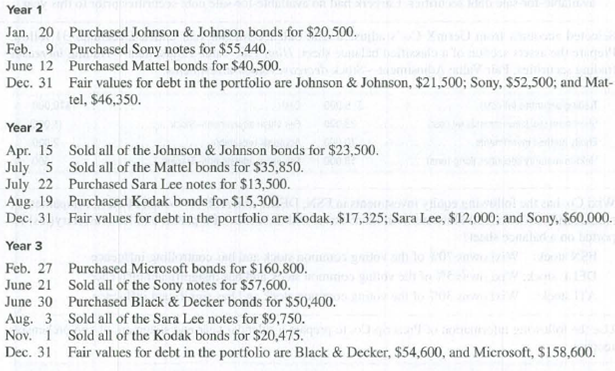

Mead Inc. began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities.

Required

- 1. Prepare

journal entries to record these transactions and the year-end fair value adjustments to the portfolio of long-term available-for-sale debt securities. - 2. Prepare a table that summarizes the (a) total cost, (b) total fair value adjustment, and (c) total fair value of the portfolio of long-term available-for-sale debt securities at each year-end.

- 3. Prepare a table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of long-term available-for-sale debt securities at each year-end.

1.

Prepare journal entries to record the given transaction.

Explanation of Solution

Journal entry:

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Prepare the journal entries to record the given transactions as follows:

| Journal | ||||

| Date | Account Title and Explanation | Post | Debit | Credit |

| Ref. | ($) | ($) | ||

| January 20, Year 1 | Debt Investments -AFS (Company J&J) | 20,500 | ||

| Cash | 20,500 | |||

| (To record the purchase of bonds) | ||||

| February 9, Year 1 | Debt Investments—AFS (Company S) | 55,440 | ||

| Cash | 55,440 | |||

| (To record the purchase of S notes) | ||||

| June 12, Year 1 | Debt Investments —AFS (Company M) | 40,500 | ||

| Cash | 40,500 | |||

| (To record the purchase of bonds) | ||||

| December 31, Year 1 | Fair Value Adjustment—AFS | 3,910 | ||

| Unrealized Gain—Equity (Company LT) (2) | 3,910 | |||

| (To record the annual adjustment to fair value of securities) | ||||

| April 15, Year 2 | Cash | 23,500 | ||

| Gain on sale of debt investments (3) | 3,000 | |||

| Debt investment—AFS (Company J&J) | 20,500 | |||

| (To record the gain on sale of bond) | ||||

| July 5, Year 2 | Cash | 35,850 | ||

| Loss on Sale of Investments (4) | 4,650 | |||

| Debt Investments—AFS (Company M) | 40,500 | |||

| (To record the loss on sale of bond) | ||||

| July 22, Year 2 | Debt Investments—AFS (Company SL) | 13,500 | ||

| Cash | 13,500 | |||

| (To record the purchase of bond) | ||||

| August 19, Year 2 | Debt Investments —AFS (Company EK) | 15,300 | ||

| Cash | 15,300 | |||

| (To record the purchase of bond) | ||||

| December 31, Year 2 | Fair Value Adjustment-AFS (Company LT) | 1,175 | ||

| Unrealized gain Equity (6) | 1,175 | |||

| (To record the Annual adjustment to fair value of securities) | ||||

| February 27, Year 3 | Debt Investments—AFS (Company M) | 160,800 | ||

| Cash | 160,800 | |||

| (To record the purchase of bonds) | ||||

| June 21, Year 3 | Cash | 57,600 | ||

| Gain on Sale of Investments (7) | 2,160 | |||

| Debt Investments—AFS (Company S) | 55,440 | |||

| (To record the sale of bonds) | ||||

| June 30, Year 3 | Debt Investments—AFS (Company B&D) | 50,400 | ||

| Cash | 50,400 | |||

| (To record the purchase of bonds) | ||||

| August 3, Year 3 | Cash | 9,750 | ||

| Loss on Sale of Investments (8) | 3,750 | |||

| Debt Investments—AFS (Company SL) | 13,500 | |||

| (To record the sale of bond) | ||||

| November 1, Year 3 | Cash | 20,475 | ||

| Gain on Sale of Investments (9) | 5,175 | |||

| Debt Investments—AFS (Company E.K) | 15,300 | |||

| (To record the sale of bond) | ||||

| December 31, Year 3 |

Unrealized Gain—Equity | 3,085 | ||

| Fair Value Adjustment—AFS (Company LT) (10) | 3,085 | |||

| (To record the Annual adjustment to fair value of securities) | ||||

Table (1)

Working note:

Calculate the total cost and fair value of the bonds for Year 1:

| Name of the company | Cost of debt investment | Fair value of debt investment |

| Company J&J | $20,500 | $21,500 |

| Company S | $55,440 | $52,500 |

| Company M | $40,500 | $46,350 |

| Total | $116,440 | $120,350 |

Table (2)

…… (1)

Calculate the unrealized gain or loss for year 1:

Calculate the value of cash received from the sale of stock investment (Company J&J stocks)

Calculate the value of cash received from the sale of stock investment (Company M stocks)

Calculate the total cost and fair value of the bonds for Year 2:

| Name of the company | Cost of debt investment | Fair value of debt investment |

| Company K | $15,300 | $17,325 |

| Company SL | $13,500 | $12,000 |

| Company S | $55,440 | $60,000 |

| Total | $84,240 | $89,325 |

Table (3)

…… (5)

Calculate the unrealized gain or loss for year 2:

Calculate the value of cash received from the sale of stock investment (Company S stocks)

Calculate the value of cash received from the sale of stock investment (Company SL stocks)

Calculate the value of cash received from the sale of stock investment (Company E.K stocks)

Calculate the total cost and fair value of the bonds for Year 3:

| Name of the company | Cost of debt investment | Fair value of debt investment |

| Company B&D | $50,400 | $54,600 |

| Company SL | $160,800 | $158,600 |

| Total | $211,200 | $213,200 |

Table (4)

…… (10)

Calculate the unrealized gain or loss for year 3:

2.

Prepare a table that summarizes the following

- a. Total cost,

- b. Total fair value adjustments,

- c. Total fair value of the portfolio of long-term available-for-sale securities at year-end.

Explanation of Solution

Prepare a table that summarizes the total cost, total fair value adjustments, and the total fair value as follows:

| Particulars | December 31, Year 1 | December 31, Year 2 | December 31, Year 3 |

| a. Long-term AFS Securities (cost) | $116,440 | $84,240 | $211,200 |

| b. Fair Value Adjustment | 3,910 | 5,085 | 2,000 |

| c. Long-term AFS Securities (fair value) | $120,350 | $89,325 | $213,200 |

Table (5)

3.

Prepare a table that summarizes the following

- a. The realized gains and losses,

- b. The unrealized gains and losses for the portfolio of long-term available-for-sale securities at year-end.

Explanation of Solution

- a. Prepare a table that summarizes the realized gains and losses as follows:

| Particulars | Year 1 | Year 2 | Year 3 |

| Realized gains (losses) | |||

| Sale of J & J shares | $3,000 | ||

| Sale of M shares | (4,650) | ||

| Sale of SL shares | $2,160 | ||

| Sale of S shares | $(3,750) | ||

| Sale of E.K shares | 5,175 | ||

| Total realized gain (loss) | $0 | ($1,650) | $3,585 |

Table (6)

- b. Prepare a table that summarizes the Unrealized gains and losses as follows

| Particulars | Year 1 | Year 2 | Year 3 |

| Unrealized gains (losses) at year-end | $3,910 | $5,085 | $2,000 |

Table (7)

Want to see more full solutions like this?

Chapter 15 Solutions

Principles of Financial Accounting.

- Which financial statement reports a company’s assets, liabilities, and equity at a specific point in time?A. Income StatementB. Balance SheetC. Statement of Cash FlowsD. Trial Balancearrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardAccrued expenses are:A. Paid and recordedB. Incurred but not yet paidC. Not yet incurredD. Always non-casharrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardNo AI Unearned Revenue is classified as a:A. RevenueB. AssetC. LiabilityD. Contra Revenuearrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning