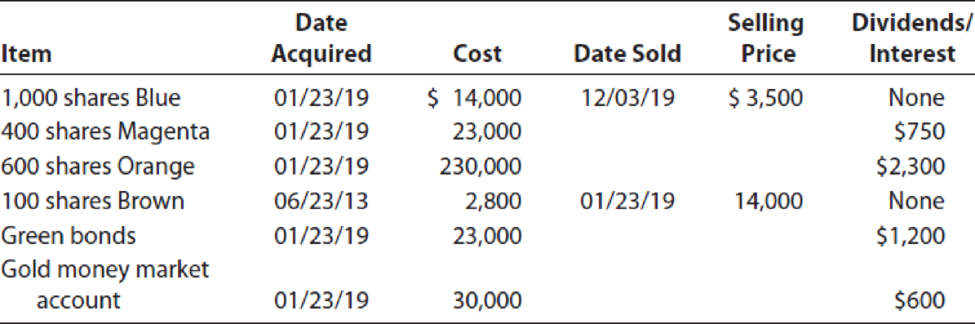

Paul Barrone is a graduate student at State University. His 10-year-old son, Jamie, lives with him, and Paul is Jamie’s sole support. Paul’s wife died in 2018, and Paul has not remarried. Paul received $320,000 of life insurance proceeds (related to his wife’s death) in early 2019 and immediately invested the entire amount as shown below.

Paul had $42,000 of taxable graduate assistant earnings from State University and received a $10,000 scholarship. He used $8,000 of the scholarship to pay his tuition and fees for the year and $2,000 for Jamie’s day care. Jamie attended Little Kids Daycare Center, a state-certified child care facility. Paul received a statement related to the Green bonds saying that there was $45 of original issue discount amortization during 2019. Paul maintains the receipts for the sales taxes he paid of $735.

Paul lives at 1610 Cherry Lane, Bradenton, FL 34212, and his Social Security number is 111-11-1111. Jamie’s Social Security number is 123-45-6789. The university withheld $2,000 of Federal income tax from Paul’s salary. Paul is not itemizing his deductions.

Part 1—Tax Computation

Compute Paul’s lowest tax liability for 2019.

Part 2—Tax Planning

Paul is concerned because the Green bonds were worth only $18,000 at the end of 2019, $5,000 less than he paid for them. He is an inexperienced investor and wants to know if this $5,000 is deductible. The bonds had original issue discount of $2,000 when he purchased them, and he is curious about how that affects his investment in the bonds. The bonds had 20 years left to maturity when he purchased them. Draft a brief letter to Paul explaining how to handle these items.

Also prepare a memo for Paul’s tax file.

Trending nowThis is a popular solution!

Chapter 16 Solutions

Individual Income Taxes

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT