Concept explainers

a.

To calculate: The discount rate of Robinson Corporation.

Introduction:

Discount Rate:

A rate that is used for the calculation of the

a.

Answer to Problem 18P

The discount rate of Robinson Corporation is 7.53% and after rounding off to a whole number, the discount rate is 8%.

Explanation of Solution

Computation of the discount rate:

b.

To calculate: The PV of total outflows of Robinson Corporation.

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the

b.

Answer to Problem 18P

The PV of total outflows of Robinson Corporation is $3,171,831.

Explanation of Solution

Computation of PV of total outflows:

Working Notes:

Calculation of net cost of underwriting expense on new issue:

Calculation of after-tax cost:

The calculation of the tax savings per year is as follows:

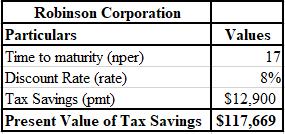

The calculation of current price of bond, that is, PV of future tax savings is shown below.

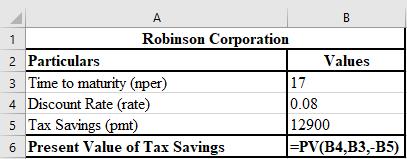

The formula used for the calculation of current price of bond, that is, PV of future tax savings is shown below.

c.

To calculate: The PV of total inflows of Robinson Corporation.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

c.

Answer to Problem 18P

The present value of total inflow of Robinson Corporation is $2,847,244.

Explanation of Solution

Calculation of the present value of total inflow:

Working Notes:

The calculation of the savings per year is as follows:

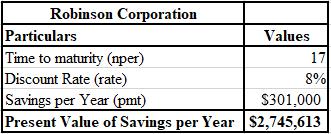

The calculation of PV of savings is shown below.

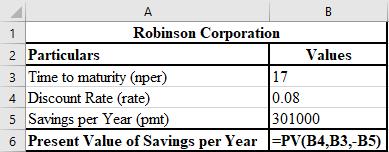

The formula used for the calculation of PV of savings is shown below.

Calculation of underwriting cost write off:

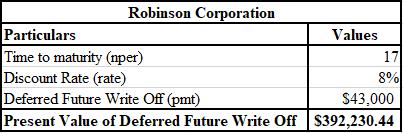

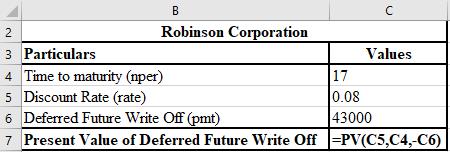

Calculation of PV of deferred future write off:

The calculation of current price of bond is shown below.

The formula used for the calculation of current price of bond is shown below.

d.

To calculate: The NPV of Robinson Corporation.

Introduction:

It is the difference between the PV (present value) of

d.

Answer to Problem 18P

The NPV of Robinson Corporation is ($324,478).

Explanation of Solution

Calculation of NPV:

Want to see more full solutions like this?

Chapter 16 Solutions

Foundations of Financial Management

- see itPlease don't answer i posted blurred image mistakely. please comment below i will write values. if you answer with incorrect values i will give unhelpful confirm.arrow_forwardNo use ai. if image is blurr or data is not showing properly then dont answer i will sure deslike. please comment i will write values.arrow_forwardDon't use ai. if image is blurr or data is not showing properly then dont answer i will sure deslike. please comment i will write values.arrow_forward

- no ai Please don't answer i posted blurred image mistakely. please comment below i will write values. if you answer with incorrect values i will give unhelpful confirm.arrow_forwardFinance SubjPlease don't answer i posted blurred image mistakely. please comment below i will write values. if you answer with incorrect values i will give unhelpful confirm.arrow_forwardcalculate ratios for the financial statment given and show all working manually: 3. TIE Ratio 4. Cash Coverage Ratioarrow_forward

- calculate ratios for the financial statment given and show all working manually: 1. Debt Ratios 2. Debt to Equityarrow_forwardcalculate the following ratios for the statements and show all working: 1. Current Ratios 2. Quick Ratio 3. Cash Ratioarrow_forwardDont solve this question with incorrect values. i will give unhelpful . do not solvearrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT