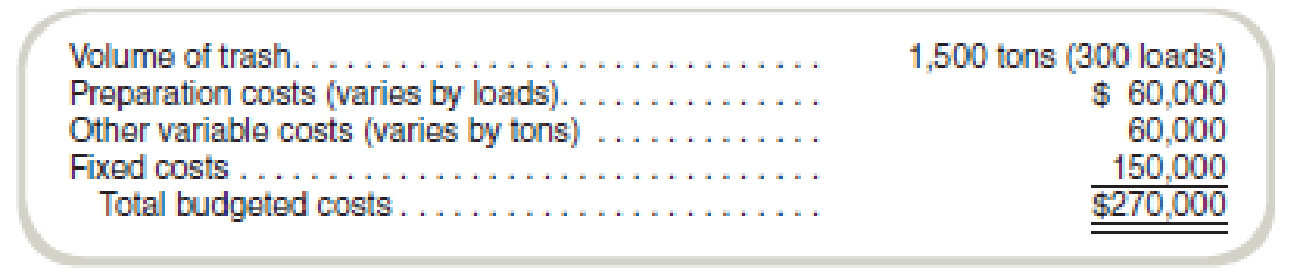

Mathes Corporation manufactures paper products. The company operates a landfill, which it uses to dispose of nonhazardous trash. The trash is hauled from the two nearby manufacturing facilities in trucks that can carry up to five tons of trash in a load. The landfill operation requires certain preparation activities regardless of the amount of trash in a truck (i.e., for each load). The budget for the landfill for next year follows:

Mathes is considering making the landfill a profit center and charging the manufacturing plants for disposal of the trash. The landfill has sufficient capacity to operate for at least the next 20 years. Other landfills are available in the area (both private and municipal), and each plant would be free to decide which landfill to use.

Required

- a. What transfer pricing rule should Mathes implement at the landfill so that its plant managers would independently make decisions regarding landfill use that would be in the company’s best interests?

- b. Illustrate your rule by computing the transfer price that would be applied to a four-ton load of trash from one of the plants.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

COST ACCOUNTING W/CONNECT

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardGeneral Accounting questionarrow_forwardWhat Is the correct answer A B ?? General Accounting questionarrow_forward

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forwardNot need ai solution please correct answer general Accountingarrow_forward

- Accounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forwardAns plzarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning