COST ACCOUNTING

16th Edition

ISBN: 9781323169261

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 15.20E

Support-department cost allocation, reciprocal method (continuation of 15-19). Refer to the data given in Exercise 15-19.

- 1. Allocate the two support departments’ costs to the two operating departments using the reciprocal method. Use (a) linear equations and (b) repeated iterations.

Required

- 2. Compare and explain differences in requirement 1 with those in requirement 1 of Exercise 15-19. Which method do you prefer? Why?

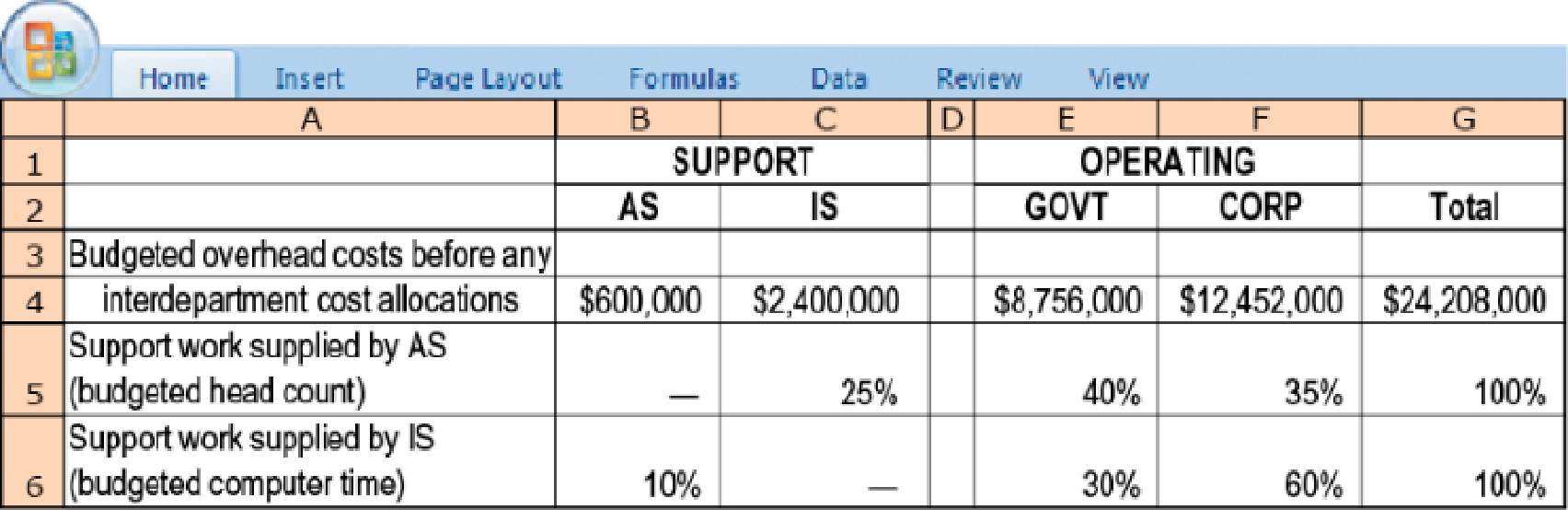

15-19 Support-department cost allocation; direct and step-down methods. Phoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments—administrative services (AS) and information systems (IS)—and two operating departments—government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2017, Phoenix’s cost records indicate the following:

- 1. Allocate the two support departments’ costs to the two operating departments using the following methods:

Required

- a. Direct method

- b. Step-down method (allocate AS first)

- c. Step-down method (allocate IS first)

- 2. Compare and explain differences in the support-department costs allocated to each operating department.

- 3. What approaches might be used to decide the sequence in which to allocate support departments when using the step-down method?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Do fast answer of this accounting question

Twin peaks cash conversion cycle is how many days? General accounting

Please answer the general accounting question

Chapter 15 Solutions

COST ACCOUNTING

Ch. 15 - Prob. 15.1QCh. 15 - Describe how the dual-rate method is useful to...Ch. 15 - How do budgeted cost rates motivate the...Ch. 15 - Give examples of allocation bases used to allocate...Ch. 15 - Why might a manager prefer that budgeted rather...Ch. 15 - To ensure unbiased cost allocations, fixed costs...Ch. 15 - Prob. 15.7QCh. 15 - What is conceptually the most defensible method...Ch. 15 - Distinguish between two methods of allocating...Ch. 15 - What are the challenges of using the incremental...

Ch. 15 - Prob. 15.11QCh. 15 - What is one key way to reduce cost-allocation...Ch. 15 - Describe how companies are increasingly facing...Ch. 15 - Distinguish between the stand-alone and the...Ch. 15 - Identify and discuss arguments that individual...Ch. 15 - Single-rate versus dual-rate methods, support...Ch. 15 - Single-rate method, budgeted versus actual costs...Ch. 15 - Dual-rate method, budgeted versus actual costs and...Ch. 15 - Support-department cost allocation; direct and...Ch. 15 - Support-department cost allocation, reciprocal...Ch. 15 - Direct and step-down allocation. E-books, an...Ch. 15 - Reciprocal cost allocation (continuation of...Ch. 15 - Allocation of common costs. Evan and Brett are...Ch. 15 - Allocation of common costs. Gordon Grimes, a...Ch. 15 - Revenue allocation, bundled products. Couture Corp...Ch. 15 - Allocation of common costs. Jim Dandy Auto Sales...Ch. 15 - Single-rate, dual-rate, and practical capacity...Ch. 15 - Prob. 15.28PCh. 15 - Fixed-cost allocation. Central University...Ch. 15 - Allocating costs of support departments; step-down...Ch. 15 - Support-department cost allocations;...Ch. 15 - Common costs. Tate Inc. and Booth Inc. are two...Ch. 15 - Prob. 15.33PCh. 15 - Support-department cost allocations;...Ch. 15 - Revenue allocation, bundled products. Boca Resorts...Ch. 15 - Support-department cost allocations; direct,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please given correct answerarrow_forwardWhat is the direct labor time variance?arrow_forwardR owns a condominium. The individual unit owners are assessed $10,000 each for an uninsured liability loss. R's HO-00-06 (HO-06) Form will pay a maximum amount of: a. $0 b. $1,000 c. $5,000 d. $7,500arrow_forward

- Get correct answer general accountingarrow_forwardPlease provide answer this general accounting questionarrow_forwardFrisco Company recently purchased 164,000 units of raw material for $642,000. Three units of raw materials are budgeted for use in each finished good manufactured, with the raw material standard set at $23.00 for each completed product. Frisco manufactured 42,305 finished units during the period just ended and used 153,037 units of raw material. If management is concerned about the timely reporting of variances in an effort to improve cost control and bottom-line performance, what would the materials purchase price variance be?arrow_forward

- Frisco Company recently purchased 164,000 units of raw material for $642,000. Three units of raw materials are budgeted for use in each finished good manufactured, with the raw material standard set at $23.00 for each completed product. Frisco manufactured 42,305 finished units during the period just ended and used 153,037 units of raw material. If management is concerned about the timely reporting of variances in an effort to improve cost control and bottom-line performance, what would the materials purchase price variance be? Answer?arrow_forwardQuick answer of this accounting questionsarrow_forwardWhich of the following items would not automatically be covered under an HO-3 form? the insured’s driveaway, if damaged by falling object The insured’s pedigreed collie valued at $6000 or $7000 A lawnmower in the insured’s garage personal property of the insured’s daughter who is away from collegearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License