Horngren's Financial & Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780133866292

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15.8SE

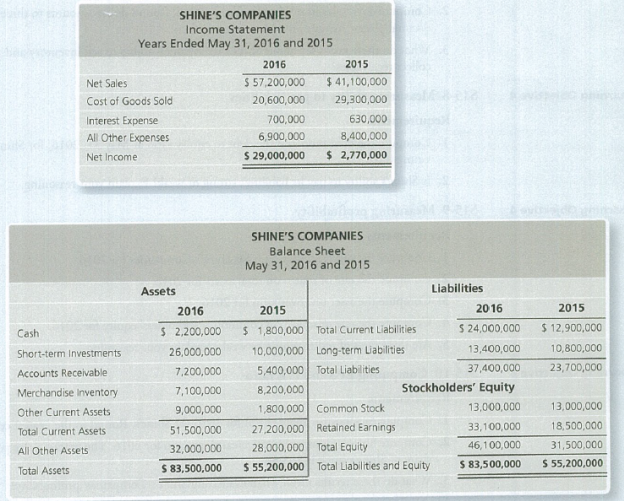

Shine's Companies, a home improvement store chain, reported the following summarized figures:

Shine's has 100,000 common shares outstanding during 2016.

Measuring ability to pay liabilities

Requirements

- 1. Compute the debt ratio and the debt to equity ratio at May 31, 2016, for Shine’s Companies.

- 2. Is Shine’s ability to pay its liabilities strong or weak? Explain your reasoning.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

...And does the current ratio improves, deteriorate, or hold steady during 2018?

Win's Companies, a home improvement store chain, reported the following summanzed figures

E (Click the icon to view the income statement.)

E (Click the icon to view the balance sheets.)

Win's has 20,000 common shares outstanding during 2018.

Read the requirements

Requirement 1. Compute Win's Companies' current ratio at May 31, 2018 and 2017

Begin by selecting the formula to calculate Win's Companies' current ratio. Then enter the amounts and calcu ale the current ratio for 2018 and then 2017. (Round your answers to two decimal places, X.XX.)

Current ratio

(i Balance Sheets

Income Statement

Win's Companies

Win's Companies

Balance Sheet

Income Statement

May 31, 2018 and 2017

Years Ended May 31, 2018 and 2017

Assets

Liabilities

2018

2017

2018

2017

2018

2017

Net Sales Revenue

24

57 200 $

39,800

Cash

$.

2.300 $

1300 Total Current Liabilities

22,000 $

12,900

Cost of Goods Sold

22.500

25,500

12,200

11,300

Short-term Invesiments

29 000

13.000 Long-term Liabilities

Interest Expense

500

320…

The following information is from the 2014 annual report of Weber Corporation, a company

that supplies manufactured parts to the household appliance industry.

Average Total Assets

Average Interest - Bearing Debt

Average Other Liabilities

Average Shareholder's Equity

Sales

Interest Expense

Net Income

24,500,000

10,000,000

2,250,000

12,250,000

49,000,000

800,000

2,450,000

Required:

1. Compute Weber Corporation's return on assets (ROA) for 2014 using a combined federal

and state income tax rate of 40% where needed.

2. Compute the profit margin and asset turnover components of ROA for 2014.

3. Weber's management believes that various business initiatives will produce an asset turnover

rate of 2.25 next year. If the profit margin next year is unchanged from 2014, what

will be the company's ROA?

Chapter 15 Solutions

Horngren's Financial & Managerial Accounting (5th Edition)

Ch. 15 - What part of the Libertys annual report is written...Ch. 15 - Horizontal analysis of Liberty's balance sheet for...Ch. 15 - Vertical analysis of Liberty's balance sheet for...Ch. 15 - Which statement best describes Liberty's acid-test...Ch. 15 - Liberty's inventory turnover during 2017 was...Ch. 15 - Prob. 6QCCh. 15 - Prob. 7QCCh. 15 - Liberty's rate of return on common stockholders'...Ch. 15 - The company has 2,500 shares of common stock...Ch. 15 - Prob. 10AQC

Ch. 15 - What ate the three main ways to analyze financial...Ch. 15 - What is an annual report? Briefly describe the key...Ch. 15 - Prob. 3RQCh. 15 - What is trend analysis, and how does it differ...Ch. 15 - Prob. 5RQCh. 15 - Prob. 6RQCh. 15 - Prob. 7RQCh. 15 - Briefly describe the ratios that can be used to...Ch. 15 - Prob. 9RQCh. 15 - Briefly describe the ratios that can be used to...Ch. 15 - Briefly describe the ratios that can be used to...Ch. 15 - Prob. 12RQCh. 15 - Prob. 13RQCh. 15 - Prob. 14RQCh. 15 - Prob. 15RQCh. 15 - Prob. 15.1SECh. 15 - Performing horizontal analysis McDonald Corp....Ch. 15 - Calculating trend analysis Variline Corp. reported...Ch. 15 - Performing vertical analysis Hoosier Optical...Ch. 15 - Preparing common-size income statement Data for...Ch. 15 - Shine's Companies, a home improvement store chain,...Ch. 15 - Shine's Companies, a home improvement store chain,...Ch. 15 - Shine's Companies, a home improvement store chain,...Ch. 15 - Prob. 15.9SECh. 15 - Prob. 15.10SECh. 15 - Prob. 15.11SECh. 15 - Using ratios to reconstruct a balance sheet...Ch. 15 - Prob. 15.13SECh. 15 - Prob. 15.14SECh. 15 - Prob. 15.15ECh. 15 - Computing trend analysis Grand Oaks Realty's net...Ch. 15 - Prob. 15.17ECh. 15 - Prob. 15.18ECh. 15 - Prob. 15.19ECh. 15 - Prob. 15.20ECh. 15 - Analyzing the ability to pay liabilities Big Bend...Ch. 15 - Analyzing profitability Varsity, Inc.s comparative...Ch. 15 - Prob. 15.23ECh. 15 - Using ratios to reconstruct a balance sheet The...Ch. 15 - Prob. 15.25ECh. 15 - Computing earnings per share Falconi Academy...Ch. 15 - Prob. 15.27APCh. 15 - Prob. 15.28APCh. 15 - Prob. 15.29APCh. 15 - Prob. 15.30APCh. 15 - Using ratios to evaluate a stock investment...Ch. 15 - Prob. 15.32APCh. 15 - Preparing an income statement The following...Ch. 15 - Computing trend analysis and return on common...Ch. 15 - Prob. 15.35BPCh. 15 - Prob. 15.36BPCh. 15 - Determining the effects of business transactions...Ch. 15 - Prob. 15.38BPCh. 15 - Prob. 15.39BPCh. 15 - Prob. 15.40BPCh. 15 - Prob. 15.41CPCh. 15 - Lance Berkman is the controller of Saturn, a dance...Ch. 15 - Prob. 15.1CTEI

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The financial statements for Tyler Toys, Inc. are shown in the popup window: LOADING... . Calculate the debt ratio, times interest earned ratio, and cash coverage ratio for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $14,146,575 $13,566,748 Cost of goods sold $-8,448,000 $-8,132,335 Selling, general, andadministrative expenses $-998,406 $-980,458 Depreciation $-1,497,529 $-1,471,013 EBIT $3,202,640 $2,982,942 Interest expense $-376,217 $-354,594 Taxes $-1,074,041 $-998,772 Net income $1,752,382 $1,629,576 Right-click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its…arrow_forwardThe whole problem is in the picture attached. Thank you in advance for your help.arrow_forwardUse the following information for Short Exercises S15-6 through S15-10. Accel’s Companies, a home improvement store chain, reported the following summarized figures: Accel’s has 10,000 common shares outstanding during 2018. Evaluating current ratio Requirements Compute Accel’s Companies’ current ratio at May 31, 2018 and 2017. Did Accel’s Companies’ current ratio improve, deteriorate, or hold steady during 2018?arrow_forward

- The statement of members equity for Bonanza, LLC, follows: a. What was the income-sharing ratio in 2016? b. What was the income-sharing ratio in 2017? c. How much cash did Thomas Dunn contribute to Bonanza, LLC, for his interest? d. Why do the member equity accounts of Idaho Properties, LLC, and Silver Streams, LLC, have positive entries for Thomas Dunns contribution? e. What percentage interest of Bonanza did Thomas Dunn acquire? f. Why are withdrawals less than net income?arrow_forwardUse the following selected financial information for Cascabel Corporation to answer questions Cascabel Corporation Balance Sheet December 31, 2015 Assets Liabilities and stockholders' equity Current assets Current liabilities Cash Accounts payable Accrued liabilities 2 36 Short-term investments 10 25 Accounts receivable 52 Total current liabilities 61 Inventory 57 Other current assets Long-term debt 102 Total current assets 129 Total liabilities 163 Long-term assets Stockholders' equity Net Plant 195 Common stock 110 Retained earnings Total stockholders' equity Total liabilities and equity 51 161 324 Total assets 324 Cascabel Corporation Income Statement For the Year Ended December 31, 2015arrow_forwardSuppose the following information was taken from the 2017 financial statements of FedEx Corporation, a major global transportation/delivery company. (in millions) 2017 2016 Accounts receivable (gross) $ 3,302 $ 4,396 Accounts receivable (net) 3,273 4,367 Allowance for doubtful accounts 29 29 Sales revenue 32,226 39,472 Total current assets 6,758 6,532 Answer each of the following questions. (a) Calculate the accounts receivable turnover and the average collection period for 2017 for FedEx Corporation. (Round answers to 1 decimal place, e.g. 12.5. Use 365 days for calculation.)arrow_forward

- Bargain Deal, Inc., is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the fiscal year ended January 28, 2017, are shown below. Current assets: Cash and cash equivalents Short-term investments Accounts receivable (net) Inventory Other current assets Total current assets. Long-term assets Total assets Bargain Deal, Inc. Balance Sheet At January 28, 2017 ($ in millions) Assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Other current liabilities Total current liabilities Long-term liabilities Shareholders' equity Total liabilities and shareholders' equity Bargain Deal, Inc. Income Statement For the Year Ended January 28, 2017 ($ in millions) Revenues Costs and expenses Operating income Other income (expense)* Income before income taxes Income tax expense Net income Current ratio 1-a. 1-b. Acid-test ratio 1-c. Debt to equity ratio 1-d. $39,618 38,171 1,447 Times interest earned ratio $ (83) 1,364…arrow_forwardThe attached table illustrates the balance sheets for ABC Corporation. Answering the following questions. What is the total current assets in 2015 for ABC Corporation? What is the total assets in 2015 for ABC Corporation? What is the total current liabilities in 2015 for ABC Corporation? What is the total liabilities in 2015 for ABC Corporation? What is the net working capital in 2015 for ABC Corporation? What is the equity in 2015 for ABC Corporation?arrow_forwardFlynn Plastics Company reports the following data in its September 30, 2015, financial statements: Gross sales $225 000 Current assets $50 000 Long-term assets $130 000 Current liabilities $33 000 Long-term liabilities $52 000 Net income $11 250 (a) Compute the owners’ equity. (b) Compute the current ratio. (c) Compute the debt-to-equity ratio.arrow_forward

- At May 31, 2016, FedEx Corporation reported the following amounts (in millions) in its financial statements: 2016 2015 Total Assets $ 13,200 $ 12,300 Total Liabilities 8,316 7,503 Interest Expense 300 300 Income Tax Expense 480 290 Net Income 1,080 1,000 Required: 1.Compute the debt-to-assets ratio and times interest earned ratio for 2016 and 2015. (Round your answers to 2 decimal places.)arrow_forwardThreads Limited manufactures nuts and bolts, which are sold to industrial users. The abbreviated financial statements for 2014 and 2015 are as follows: Dividends were paid on ordinary shares of £70,000 and £72,000 in respect of 2014 and 2015 respectively. Required: (a) Calculate the following financial ratios for both 2014 and 2015 (using year-end figures for statement of financial position items): 1 return on capital employed 2 operating profit margin 3 gross profit margin 4 current ratio 5 acid test ratio 6 settlement period for trade receivables 7 settlement period for trade payables 8 inventories turnover period. (b) Comment on the performance of Threads Limited from the viewpoint of a business considering supplying a substantial amount of goods to Threads Limited on usual trade credit terms. please do "b"arrow_forwardCan you please answer this accounting question ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License