Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 3CPA

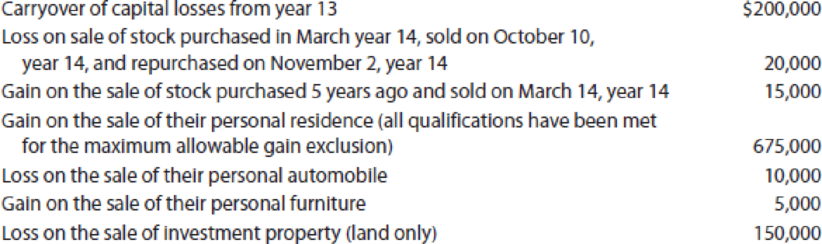

Brad and Angie are married and file a joint return. For year 14, they had income from wages in the amount of $100,000 and had the following capital transactions to report on their income tax return:

What is the amount of capital loss carryover to year 15?

- a. ($155,000)

- b. ($152,000)

- c. ($132,000)

- d. ($125,000)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Need help with this question solution general accounting

Select the correct answer

What is a good response to this post?

Hello everyone,The theory of facework is a beneficial instrument for preserving self-image and fostering mutual respect during exchanges. According to Nguyen-Phuong-Mai, Terlouw, and Pilot (2014), facework is the strategic approach individuals employ to validate their own identity while simultaneously considering the requirements of others. The necessity of these strategies has been evident to me during my nine years as a rideshare driver. I endeavor to understand the context and intentions of each passenger by dedicating sufficient time to attentive listening before disclosing undue personal information. This empathetic and respectful approach safeguards my identity and fosters trust, reducing the probability of rambling and mitigating the potential harm of receiving a poor rating.My experience in the restaurant industry, particularly at venues such as Tavern on the Green in New York City, has emphasized the significance of effective facework.…

Chapter 16 Solutions

Individual Income Taxes

Ch. 16 - Prob. 1DQCh. 16 - An individual taxpayer sells some used assets at a...Ch. 16 - Alison owns a painting that she received as a gift...Ch. 16 - Prob. 4DQCh. 16 - Prob. 5DQCh. 16 - Prob. 6DQCh. 16 - Prob. 7DQCh. 16 - Prob. 8DQCh. 16 - After netting all of her short-term and long-term...Ch. 16 - Prob. 10DQ

Ch. 16 - Near the end of 2019, Byron realizes that he has a...Ch. 16 - Prob. 12CECh. 16 - Prob. 13CECh. 16 - Prob. 14CECh. 16 - On May 9, 2019, Glenna purchases 500 shares of...Ch. 16 - Prob. 16CECh. 16 - Prob. 17CECh. 16 - Elliott has the following capital gain and loss...Ch. 16 - Prob. 19PCh. 16 - Prob. 20PCh. 16 - Prob. 21PCh. 16 - George is the owner of numerous classic...Ch. 16 - Prob. 23PCh. 16 - Prob. 24PCh. 16 - Prob. 25PCh. 16 - Melaney has had a bad year with her investments....Ch. 16 - Prob. 27PCh. 16 - Prob. 28PCh. 16 - Prob. 29PCh. 16 - Prob. 30PCh. 16 - Prob. 31PCh. 16 - Prob. 32PCh. 16 - Prob. 33PCh. 16 - Prob. 34PCh. 16 - Prob. 35PCh. 16 - Prob. 36PCh. 16 - Prob. 37PCh. 16 - Dennis sells short 100 shares of ARC stock at 20...Ch. 16 - Elaine Case (single with no dependents) has the...Ch. 16 - Prob. 40PCh. 16 - Prob. 41PCh. 16 - Prob. 42PCh. 16 - Paul has the following long-term capital gains and...Ch. 16 - Helena has the following long-term capital gains...Ch. 16 - For 2019, Ashley has gross income of 38,350 and a...Ch. 16 - Prob. 46PCh. 16 - For 2019, Wilma has properly determined taxable...Ch. 16 - Prob. 48PCh. 16 - Gray, Inc., a C corporation, has taxable income...Ch. 16 - Harriet, who is single, is the owner of a sole...Ch. 16 - Ashley Panda lives at 1310 Meadow Lane, Wayne, OH...Ch. 16 - Paul Barrone is a graduate student at State...Ch. 16 - Prob. 1RPCh. 16 - Prob. 2RPCh. 16 - Prob. 3RPCh. 16 - Prob. 4RPCh. 16 - Prob. 1CPACh. 16 - Conner purchased 300 shares of Zinco stock for...Ch. 16 - Brad and Angie are married and file a joint...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need correct answer general accounting questionarrow_forwardNonearrow_forwardA supplier offers credit terms of 2/10, net 30, meaning a 2% discount is available if payment is made within 10 days. If a company purchases $12,000 worth of goods and pays within 7 days, calculate the amount paid after applying the discount.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License