Concept explainers

Weighted-average method, assigning costs (continuation of 17-24).

For the data in Exercise 17-24, summarize the total costs to account for calculate the cost per equivalent unit for direct materials and conversion costs, and assign costs to the units completed (and transferred out) and units in ending work in process.

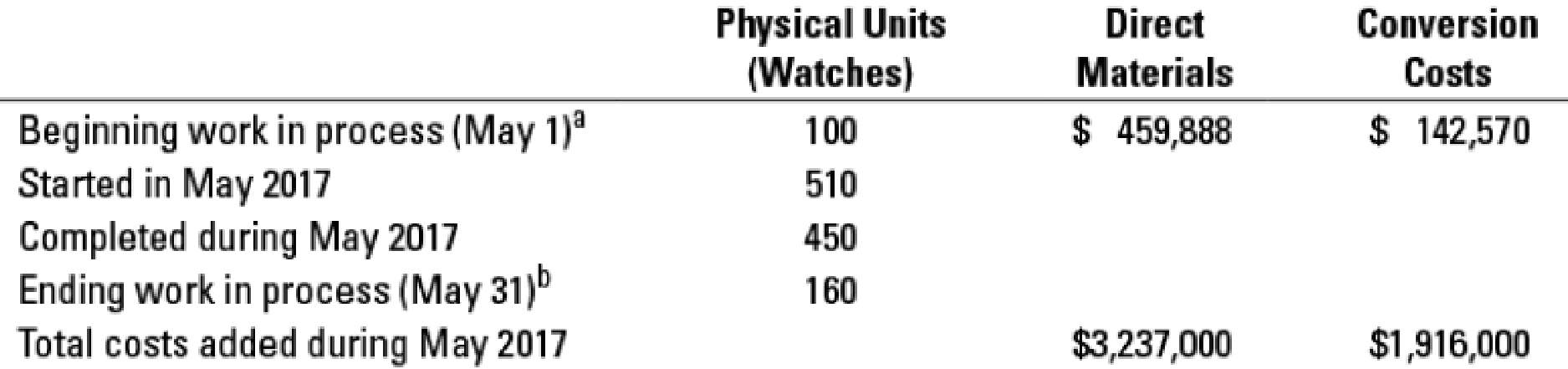

17-24 Weighted-average method, equivalent units. The assembly division of Quality Time Pieces, Inc. uses the weighted-average method of

a Degree of completion: direct materials. 80%: conversion costs, 35%.

b Degree of completion: direct materials, 80%; conversion costs, 40%.

Compute equivalent units for direct materials and conversion costs. Show physical units in the first column of your schedule.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Macroeconomics

Intermediate Accounting (2nd Edition)

Financial Accounting, Student Value Edition (5th Edition)

Foundations Of Finance

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning