Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 4PB

Analyzing

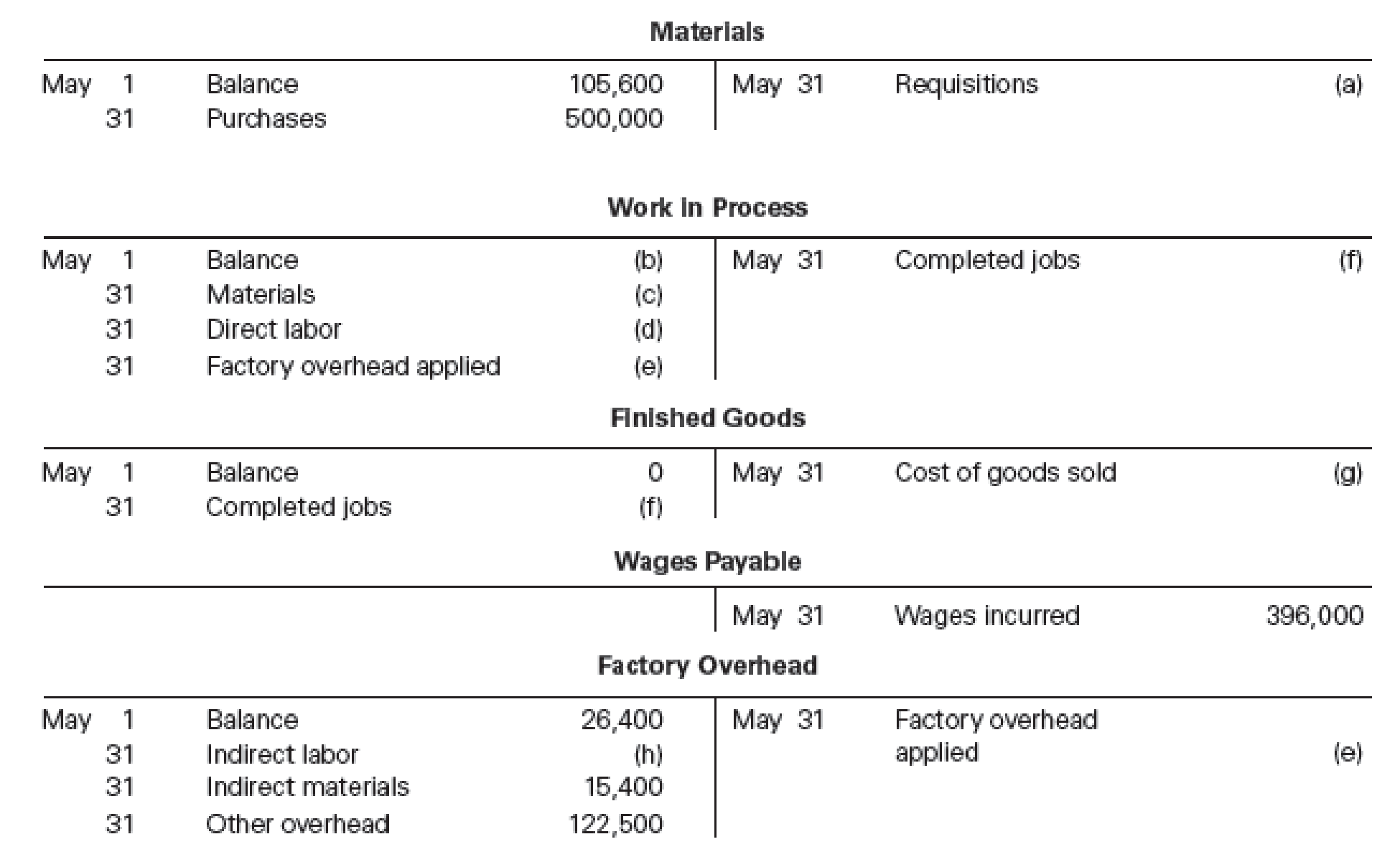

Clapton Company manufactures custom guitars in a wide variety of styles. The following incomplete ledger accounts refer to transactions that are summarized for May:

In addition, the following information is available:

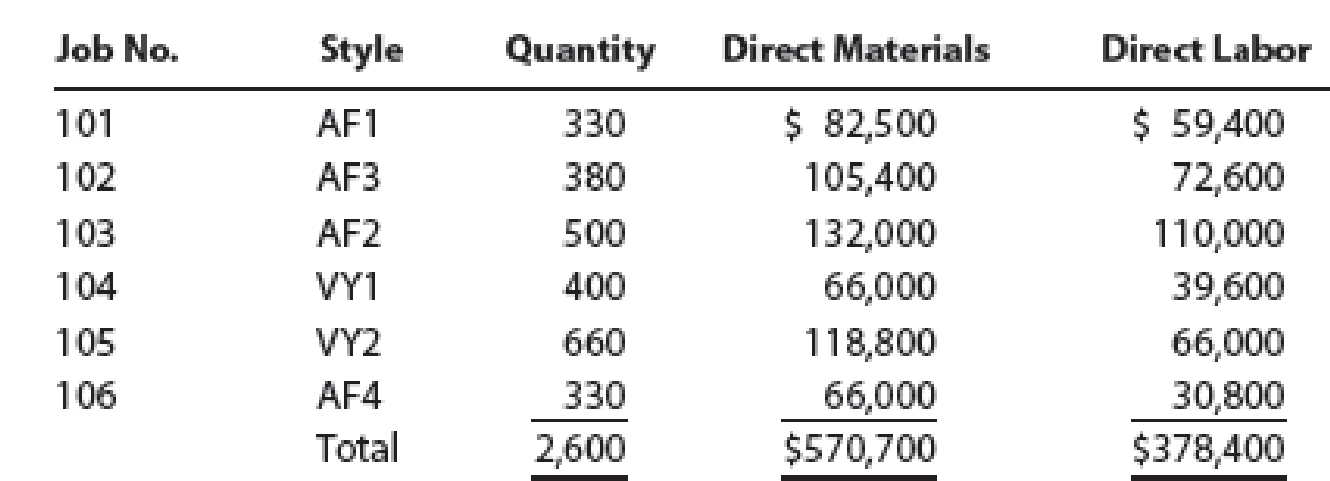

- A. Materials and direct labor were applied to six jobs in May:

- B. Factory

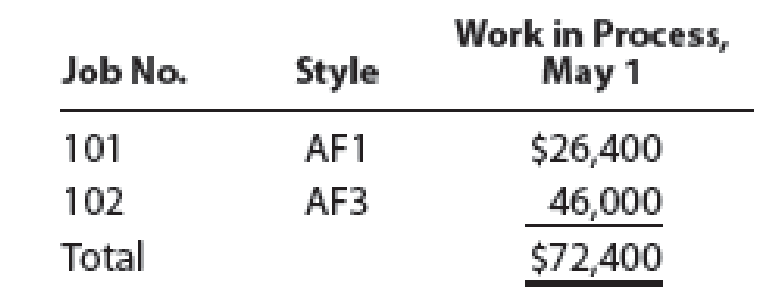

overhead is applied to each job at a rate of 50% of direct labor cost. - C. The May 1 Work in Process balance consisted of two jobs, as follows:

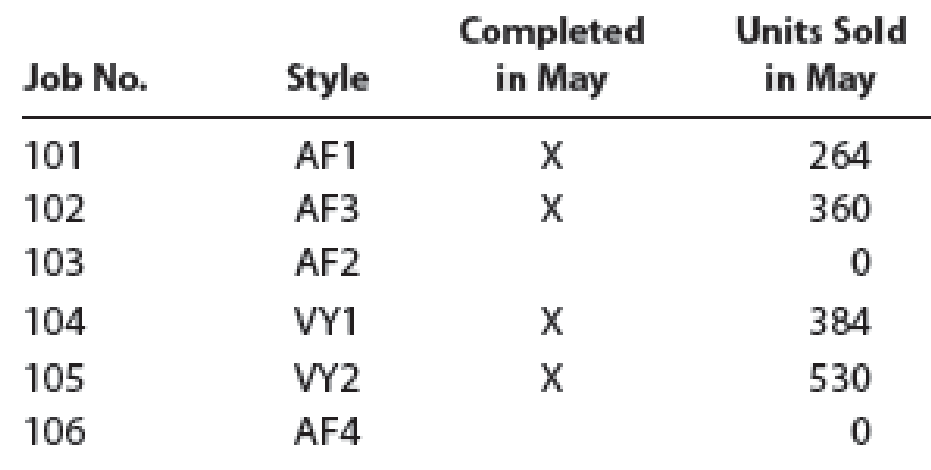

- D. Customer jobs completed and units sold in May were as follows:

Instructions

- 1. Determine the missing amounts associated with each letter. Provide supporting computations by completing a table with the following headings:

- 2. Determine the May 31 balances for each of the inventory accounts and factory overhead.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Provide solution of this all Question please Financial Accounting

Don't Use AI

Please Provide solution of this General Accounting Question

Chapter 16 Solutions

Financial And Managerial Accounting

Ch. 16 - A. Name two principal types of cost accounting...Ch. 16 - What kind of firm would use a job order cost...Ch. 16 - Prob. 3DQCh. 16 - Prob. 4DQCh. 16 - What is a job cost sheet?Ch. 16 - Prob. 6DQCh. 16 - Discuss how the predetermined factory overhead...Ch. 16 - A. How is a predetermined factory overhead rate...Ch. 16 - A. What is (1) overapplied factory overhead and...Ch. 16 - Describe how a job order cost system can be used...

Ch. 16 - Issuance of materials On May 7, Bergan Company...Ch. 16 - Direct labor costs During May, Bergan Company...Ch. 16 - Factory overhead costs During May, Bergan Company...Ch. 16 - Applying factory overhead Bergan Company estimates...Ch. 16 - Job costs At the end of May, Bergan Company had...Ch. 16 - Cost of goods sold Pine Creek Company completed...Ch. 16 - Transactions in a job order cost system Five...Ch. 16 - The following information is available for the...Ch. 16 - Cost of materials issuances under the FIFO method...Ch. 16 - Prob. 4ECh. 16 - Kingsford Furnishings Company manufactures...Ch. 16 - A summary of the time tickets is as follows:...Ch. 16 - Entry for factory labor costs The weekly time...Ch. 16 - Schumacher Industries Inc. manufactures...Ch. 16 - Eclipse Solar Company operates two factories. The...Ch. 16 - Exotic Engine Shop uses a job order cost system to...Ch. 16 - Predetermined factory overhead rate Obj. 2...Ch. 16 - The following account appears in the ledger prior...Ch. 16 - Collegiate Publishing Inc. began printing...Ch. 16 - The following events took place for Rushmore...Ch. 16 - Job order cost accounting for a service company...Ch. 16 - Job order cost accounting for a service company...Ch. 16 - Barnes Company uses a job order cost system. The...Ch. 16 - Entries and schedules for unfinished jobs and...Ch. 16 - Job cost sheet Remnant Carpet Company sells and...Ch. 16 - Analyzing manufacturing cost accounts Fire Rock...Ch. 16 - Prob. 5PACh. 16 - Entries for costs in a job order cost system Royal...Ch. 16 - Entries and schedules for unfinished jobs and...Ch. 16 - Job cost sheet Stretch and Trim Carpet Company...Ch. 16 - Analyzing manufacturing cost accounts Clapton...Ch. 16 - Prob. 5PBCh. 16 - Antolini Enterprises produces mens sports coats...Ch. 16 - Alvarez Manufacturing Inc. is a job shop. The...Ch. 16 - Raneri Trophies Inc. uses a job order cost system...Ch. 16 - Brady Furniture Company manufactures wooden oak...Ch. 16 - Ethics in Action TAC Industries Inc. sells heavy...Ch. 16 - Team Activity As an assistant cost accountant for...Ch. 16 - Prob. 3TIFCh. 16 - RIRA Company makes attachments such as backhoes...Ch. 16 - Todd Lay just began working as a cost accountant...Ch. 16 - Baldwin Printing Company uses a job order cost...Ch. 16 - John Sheng, a cost accountant at Starlet Company,...Ch. 16 - Lucy Sportswear manufactures a specialty line of...Ch. 16 - Patterson Corporation expects to incur 70,000 of...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY