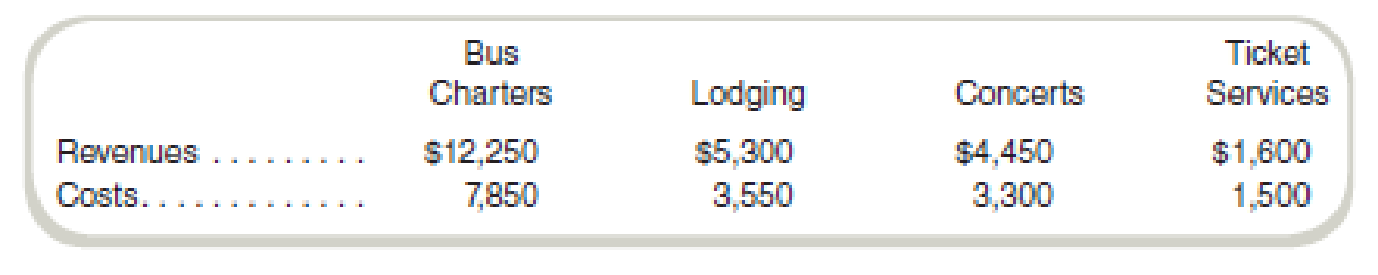

Midwest Entertainment has four operating divisions: Bus Charters, Lodging, Concerts, and Ticket Services. Each division is a separate segment for financial reporting purposes. Revenues and costs related to outside transactions were as follows for the past year (dollars in thousands):

Bus Charters Division participates in a frequent guest program with Lodging Division. During the past year, Bus Charters reported that it traded lodging award coupons for travel that had a retail value of $1.3 million, assuming that the travel was redeemed at full fares. Concerts Division offered 20 percent discounts to Midwest’s bus passengers and lodging guests. These discounts to bus passengers were estimated to have a retail value of $350,000. Midwest’s lodging guests redeemed $150,000 in concert discount coupons. Midwest’s hotels also provided rooms for Bus Charters’s employees (drivers and guides). The value of the rooms for the year was $650,000.

Ticket Services Division sold chartered tours for Bus Charters valued at $200,000 for the year. This service for intracompany lodging was valued at $100,000. It also sold concert tickets for Concerts; tickets for intracompany concert admission were valued at $50,000.

While preparing all of these data for financial statement presentation, Lodging Division’s controller stated that the value of the bus coupons should be based on their differential and opportunity costs, not on the full fare. This argument was supported because travel coupons are usually allocated to seats that would otherwise be empty or that are restricted similar to those on discount tickets. If the differential and opportunity costs were used for this transfer price, the value would be $250,000 instead of $1.3 million. Bus Charters’s controller made a similar argument concerning the concert discount coupons. If the differential cost basis were used for the concert coupons, the transfer price would be $50,000 instead of the $350,000.

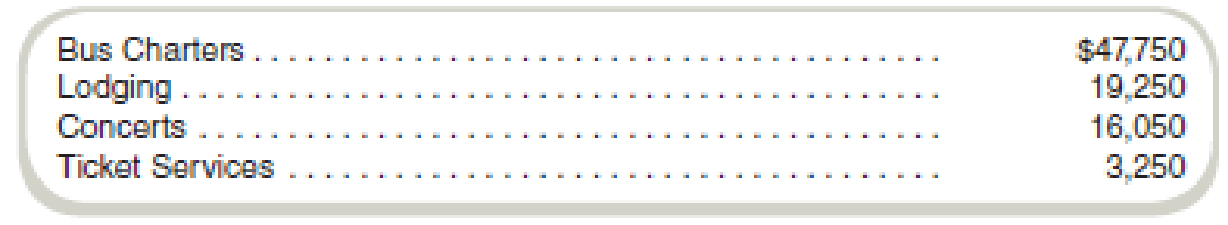

Midwest reports assets in each division as follows (dollars in thousands):

Required

- a. Using the retail values for transfer pricing for segment reporting purposes, what are the operating profits for each Midwest division?

- b. What are the operating profits for each Midwest division using the differential cost basis for pricing transfers?

- c. Rank each division by

ROI using the transfer pricing methods in requirements (a) and (b). What difference does the transfer pricing system have on the rankings?

Trending nowThis is a popular solution!

Chapter 15 Solutions

COST ACCOUNTING W/CONNECT

- Degregorio Corporation makes a product that uses a material with the following direct material standards: Standard quantity 2.7 kilos per unit Standard price $9 per kilo The company produced 5,700 units in November using 15,760 kilos of the material. During the month, the company purchased 17,830 kilos of direct material at a total cost of $156,904. The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for November is: a. $3,330 F b. $3,236 F c. $3,330 U d. $3,236 Uarrow_forwardNonearrow_forwardGeneral Accountarrow_forward

- Financial accountingarrow_forwardSubject: Financial Accountingarrow_forwardThe blending department had the following data for the month of March: Units in BWIP Units completed 7,200 Units in EWIP (40% complete) 750 $27,000 Total manufacturing costs Required: 1. What is the output in equivalent units for March? 2. What is the unit manufacturing cost for March?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning