Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15.MJ, Problem 2IFRS

IFRS Activity 2

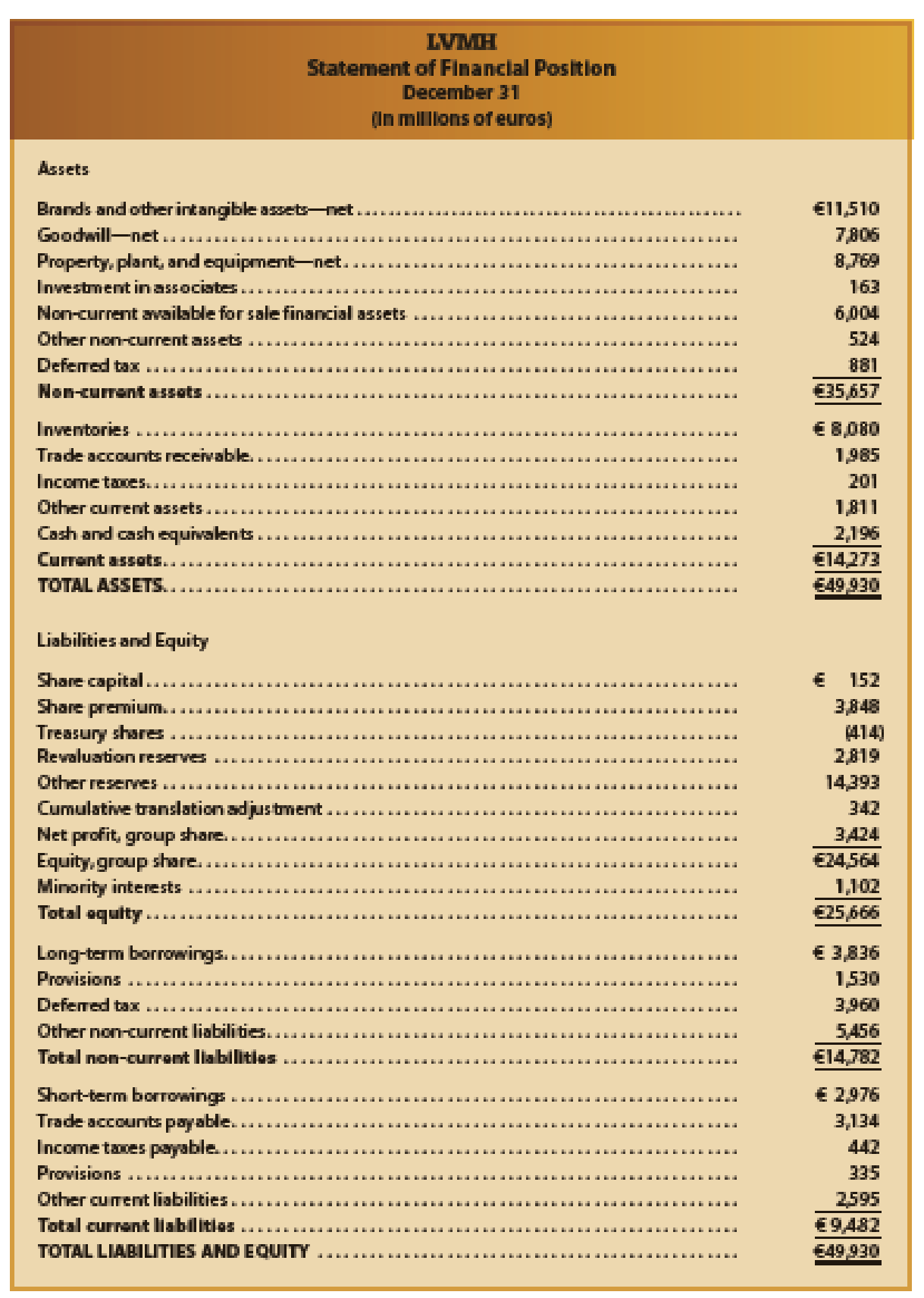

The following is a recent consolidated

- a. Identify presentation differences between the balance sheet of LVMH and a balance sheet prepared under U.S. GAAP. Use the Mornin’ Joe balance sheet (Exhibit 2) as an example of a U.S. GAAP balance sheet. (Ignore minority interests and cumulative translation adjustment.)

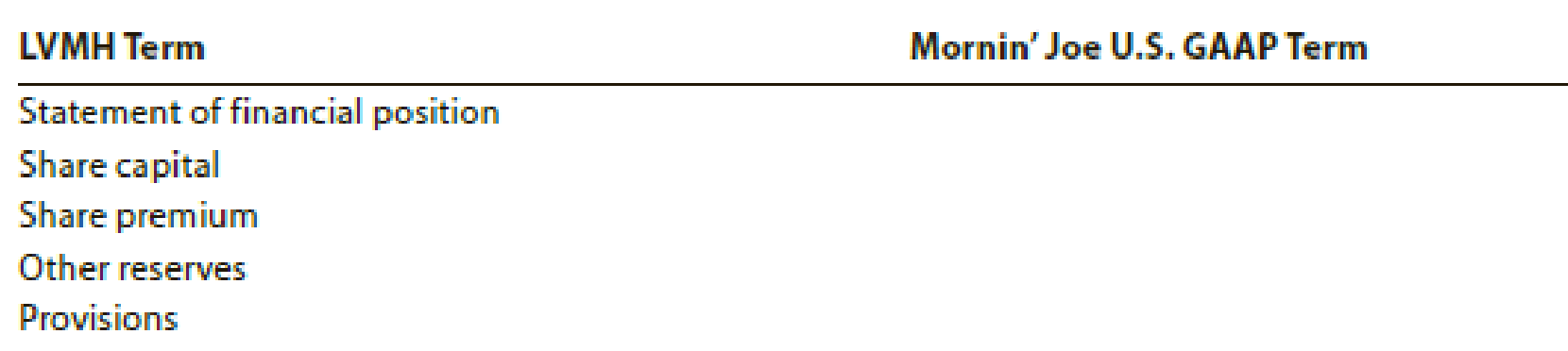

- b. Compare the terms used in this balance sheet with the terms used by Mornin’ Joe (Exhibit 2), using the table that follows:

- c. What does the “Revaluation reserves” in the Equity section of the balance sheet represent?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Jane Yoakim, President of Estefan Co., recently read an article that claimed that at least 100 of the country's 500 largest companies were either adopting or considering adopting the last in, first out (LIFO) method for valuing inventories. The article stated that the firms were switching to LIFO to (1) neutralize the effect of inflation in their financial statements, (2) eliminate inventory profits, and (3) reduce income taxes. Ms. Yoakim wonders if the switch would benefit her company.

Estefan currently uses the first-in, first-out (FIFO) method of inventory valuation in its periodic inventory system. The company has a high inventory turnover rate, and inventories represent a significant proportion of the assets.

Ms. Yoakim has been told that the LIFO system is more costly to operate and will provide little benefit to companies with high turnover. She intends to use the inventory method that is best for the company in the long run rather than selecting a method just because it is the…

please help with how im supposed to solve this

INVOLVE was incorporated as a not-for-profit organization on January 1, 2023. During the fiscal year ended December 31,

2023, the following transactions occurred.

1. A business donated rent-free office space to the organization that would normally rent for $35,600 a year.

2. A fund drive raised $188,000 in cash and $106,000 in pledges that will be paid next year. A state government grant of

$156,000 was received for program operating costs related to public health education.

3. Salaries and fringe benefits paid during the year amounted to $209,160. At year-end, an additional $16,600 of salaries

and fringe benefits were accrued.

4. A donor pledged $106,000 for construction of a new building, payable over five fiscal years, commencing in 2025. The

discounted value of the pledge is expected to be $94,860.

5. Office equipment was purchased for $12,600. The useful life of the equipment is estimated to be five years. Office

furniture with a fair value of $10,200 was donated by a local office…

Chapter 15 Solutions

Financial Accounting

Ch. 15.MJ - Prob. 1DQCh. 15.MJ - What is the difference between classifying an...Ch. 15.MJ - If a functional expense classification is used for...Ch. 15.MJ - Prob. 4DQCh. 15.MJ - What are two main differences in inventory...Ch. 15.MJ - Prob. 6DQCh. 15.MJ - Prob. 7DQCh. 15.MJ - Prob. 8DQCh. 15.MJ - Prob. 9DQCh. 15.MJ - How is treasury stock reported under IFRS? How...

Ch. 15.MJ - IFRS Activity 1

Unilever Group is a global company...Ch. 15.MJ - IFRS Activity 2 The following is a recent...Ch. 15.MJ - Prob. 3IFRSCh. 15 - Why might a business invest cash in temporary...Ch. 15 - What causes a gain or loss on the sale of a bond...Ch. 15 - When is the equity method the appropriate...Ch. 15 - Prob. 4DQCh. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQCh. 15 - Prob. 1PEACh. 15 - Prob. 1PEBCh. 15 - On February 10, 15,000 shares of Sting Company are...Ch. 15 - Prob. 2PEBCh. 15 - Prob. 3PEACh. 15 - Prob. 3PEBCh. 15 - Prob. 4PEACh. 15 - Prob. 4PEBCh. 15 - Prob. 5PEACh. 15 - On January 1, 2016, Valuation Allowance for...Ch. 15 - Prob. 6PEACh. 15 - Prob. 6PEBCh. 15 - Parilo Company acquired 170,000 of Makofske Co.,...Ch. 15 - Prob. 2ECh. 15 - Prob. 3ECh. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - On March 4, Breen Corporation acquired 7,500...Ch. 15 - Prob. 7ECh. 15 - Prob. 8ECh. 15 - Seamus Industries Inc. buys and sells investments...Ch. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - Prob. 12ECh. 15 - Prob. 13ECh. 15 - JED Capital Inc. makes investments in trading...Ch. 15 - Prob. 15ECh. 15 - Prob. 16ECh. 15 - Prob. 17ECh. 15 - Prob. 18ECh. 15 - Prob. 19ECh. 15 - The investments of Steelers Inc. include a single...Ch. 15 - Prob. 21ECh. 15 - Storm, Inc. purchased the following...Ch. 15 - Prob. 23ECh. 15 - Prob. 24ECh. 15 - Prob. 25ECh. 15 - Prob. 26ECh. 15 - Prob. 27ECh. 15 - Prob. 28ECh. 15 - Prob. 29ECh. 15 - Prob. 1PACh. 15 - Prob. 2PACh. 15 - Prob. 3PACh. 15 - OBrien Industries Inc. is a book publisher. The...Ch. 15 - Prob. 1PBCh. 15 - Prob. 2PBCh. 15 - Prob. 3PBCh. 15 - Prob. 4PBCh. 15 - Selected transactions completed by Equinox...Ch. 15 - On July 16, 1998, Wyatt Corp. purchased 40 acres...Ch. 15 - International Financial Reporting Standard No. 16...Ch. 15 - Prob. 3CPCh. 15 - Berkshire Hathaway, the investment holding company...Ch. 15 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fairfield Company's payroll costs for the most recent month are summarized here: Item Hourly labor unges Description 920 hours $27 per hour 190 hours for Job 101 340 hours for Job 102 Factory supervision Production engineer Factory Janitorial work Selling, general, and administrative salaries Total payroll costs Required: 390 hours for Job 103 Total Cost $ 5,130 9,180 10,530 $ 24,840 4,350 7,100 1,200 8,800 $ 46,298 1. & 2. Prepare the journal entries for payroll and to apply manufacturing overhead to production. The company applies manufacturing overhead to products at a predetermined rate of $54 per direct labor hour Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. View transaction list Journal entry worksheet A B Record Fairfield Company's payroll costs to be paid at a later date. Note Enter debits before credits. S.No Date 1 Account Title Debit Creditarrow_forwardNo wrong answerarrow_forwardL.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Now assume that 5% of the L.L. Bean boots are returned by customers for various reasons. L. Bean has a 100% refund policy for returns, no matter what the reason. What would the journal entry be to accrue L.L. Bean's sales returns for this one pair of boots?arrow_forward

- The following data were taken from the records of Splish Brothers Company for the fiscal year ended June 30, 2025. Raw Materials Inventory 7/1/24 $58,100 Accounts Receivable $28,000 Raw Materials Inventory 6/30/25 46,600 Factory Insurance 4,800 Finished Goods Inventory 7/1/24 Finished Goods Inventory 6/30/25 99,700 Factory Machinery Depreciation 17,100 21,900 Factory Utilities 29,400 Work in Process Inventory 7/1/24 21,200 Office Utilities Expense 9,350 Work in Process Inventory 6/30/25 29,400 Sales Revenue 560,500 Direct Labor 147,550 Sales Discounts 4,700 Indirect Labor 25,360 Factory Manager's Salary 63,400 Factory Property Taxes 9,910 Factory Repairs 2,500 Raw Materials Purchases 97,300 Cash 39,200 SPLISH BROTHERS COMPANY Income Statement (Partial) $arrow_forwardNo AIarrow_forwardL.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7.In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Assume that a pair of 8" Bean Boots are ordered on December 3, 2015. The order price is $109. The sales tax rate in the state in which the boots are order is 7%. L.L. Bean ships the boots on January 29, 2016. Assume same-day shipping for the sake of simplicity. On what day would L.L. Bean recognize the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Business Diversification; Author: GreggU;https://www.youtube.com/watch?v=50-d__Pn_Ac;License: Standard Youtube License