratio the profit margin ratioarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning