Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 4PA

Analyzing

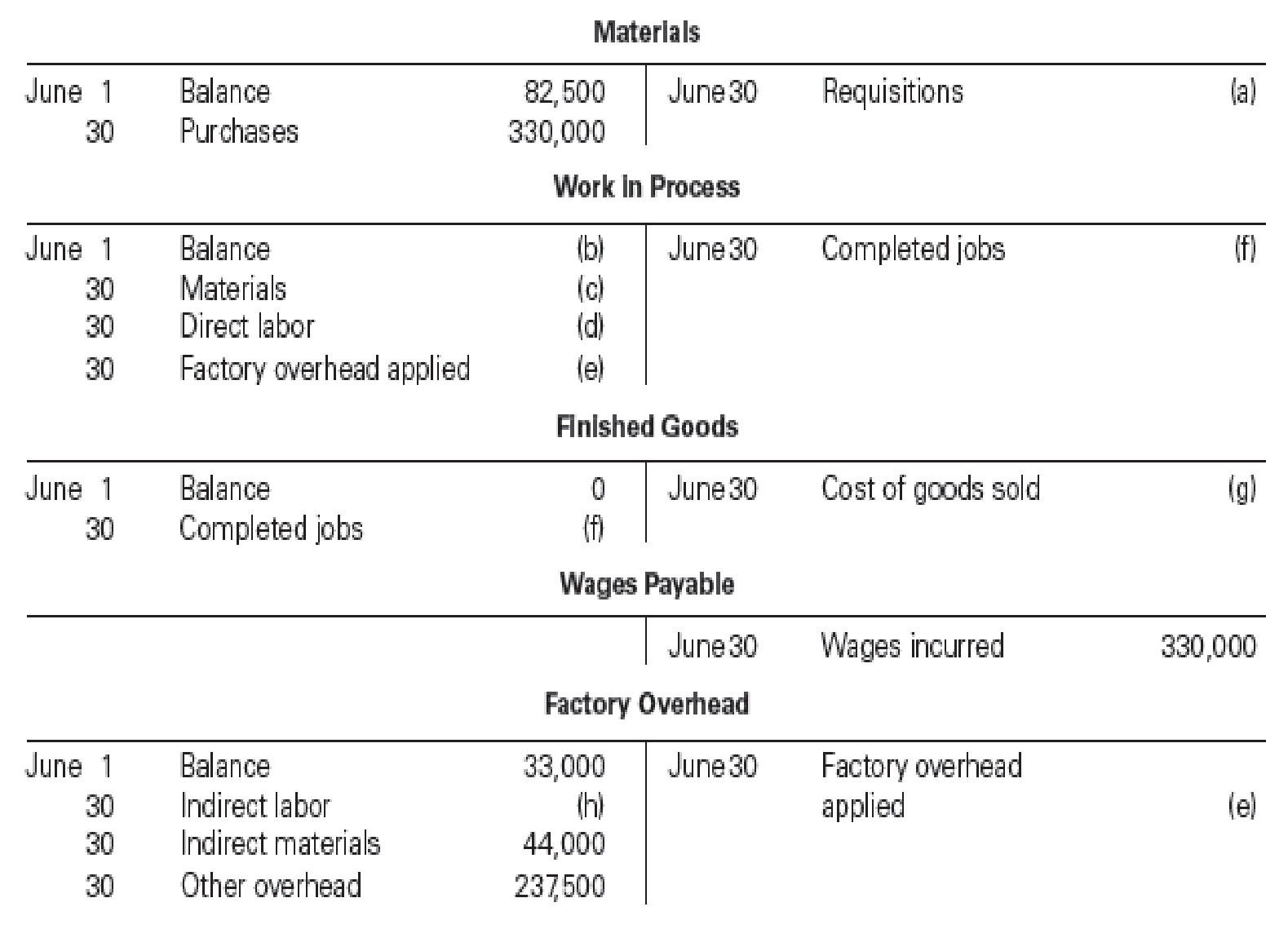

Fire Rock Company manufactures designer paddle boards in a wide variety of sizes and styles. The following incomplete ledger accounts refer to transactions that are summarized for June:

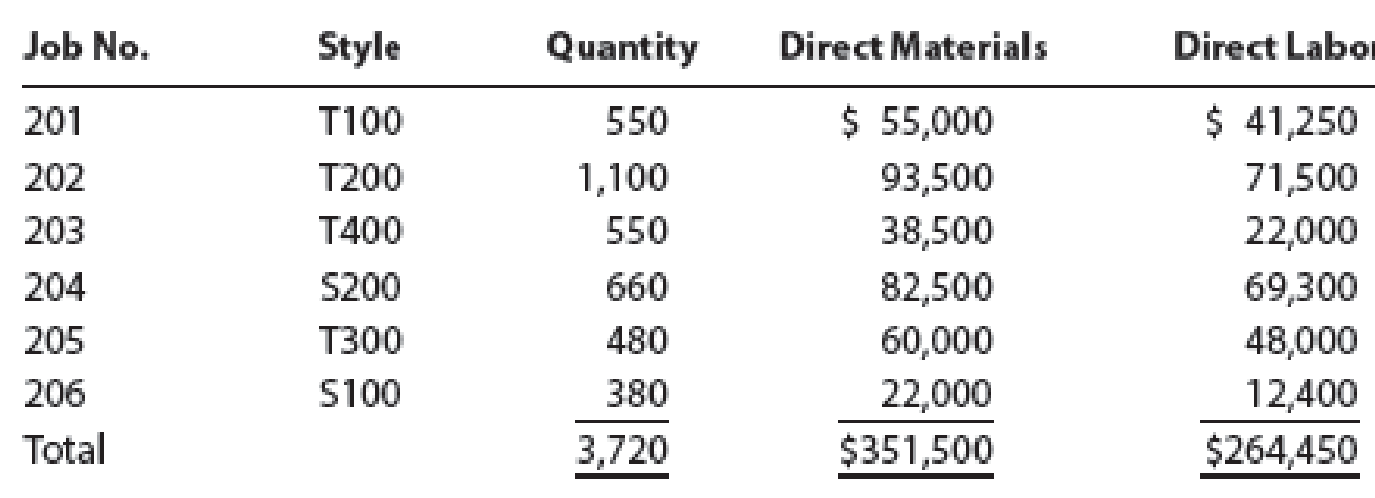

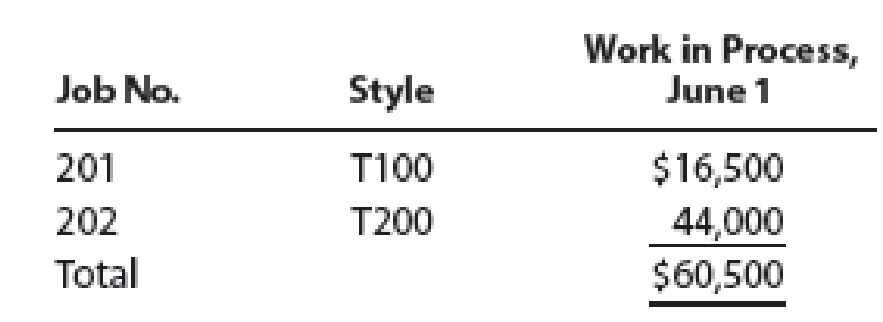

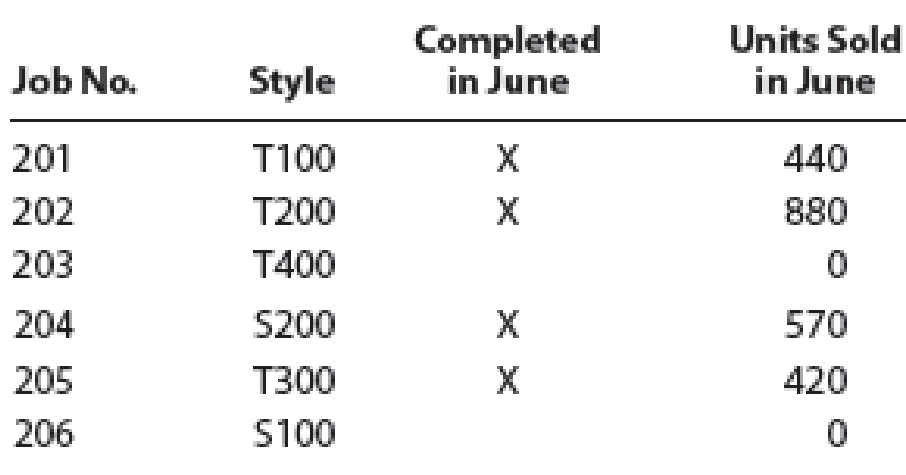

In addition, the following information is available:

- A. Materials and direct labor were applied to six jobs in June:

- B. Factory

overhead is applied to each job at a rate of 140% of direct labor cost. - C. The June 1 Work in Process balance consisted of two jobs, as follows:

- D. Customer jobs completed and units sold in June were as follows:

Instructions

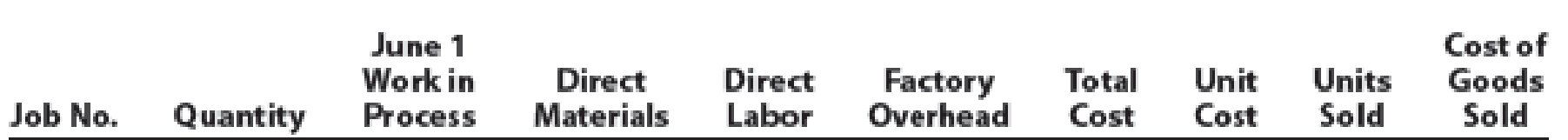

- 1. Determine the missing amounts associated with each letter. Provide supporting computations by completing a table with the following headings:

- 2. Determine the June 30 balances for each of the inventory accounts and factory overhead.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

ayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000.

