Concept explainers

Fixed-cost allocation. Central University completed construction of its newest administrative building at the end of 2017. The University’s first employees moved into the building on January 1, 2018. The building consists of office space, common meeting rooms (including a conference center), a cafeteria, and even a workout room for its exercise enthusiasts. The total 2018 building space of 250,000 square feet was utilized as follows:

| Usage of Space | % of Total Building Space |

| Office space (occupied) | 52% |

| Vacant office space | 8% |

| Common area and meeting space | 17% |

| Workout room | 8% |

| Cafeteria | 15% |

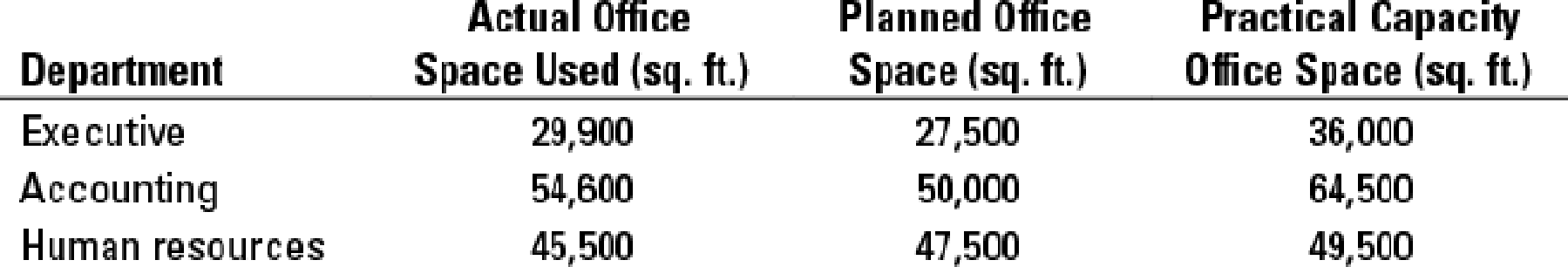

The new building cost the university $40 million and was depreciated using the straight-line method over 20 years with zero residual value so $2,000,000 per year. At the end of 2018 three departments occupied the building: executive offices of the president, accounting, and human resources. Each department’s usage of its assigned space was as follows:

- 1. How much of the total annual building cost of $2,000,000 will be allocated in 2018 to each of the departments, if the cost is allocated to each department on the basis of the following?

- a. Actual usage of the three departments

- b. Planned office space of the three departments

- c. Practical capacity of the three departments

- 2. Assume that Central University allocates the total annual building cost of $2,000,000 in the following manner:

- a. All vacant office space is absorbed by the university and is not allocated to the departments.

- b. All occupied office space costs are allocated on the basis of actual square footage used by each department.

- c. All common area costs are allocated on the basis of a department’s practical capacity. Calculate the cost allocated to each department in 2018 under this plan. Do you think the allocation method used here is appropriate? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

EBK HORNGREN'S COST ACCOUNTING

- Quick answer of this accounting questionsarrow_forwardDull Corporation produces a single product and has the following cost structure: Number of units produced each year 6,000 Variable costs per unit: Direct materials Direct labor $43 $13 $5 Variable manufacturing overhead Variable selling and administrative expense $1 Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense The absorption costing unit product cost is: A. $95 B. $119 C. $61 D. $56 $204,000 $138,000arrow_forwardWhat is its gross income for the year of this general accounting question?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning