Concept explainers

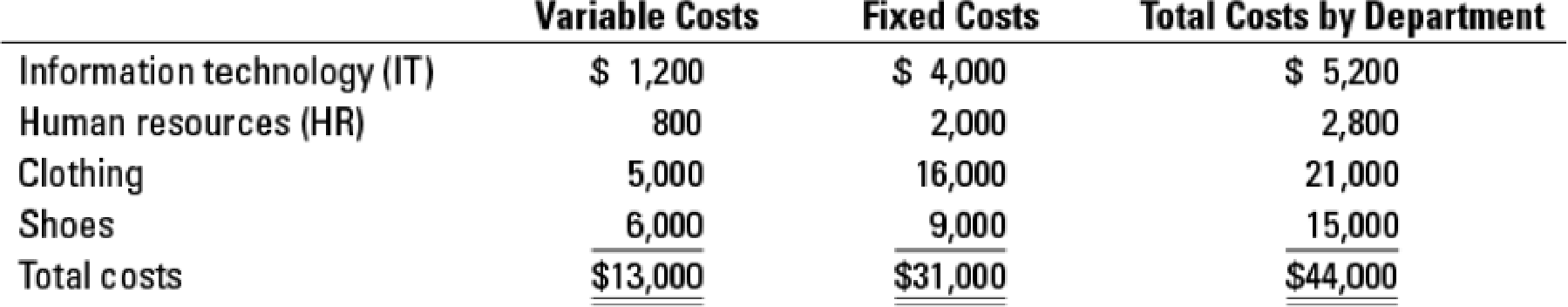

Support-department cost allocations; single-department cost pools; direct, step-down, and reciprocal methods. Sportz, Inc., manufactures athletic shoes and athletic clothing for both amateur and professional athletes. The company has two product lines (clothing and shoes), which are produced in separate manufacturing facilities; however, both manufacturing facilities share the same support services for information technology and human resources. The following shows costs (in thousands) for each manufacturing facility and for each support department.

The total costs of the support departments (IT and HR) are allocated to the production departments (clothing and shoes) using a single rate based on the following:

| Information technology: | Number of IT labor-hours worked by department |

| Human resources: | Number of employees supported by department |

Data on the bases, by department, are given as follows:

| Department | IT Hours Used | Number of Employees |

| Clothing | 10,080 | 440 |

| Shoes | 7,920 | 176 |

| Information technology | — | 184 |

| Human resources | 6,000 | — |

- 1. What are the total costs of the production departments (clothing and shoes) after the support-department costs of information technology and human resources have been allocated using (a) the direct method, (b) the step-down method (allocate information technology first), (c) the step-down method (allocate human resources first), and (d) the reciprocal method?

Required

- 2. Assume that all of the work of the IT department could be outsourced to an independent company for $97.50 per hour. If Sportz no longer operated its own IT department, 30% of the fixed costs of the IT department could be eliminated. Should Sportz outsource its IT services?

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

EBK HORNGREN'S COST ACCOUNTING

Additional Business Textbook Solutions

Essentials of MIS (13th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

FUNDAMENTALS OF CORPORATE FINANCE

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- If UPPA Company had net income of $561,600 in 2022 and it experienced a 17% increase in net income over 2021, what was its 2021 net income?arrow_forwardAnsarrow_forwardMonica company sells goods on credit. On one sale, they sold it for $20,000 and offered a 2/10, net 30 payment option. Two days after sale, the customer complained and they allowed them a $1,000 sales allowance. The customer paid the net amount within 8 days after the sale. The cash proceeds received by the seller are _.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub