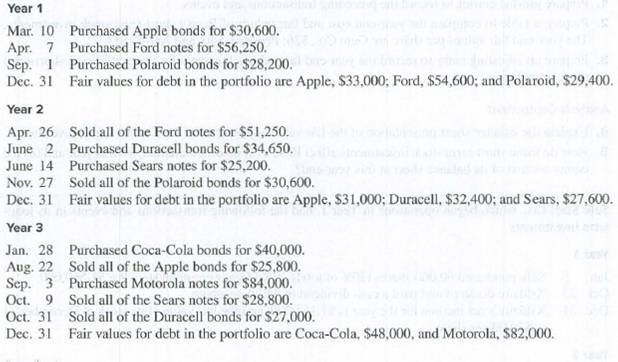

Paris Inc. began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities.

Required

- 1. Prepare

journal entries to record these transactions and events and any year-end fair value adjustments to the portfolio of long-term available-for-sale debt securities. - 2. Prepare a table that summarizes the (a) total cost, (b) total fair value adjustment, and (c) total fair value for the portfolio of long-term available-for-sale debt securities at each year-end.

- 3. Prepare a table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of long-term available-for-sale debt securities at each year-end.

1.

Prepare journal entries to record the given transaction.

Explanation of Solution

Journal entry:

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Prepare the journal entries to record the given transactions as follows:

| Journal | ||||

| Date | Account Title and Explanation | Post | Debit | Credit |

| Ref. | ($) | ($) | ||

| March 10, Year 1 | Debt Investments -AFS (Company A) | 30,600 | ||

| Cash | 30,600 | |||

| (To record the purchase of bonds) | ||||

| April 7, Year 1 | Debt Investments—AFS (Company F) | 56,250 | ||

| Cash | 56,250 | |||

| (To record the purchase of F notes) | ||||

| September, 1 Year 1 | Debt Investments —AFS (Company P) | 28,200 | ||

| Cash | 28,200 | |||

| (To record the purchase of bonds) | ||||

| December 31, Year 1 | Fair Value Adjustment—AFS | 1,950 | ||

| Unrealized Gain—Equity (LT) (2) | 1,950 | |||

| (To record the annual adjustment to fair value of securities) | ||||

| April 26, Year 2 | Cash | 51,250 | ||

| Loss on sale of debt investments (3) | 5,000 | |||

| Debt investment—AFS (Company F) | 56,250 | |||

| (To record the gain on sale of bond) | ||||

| June 2, Year 2 | Debt Investments—AFS (Company D) | 34,650 | ||

| Cash | 34,650 | |||

| (To record the purchase of bond) | ||||

| June 14, Year 2 | Debt Investments —AFS (Company S) | 25,200 | ||

| Cash | 25,200 | |||

| (To record the purchase of bond) | ||||

| November, 27 Year 2 | Cash | 30,600 | ||

| Gain on Sale of Investments (4) | 2,400 | |||

| Debt Investments—AFS (Company P) | 28,200 | |||

| (To record the loss on sale of bond) | ||||

| December 31, Year 2 | Fair Value Adjustment—AFS | 1,400 | ||

| Unrealized Gain—Equity (LT) (6) | 1,400 | |||

| (To record the Annual adjustment to fair value of securities) | ||||

| January 28, Year 3 | Debt Investments—AFS (Company C) | 40,000 | ||

| Cash | 40,000 | |||

| (To record the purchase of bonds) | ||||

| August 22, Year 3 | Cash | 25,800 | ||

| Loss on Sale of Investments (7) | 4,800 | |||

| Debt Investments—AFS (Company A) | 30,600 | |||

| (To record the sale of bond) | ||||

| September 3, Year 3 | Debt Investments—AFS (Company M) | 84,000 | ||

| Cash | 84,000 | |||

| (To record the purchase of bonds) | ||||

| October 9, Year 3 | Cash | 28,800 | ||

| Gain on Sale of Investments (8) | 3,600 | |||

| Debt Investments—AFS (Company S) | 25,200 | |||

| (To record the sale of bonds) | ||||

| October 31, Year 3 | Cash | 27,000 | ||

| Loss on Sale of Investments (9) | 7,650 | |||

| Debt Investments—AFS (Company D) | 34,650 | |||

| (To record the sale of bond) | ||||

| December 31, Year 3 | Fair Value Adjustment—AFS | 5,450 | ||

| Unrealized Gain—Equity (LT) (11) | 5,450 | |||

| (To record the Annual adjustment to fair value of securities) | ||||

Table (1)

Working note:

Calculate the total cost and fair value of the bonds for Year 1:

| Name of the company | Cost of debt investment | Fair value of debt investment |

| Company A | $30,600 | $33,000 |

| Company F | $56,250 | $54,600 |

| Company P | $28,200 | $29,400 |

| Total | $115,050 | $117,000 |

Table (2)

…… (1)

Calculate the unrealized gain or loss for year 1:

Calculate the value of cash received from the sale of stock investment (Company F stocks)

Calculate the value of cash received from the sale of stock investment (Company P stocks)

Calculate the total cost and fair value of the bonds for Year 2:

| Name of the company | Cost of debt investment | Fair value of debt investment |

| Company A | S30,600 | $31,200 |

| Company F | $34,650 | $32,400 |

| Company S | $25,200 | $27,600 |

| Total | $90,450 | $91,000 |

Table (3)

…… (5)

Calculate the unrealized gain or loss for year 2:

Calculate the value of cash received from the sale of stock investment (Company A stocks)

Calculate the value of cash received from the sale of stock investment (Company S stocks)

Calculate the value of cash received from the sale of stock investment (Company D stocks)

Calculate the total cost and fair value of the bonds for Year 3:

| Name of the company | Cost of debt investment | Fair value of debt investment |

| Company C | $40,000 | $48,000 |

| Company M | $84,000 | $82,000 |

| Total | $124,000 | $130,000 |

Table (4)

…… (10)

Calculate the unrealized gain or loss for year 3:

2.

Prepare a table that summarizes the following

- a. Total cost,

- b. Total fair value adjustments,

- c. Total fair value of the portfolio of long-term available-for-sale securities at year-end.

Explanation of Solution

Prepare a table that summarizes the total cost, total fair value adjustments, and the total fair value as follows:

| Particulars | December 31, Year 1 | December 31, Year 2 | December 31, Year 3 |

| a. Long-term AFS Securities (cost) | $115,050 | $90,450 | $124,000 |

| b. Fair Value Adjustment | 1,950 | 550 | 6,000 |

| c. Long-term AFS Securities (fair value) | $117,000 | $91,000 | $130,000 |

Table (5)

3.

Prepare a table that summarizes the following

- a. The realized gains and losses,

- b. The unrealized gains and losses for the portfolio of long-term available-for-sale securities at year-end.

Explanation of Solution

- a. Prepare a table that summarizes the realized gains and losses as follows:

| Particulars | Year 1 | Year 2 | Year 3 |

| Realized gains (losses) | |||

| Sale of F shares | $(5,000 ) | ||

| Sale of P shares | 2,400 | ||

| Sale of A shares | $(4,800) | ||

| Sale of S shares | $3,600 | ||

| Sale of D shares | $(7,650) | ||

| Total realized gain (loss) | $0 | $ (2,600) | $(8,850) |

Table (6)

- b. Prepare a table that summarizes the Unrealized gains and losses as follows

| Particulars | Year 1 | Year 2 | Year 3 |

| Unrealized gains (losses) at year-end | $1,950 | $ 550 | $ 6,000 |

Table (7)

Want to see more full solutions like this?

Chapter 15 Solutions

Principles of Financial Accounting.

- A college's food operation has an average meal price of $9.20. Variable costs are $4.35 per meal and fixed costs total $95,000. How many meals must be sold to provide an operating income of $33,000? How many meals would have to be sold if fixed costs declined by 23%? (round to the nearest meal)arrow_forwardHiii tutor give me Answerarrow_forwardAnna company reported the following dataarrow_forward

- Use this information to determine the number of unitsarrow_forwardA firm has net working capital of $980, net fixed assets of $4,418, sales of $9,250, and current liabilities of $1,340. How many dollars worth of sales are generated from every $1 in total assets? Need answerarrow_forwardA firm has net working capital of $980, net fixed assets of $4,418, sales of $9,250, and current liabilities of $1,340. How many dollars worth of sales are generated from every $1 in total assets?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning