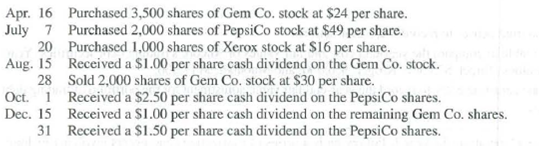

Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short-term stock investments with insignificant influence.

Required

- 1. Prepare

journal entries to record the preceding transactions and events. - 2. Prepare a table to compare the year-end cost and fair values of Rose’s short-term stock investments. The year-end fair values per share are Gem Co., $26; PepsiCo, $46; and Xerox, $13.

- 3. Prepare an

adjusting entry to record the year-end fair value adjustment for the portfolio of short-term stock investments.

Analysis Component

- 4. Explain the

balance sheet presentation of the fair value adjustment for Rose's short-term investments. - 5. How do these short-term stock investments affect Rose’s (a) income statement for this year and (b) the equity section of its balance sheet at this year-end?

1.

Prepare the journal entries to record the given transactions.

Explanation of Solution

Journal entry:

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Prepare the journal entries to record the given transactions as follows:

| Date | Account Titles and Description | Post Ref. | Debit ($) | Credit ($) |

| April 16, | Stock Investments in company G (1) | 84,000 | ||

| Cash | 84,000 | |||

| (To record the Purchase of 4,000 shares of Company G in cash) | ||||

| July 7, | Stock Investments in Company P (2) | 98,000 | ||

| Cash | 98,000 | |||

| (To record 2,000 shares of company P purchased in cash) | ||||

| July 20, | Stock Investments in company X (3) | 16,000 | ||

| Cash | 16,000 | |||

| (To record 1,000 shares of Company X purchased in cash) | ||||

| August 15, | Cash | 3,500 | ||

| Dividend Revenue (4) | 3,500 | |||

| (To record dividend revenue received in cash) | ||||

| August 28, | Cash (5) | 60,000 | ||

| Stock Investments in Company G (6) | 48,000 | |||

| Gain on Sale of Stock Investments (7) | 12,000 | |||

| (To record sales made 2,000 shares at the rate of $30 per share) | ||||

| October 1, | Cash | 5,000 | ||

| Dividend Revenue (8) | 5,000 | |||

| (To record dividend revenue received in cash) | ||||

| December 1, | Cash | 1,500 | ||

| Dividend Revenue (9) | 1,500 | |||

| (To record dividend revenue received in cash) | ||||

| December 31, | Cash | 3,000 | ||

| Dividend Revenue (10) | 3,000 | |||

| (To record dividend revenue received in cash) |

Table (1)

Working note:

Calculate the purchased value of stock investment (Company G)

Calculate the purchased value of stock investment (Company P)

Calculate the purchased value of stock investment (Company X)

Calculate the dividend revenue received from Company G

Calculate the value of cash received from the sale of stock investment (Company G stocks)

Calculate the purchase value of long-term investment for 2,000 shares of Company G

Calculate the gain (loss) from sale of stock investment.

Calculate the dividend revenue received from Company P

Calculate the dividend revenue received from Company G

Calculate the dividend revenue received from Company X

2.

Prepare a table to compare the year-end cost and fair value of Company R’s stock investments in available-for sale securities.

Explanation of Solution

Prepare a table to compare the year-end cost and fair value of Company R’s stock investments in available-for sale securities as follows:

| Name of the company | Cost of short-term investment | Fair value of short-term investment | Unrealized gain or (loss) |

| Company G | $36,000 (12) | $39,000 (13) | |

| Company P | $98,00 (2) | $92,000 (14) | |

| Company X | $16,000 (3) | $13,000 (15) | |

| Totals | $150,000 | $144,000 | $(6,000) (15) |

Table (2)

Working note:

Calculate the cost of stock investment of Company G

Calculate the fair value of stock investment of Company G

Calculate the fair value of stock investment of Company P

Calculate the fair value of stock investment of Company X

Calculate the value of unrealized gain or loss

3.

Prepare an adjusting entry, if necessary, to record the year-end fair value adjustment for the portfolio of stock investments in available-for-sale securities.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and expenses during the period in which they actually occurs.

Prepare an adjusting entry, if necessary, to record the year-end fair value adjustment for the portfolio of stock investments in available-for-sale securities as follows:

Adjusting entry for unrealized loss:

| Date | Account Titles and Description | Post Ref. | Debit ($) | Credit ($) |

| December, 31 | Unrealized loss - Equity | 6,000 | ||

| Fair value adjustment | 6,000 | |||

| (To record the adjustment entry for unrealized loss at the end of the accounting year ) |

Table (3)

- Unrealized Loss–Equity is an adjustment account to report the investment at fair market value. Since loss has occurred while adjusting; therefore, debit the unrealized Gain or Loss–Equity account with $6,000.

- Fair Value Adjustment is a contra-asset account. The account shows a credit balance since the market price has decreased (loss); therefore, credit the fair value adjustment with $6,000.

4.

Explain the manner in which the fair value adjustment of Company R’s stock investment is presented in the balance sheet.

Explanation of Solution

Explain the manner in which the fair value adjustment of Company R’s stock investment is presented in the balance sheet as follows:

Cost of stock investment in available-for-sale securities of $150,000 is reported in the assets side of the balance sheet and unrealized loss of $6,000 is subtracted from the cost of investment for the fair value adjustment. Net fair value of $144,000

5.

Explain the manner in which the stock investments affect company R’s

- a. Income statement for the year, and

- b. The equity section of the balance sheet at year ended.

Explanation of Solution

Explain the manner in which the stock investments affect company R’s income statement for the year, and the equity section of the balance sheet at year ended as follows:

(a) Income statement:

- Unrealized loss-Interest Revenue, $6,000

- Dividend Revenue, $13,000 (17)

- Gain on Sale of Stock Investments, $12,000

- Net effect on income is $19,000

(b) Equity section of Balance sheet:

- Increase to equity from the $19,000 increase in income

Working note:

Calculate the value of total dividend revenue received:

Want to see more full solutions like this?

Chapter 15 Solutions

Principles of Financial Accounting.

- Accounting question is correct answer with solutionarrow_forwardThe industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardprovide correct answer of this General accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education