Concept explainers

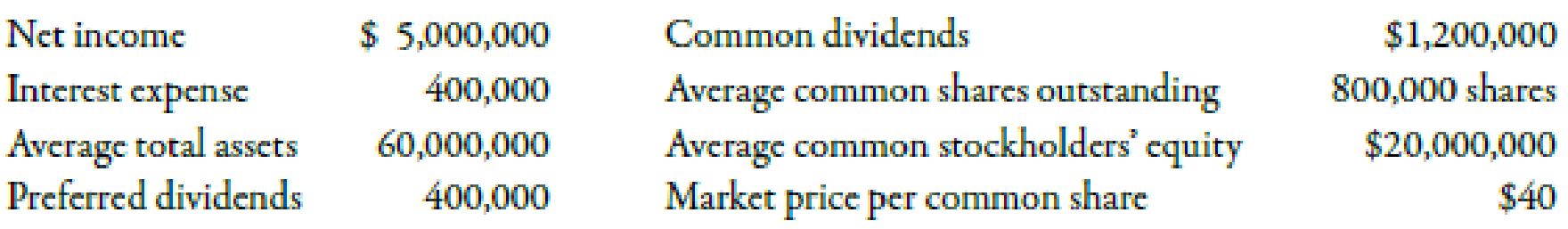

The following information has been gathered for Malette Manufacturing:

Assume that the firm has no common stock equivalents. The tax rate is 34%.

Required:

- 1. Compute the return on assets.

- 2. Compute the return on common stockholders’ equity.

- 3. Compute the earnings per share.

- 4. Compute the price-earnings ratio.

- 5. Compute the dividend yield.

- 6. Compute the dividend payout ratio.

1.

Calculate return on assets.

Answer to Problem 58P

Return on assets is 0.088 or 8.8%.

Explanation of Solution

Profitability Ratio

These ratios evaluate a firm’s ability to earn profits. They help the stakeholders of the company to measure the degree to which funds invested by them are efficiently used. Some of the ratios calculated return on sales, total assets and stockholder’s equity.

Use the following formula to compute return on assets:

Substitute the values in the above formula:

Therefore, return on assets is 8.8%.

2.

Calculate return stockholders’ equity.

Answer to Problem 58P

Return on stockholders’ equity is 0.23 or 23%

Explanation of Solution

Use the following formula to compute return stockholders’ equity:

Substitute the values in the above formula:

Therefore, return on stockholders’ equity is 0.23 or 23%.

3.

Calculate earnings per share.

Answer to Problem 58P

Earnings per share is $5.75 per share

Explanation of Solution

Use the following formula to compute earnings per share:

Substitute the values in the above formula:

Therefore, earnings per share are $5.75 per share.

4.

Calculate price earnings ratio.

Answer to Problem 58P

Price earnings ratio is 6.96.

Explanation of Solution

Use the following formula to compute price earnings ratio:

Substitute the values in the above formula:

Therefore, price earnings ratio is 6.96.

5.

Calculate dividend yield.

Answer to Problem 58P

Divided yield is 0.0375 or 3.75%.

Explanation of Solution

Use the following formula to compute dividend yield:

Substitute the values in the above formula:

Therefore, dividend yield is 0.0375 or 3.75%.

Working notes

Calculation of dividend per common share:

6.

Calculate dividend payout ratio.

Answer to Problem 58P

Dividend payout ratio is 0.26.

Explanation of Solution

Use the following formula to compute dividend payout ratio:

Substitute the values in the above formula:

Therefore, dividend payout ratio is 0.26.

Want to see more full solutions like this?

Chapter 15 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

- What is a good response to this post? My chosen product is an ergonomic pet bed similar to a large bean bag called a Pooch Poof. And my proposed markets are the United States, as it currently has the largest share of pet product sales, Europe as the pet population is 324.4 million currently, and South America, as this country is expected to be one of the fastest growing markets for pet accessories and food (Shahbandeh, 2024). With my product in two stable markets, and one emerging market, financial risks will be minimized as much as possible when expanding into the emerging market of South America by the stability of the American and European markets that are established. My slogan will be “Pamper your pooch with softness and watch your worries about your pup’s good night sleep go “Poof”. A “poofed” pet is a proper pet!” This slogan works as in the United States and Europe, dogs are generally considered family members, and allowed in public spaces, and socialization, training, health…arrow_forwardWhat is its debt to equity ratio for WACC purposes?arrow_forwardWhat is its debt to equity ratio for WACC purposes? Accountingarrow_forward

- What is a good response to this post? In this week’s discussion, we will consider product slogans and expansion into other countries. For my post, I will be focusing on make-up brand Merit Beauty. It is a vegan beauty brand that focuses on minimalist beauty and offers kits that have all five pieces for ease of application and enhances the natural beauty of the wearer (Fallon, 2024). My slogan: “Where less is more and looking good is easy” The countries I would like to expand marketing to are: Singapore: The country focuses on health and beauty with emphasis on wellbeing and the country has a comprehensive offering of insurance, both private and national insurance, along with initiatives to promote wellbeing (GCPIT, n.d.). Additionally, the makeup market had total revenues of $221.4 million in 2023 which was an annual growth rate of 3.7% between 2018 and 2023 (Marketline, 2024). France: France too has a commitment to offering clean products to their citizens and have been know as one…arrow_forwardPlease find the interest revenue HELParrow_forwardAns plzarrow_forward

- Toodles Inc. had sales of $1,840,000. Cost of goods sold,administrative and selling expenses, and depreciation expenses were $1,180,000, $185,000 and $365,000 respectively. In addition, the company had an interest expense of $280,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.)Arrange the financial information for Toodles Inc. in an income statement and compute its OCF?arrow_forwardAnti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000; Costs = $2,173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes = $76,000; Dividends = $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capitalarrow_forwardAnswer the questions in the attached imagearrow_forward

- Auditor should assess the likelihood of --------- when identifying potential criteria for the audit. material misstatement wrong answerarrow_forwardWhen information comes to the auditors' attention indicating that ----- may have occured, auditors should evaluate whether the possible effect is significant within the context of the audit objectives.arrow_forwardNeed help with this question solution general accountingarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT