Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 4PA

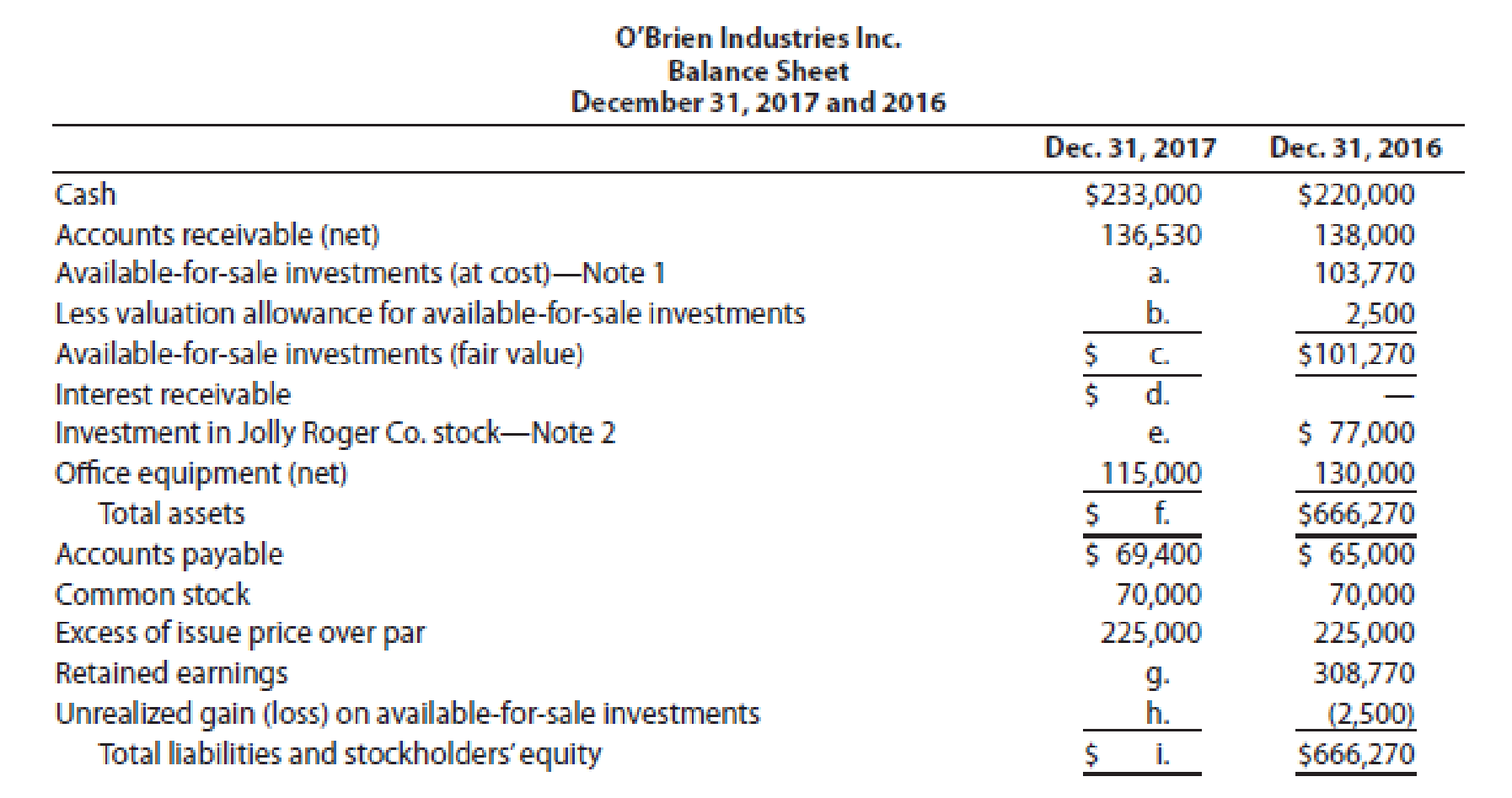

O’Brien Industries Inc. is a book publisher. The comparative unclassified balance sheets for December 31, 2017 and 2016 follow. Selected missing balances are shown by letters.

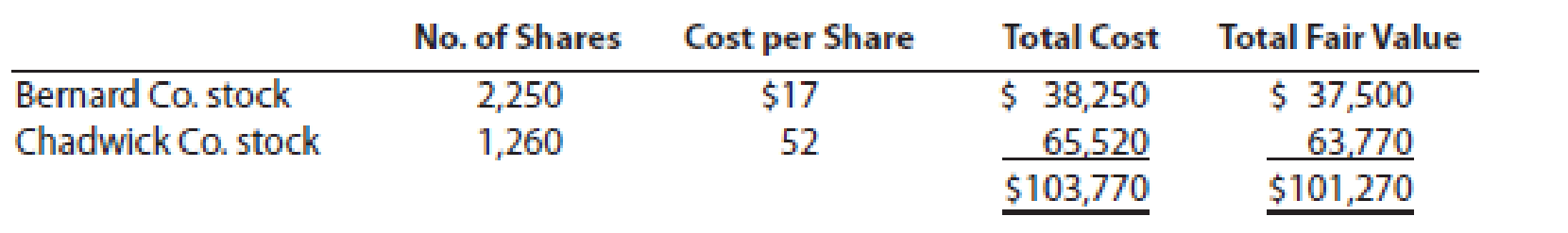

Note 1. Investments are classified as available for sale. The investments at cost and fair value on December 31, 2016, are as follows:

Note 2. The investment in Jolly Roger Co. stock is an equity method investment representing 30% of the outstanding shares of Jolly Roger Co. The following selected investment transactions occurred during 2017:

| May 5. | Purchased 3,080 shares of Gozar Inc. at $30 per share including brokerage commission. Gozar Inc. is classified as an available-for-sale security. |

| Oct. 1. | Purchased $40,000 of Nightline Co. 6%, 10-year bonds at 100. The bonds are classified as available for sale. The bonds pay interest on October 1 and April 1. |

| 9. | Dividends of $12,500 are received on the Jolly Roger Co. investment. |

| Dec. 31. | Jolly Roger Co. reported a total net income of $112,000 for 2017. O’Brien Industries Inc. recorded equity earnings for its share of Jolly Roger Co. net income. |

| 31. | Accrued three months of interest on the Nightline bonds. |

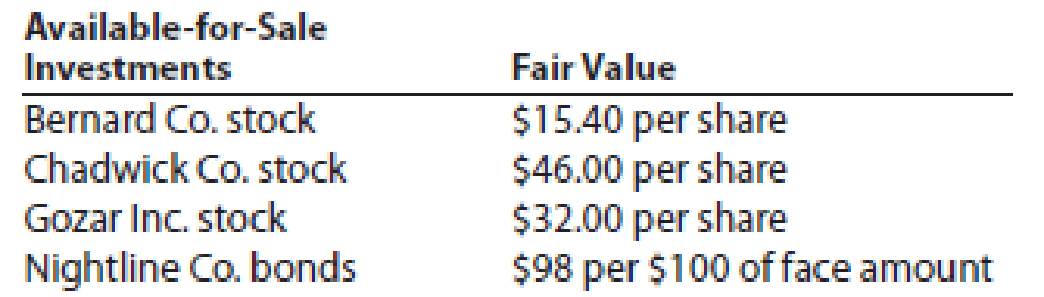

| 31. | Adjusted the available-for-sale investment portfolio to fair value, using the following fair value per-share amounts: |

| 31. | Closed the O’Brien Industries Inc. net income of $146,230. O’Brien Industries Inc. paid no dividends during the year. |

Instructions

Determine the missing letters in the unclassified

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Stanley Woodworks manufactures wooden cabinets and can either make or buy a specific cabinet door component. The cost to manufacture the component is $12 for direct materials, $9 for direct labor, and $11 for variable overhead. Additionally, a supervisor is required to oversee production of the component at an annual salary cost of $60,000. If Stanley Woodworks requires 120,000 components per year, the maximum purchase price per unit they should consider paying is $__.

Answer? ? Financial accounting

hello tutor please help me answer

Chapter 15 Solutions

Financial Accounting

Ch. 15.MJ - Prob. 1DQCh. 15.MJ - What is the difference between classifying an...Ch. 15.MJ - If a functional expense classification is used for...Ch. 15.MJ - Prob. 4DQCh. 15.MJ - What are two main differences in inventory...Ch. 15.MJ - Prob. 6DQCh. 15.MJ - Prob. 7DQCh. 15.MJ - Prob. 8DQCh. 15.MJ - Prob. 9DQCh. 15.MJ - How is treasury stock reported under IFRS? How...

Ch. 15.MJ - IFRS Activity 1

Unilever Group is a global company...Ch. 15.MJ - IFRS Activity 2 The following is a recent...Ch. 15.MJ - Prob. 3IFRSCh. 15 - Why might a business invest cash in temporary...Ch. 15 - What causes a gain or loss on the sale of a bond...Ch. 15 - When is the equity method the appropriate...Ch. 15 - Prob. 4DQCh. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQCh. 15 - Prob. 1PEACh. 15 - Prob. 1PEBCh. 15 - On February 10, 15,000 shares of Sting Company are...Ch. 15 - Prob. 2PEBCh. 15 - Prob. 3PEACh. 15 - Prob. 3PEBCh. 15 - Prob. 4PEACh. 15 - Prob. 4PEBCh. 15 - Prob. 5PEACh. 15 - On January 1, 2016, Valuation Allowance for...Ch. 15 - Prob. 6PEACh. 15 - Prob. 6PEBCh. 15 - Parilo Company acquired 170,000 of Makofske Co.,...Ch. 15 - Prob. 2ECh. 15 - Prob. 3ECh. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - On March 4, Breen Corporation acquired 7,500...Ch. 15 - Prob. 7ECh. 15 - Prob. 8ECh. 15 - Seamus Industries Inc. buys and sells investments...Ch. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - Prob. 12ECh. 15 - Prob. 13ECh. 15 - JED Capital Inc. makes investments in trading...Ch. 15 - Prob. 15ECh. 15 - Prob. 16ECh. 15 - Prob. 17ECh. 15 - Prob. 18ECh. 15 - Prob. 19ECh. 15 - The investments of Steelers Inc. include a single...Ch. 15 - Prob. 21ECh. 15 - Storm, Inc. purchased the following...Ch. 15 - Prob. 23ECh. 15 - Prob. 24ECh. 15 - Prob. 25ECh. 15 - Prob. 26ECh. 15 - Prob. 27ECh. 15 - Prob. 28ECh. 15 - Prob. 29ECh. 15 - Prob. 1PACh. 15 - Prob. 2PACh. 15 - Prob. 3PACh. 15 - OBrien Industries Inc. is a book publisher. The...Ch. 15 - Prob. 1PBCh. 15 - Prob. 2PBCh. 15 - Prob. 3PBCh. 15 - Prob. 4PBCh. 15 - Selected transactions completed by Equinox...Ch. 15 - On July 16, 1998, Wyatt Corp. purchased 40 acres...Ch. 15 - International Financial Reporting Standard No. 16...Ch. 15 - Prob. 3CPCh. 15 - Berkshire Hathaway, the investment holding company...Ch. 15 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial accounting problemarrow_forwardGinx Enterprises had $250,000 in sales on account last year. The beginning accounts receivable balance was $15,000, and the ending accounts receivable balance was $22,000. The company's average collection period (age of receivables) was closest to: (a) 19.54 days. (b) 36.68 days. (c) 27.02 days. (d) 52.45 days. Need answerarrow_forwardHelparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License