The unadjusted balances of selected accounts at December 31, 2023 are as follows:

Accounts receivable

$

300,000

Allowance for doubtful accounts (debit)

10,000

Sales revenue (including 80 percent in sales on account)

800,000

Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts.

Required:

1. Prepare the journal entries to record all the transactions during 2022 and post them to appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)…

Calculate the sample size based on the specifications in Buhi's contract. Make sure it is within budget, reasonable to obtain, and that you use appropriate inputs relative to market research best practices.

Use the calculator to adjust the sample size statement.

Use the agreed-upon sample size in Buhi's contract: 996.

In your secondary research, find the target population size (an estimate of those in the United States looking to purchase luggage in the category in the next two years). You will use this target population size for each sample size estimate.

Adjust the provided sample size calculator inputs to find the rest of the figures that get you to the agreed-upon sample size.

The caveats from Buhi are that you must:

Use the market research standard for your confidence level.

Use a confidence interval that is better than the market research standard for your confidence interval.

The partnership of Keenan and Kludlow paid the following wages during this year:

Line Item Description

Amount

M. Keenan (partner)

$108,000

S. Kludlow (partner)

96,000

N. Perry (supervisor)

54,700

T. Lee (factory worker)

35,100

R. Rolf (factory worker)

27,200

D. Broch (factory worker)

6,300

S. Ruiz (bookkeeper)

26,000

C. Rudolph (maintenance)

5,200

In addition, the partnership owed $250 to Rudolph for work he performed during December. However, payment for this work will not be made until January of the following year. The state unemployment tax rate for the company is 2.95% on the first $9,000 of each employee's earnings. Compute the following:

ound your answers to the nearest cent.

a. Net FUTA tax for the partnership for this year

b. SUTA tax for this year

Chapter 16 Solutions

Financial And Managerial Accounting

Ch. 16 - A. Name two principal types of cost accounting...Ch. 16 - What kind of firm would use a job order cost...Ch. 16 - Prob. 3DQCh. 16 - Prob. 4DQCh. 16 - What is a job cost sheet?Ch. 16 - Prob. 6DQCh. 16 - Discuss how the predetermined factory overhead...Ch. 16 - A. How is a predetermined factory overhead rate...Ch. 16 - A. What is (1) overapplied factory overhead and...Ch. 16 - Describe how a job order cost system can be used...

Ch. 16 - Issuance of materials On May 7, Bergan Company...Ch. 16 - Direct labor costs During May, Bergan Company...Ch. 16 - Factory overhead costs During May, Bergan Company...Ch. 16 - Applying factory overhead Bergan Company estimates...Ch. 16 - Job costs At the end of May, Bergan Company had...Ch. 16 - Cost of goods sold Pine Creek Company completed...Ch. 16 - Transactions in a job order cost system Five...Ch. 16 - The following information is available for the...Ch. 16 - Cost of materials issuances under the FIFO method...Ch. 16 - Prob. 4ECh. 16 - Kingsford Furnishings Company manufactures...Ch. 16 - A summary of the time tickets is as follows:...Ch. 16 - Entry for factory labor costs The weekly time...Ch. 16 - Schumacher Industries Inc. manufactures...Ch. 16 - Eclipse Solar Company operates two factories. The...Ch. 16 - Exotic Engine Shop uses a job order cost system to...Ch. 16 - Predetermined factory overhead rate Obj. 2...Ch. 16 - The following account appears in the ledger prior...Ch. 16 - Collegiate Publishing Inc. began printing...Ch. 16 - The following events took place for Rushmore...Ch. 16 - Job order cost accounting for a service company...Ch. 16 - Job order cost accounting for a service company...Ch. 16 - Barnes Company uses a job order cost system. The...Ch. 16 - Entries and schedules for unfinished jobs and...Ch. 16 - Job cost sheet Remnant Carpet Company sells and...Ch. 16 - Analyzing manufacturing cost accounts Fire Rock...Ch. 16 - Prob. 5PACh. 16 - Entries for costs in a job order cost system Royal...Ch. 16 - Entries and schedules for unfinished jobs and...Ch. 16 - Job cost sheet Stretch and Trim Carpet Company...Ch. 16 - Analyzing manufacturing cost accounts Clapton...Ch. 16 - Prob. 5PBCh. 16 - Antolini Enterprises produces mens sports coats...Ch. 16 - Alvarez Manufacturing Inc. is a job shop. The...Ch. 16 - Raneri Trophies Inc. uses a job order cost system...Ch. 16 - Brady Furniture Company manufactures wooden oak...Ch. 16 - Ethics in Action TAC Industries Inc. sells heavy...Ch. 16 - Team Activity As an assistant cost accountant for...Ch. 16 - Prob. 3TIFCh. 16 - RIRA Company makes attachments such as backhoes...Ch. 16 - Todd Lay just began working as a cost accountant...Ch. 16 - Baldwin Printing Company uses a job order cost...Ch. 16 - John Sheng, a cost accountant at Starlet Company,...Ch. 16 - Lucy Sportswear manufactures a specialty line of...Ch. 16 - Patterson Corporation expects to incur 70,000 of...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY