Concept explainers

a.

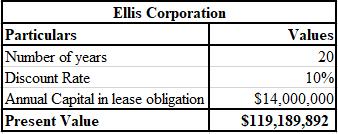

To calculate: The PV of annual lease obligations of Ellis Corporation, if discount rate is 10%.

Introduction:

Lease:

It refers to the contract between two parties, that is, lessee(user) and lessor (owner) defining the terms in which one party agrees to pay rent in exchange of usage of property, that is, owned by another party.

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the

a.

Answer to Problem 21P

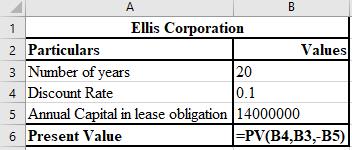

The calculation of the PV of annual lease obligations at the rate of 10% is shown below.

Thus, the PV of annual lease obligations at the rate of 10%, after rounding off, is $119 million.

Explanation of Solution

The formula used for the calculation of the PV of annual lease obligations at the rate of 10% is shown below.

b.

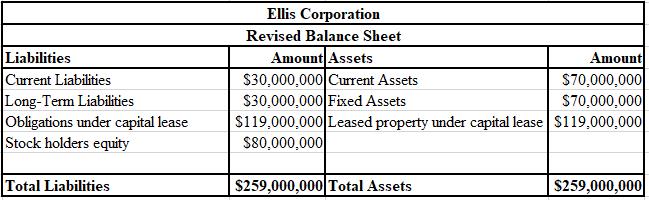

To construct: The revised

Introduction:

Balance Sheet:

It refers to the financial statement that displays the company's liabilities and assets. Through this, one can evaluate the financial position of a company.

b.

Answer to Problem 21P

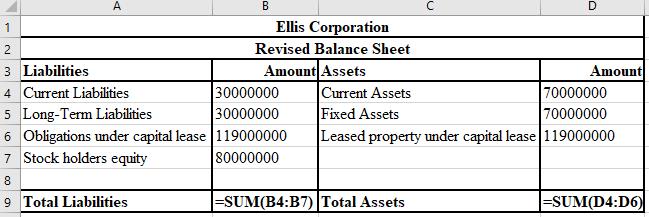

The revised balance sheet is shown below:

Explanation of Solution

The formulae used for the calculation of revised balance sheet are shown below.

c.

To calculate: The ratio of total debt to total assets on the original and revised balance sheet of Ellis Corporation.

Introduction:

Balance sheet:

It refers to the financial statement that displays the company's liabilities and assets. Through this, one can evaluate the financial position of a company.

c.

Answer to Problem 21P

The ratio of total debt to total asset on the original and revised balance sheet of Ellis Corporation is 42.9% and 69.1%, respectively.

Explanation of Solution

Calculation of the ratio of total debt to the total assets on the original balance sheet:

Calculation of the ratio of total debt to the total assets on the revised balance sheet:

d.

To calculate: The ratio of total debt to total equity on the original and revised balance sheet of Ellis Corporation.

Introduction:

Balance sheet:

It refers to the financial statement that displays the company's liabilities and assets. Through this, one can evaluate the financial position of a company.

d.

Answer to Problem 21P

The ratio of total debt to total equity on the original and revised balance sheet of Ellis Corporation is 75% and 223.8%, respectively.

Explanation of Solution

Calculation of the total debt to equity on the original balance sheet:

Calculation of the total debt to equity on the revised balance sheet:

e.

To determine: Whether the consequences of SFAS No. 13 will be viewed in the calculation of part (c) and part (d) to make changes in the stock price and credit ratings in an efficient capital market.

Introduction:

Capital Market:

It refers to the market place where trading of financial securities like stocks and bonds are undertaken by the sellers and buyers. This market usually trades in long term securities.

e.

Answer to Problem 21P

No, the consequences of SFAS No. 13 will not be viewed in the calculation of part (c) and part (d) for making changes to the stock price and credit ratings in an efficient capital market.

Explanation of Solution

In the efficient capital

f.

To explain: The management's perception of

Introduction:

Market Efficiency:

It refers to the degree at which prices circulated in the market portray the relevant information to the investors.

f.

Answer to Problem 21P

According to the financial officer, the performance may not be reliable enough as it has been presented for the first time.

Explanation of Solution

The concern of the company’s management is if the market is as efficient as it is believed to be. As per the management’s perception, the performance may appear questionable if the information is newly presented.

Want to see more full solutions like this?

Chapter 16 Solutions

Foundations of Financial Management

- see itPlease don't answer i posted blurred image mistakely. please comment below i will write values. if you answer with incorrect values i will give unhelpful confirm.arrow_forwardNo use ai. if image is blurr or data is not showing properly then dont answer i will sure deslike. please comment i will write values.arrow_forwardDon't use ai. if image is blurr or data is not showing properly then dont answer i will sure deslike. please comment i will write values.arrow_forward

- no ai Please don't answer i posted blurred image mistakely. please comment below i will write values. if you answer with incorrect values i will give unhelpful confirm.arrow_forwardFinance SubjPlease don't answer i posted blurred image mistakely. please comment below i will write values. if you answer with incorrect values i will give unhelpful confirm.arrow_forwardcalculate ratios for the financial statment given and show all working manually: 3. TIE Ratio 4. Cash Coverage Ratioarrow_forward

- calculate ratios for the financial statment given and show all working manually: 1. Debt Ratios 2. Debt to Equityarrow_forwardcalculate the following ratios for the statements and show all working: 1. Current Ratios 2. Quick Ratio 3. Cash Ratioarrow_forwardDont solve this question with incorrect values. i will give unhelpful . do not solvearrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education