COST ACCOUNTING

16th Edition

ISBN: 9781323169261

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15.25E

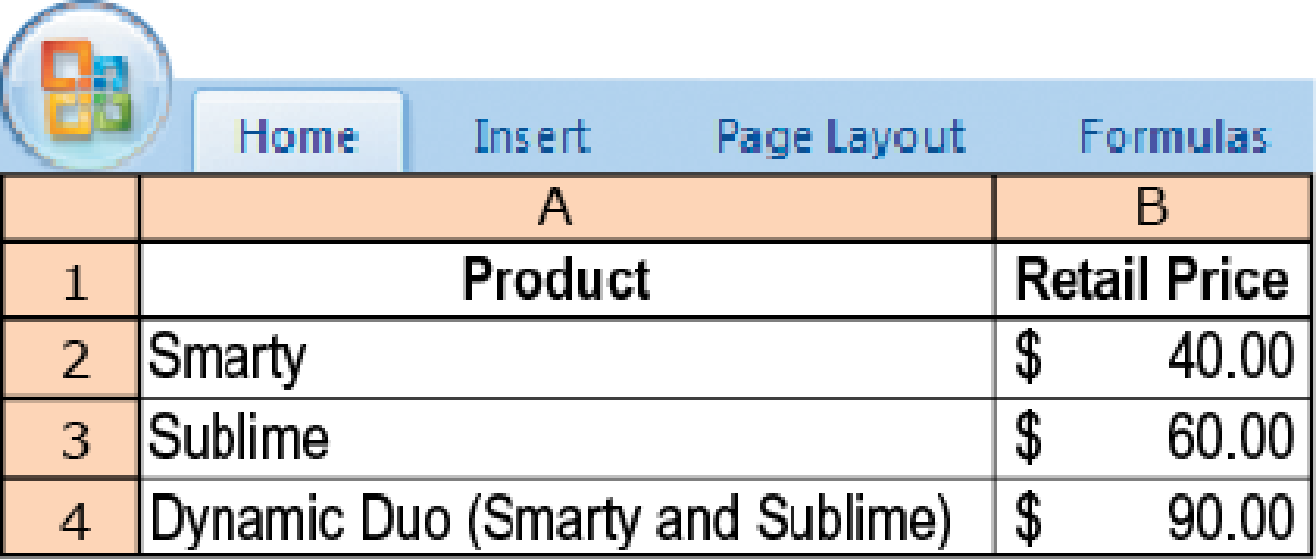

Revenue allocation, bundled products. Couture Corp sells Samsung 7 cases. It has a Men’s Division and a Women’s Division. Couture is now considering the sale of a bundled product called Dynamic Duo consisting of Smarty, a men’s case, and Sublime, a women’s case. For the most recent year, Couture sold equal quantities of Smarty and Sublime and reported the following:

- 1. Allocate revenue from the sale of each unit of Dynamic Duo to Smarty and Sublime using the following: Required

- a. The stand-alone revenue-allocation method based on selling price of each product

- b. The incremental revenue-allocation method, with Smarty ranked as the primary product

- c. The incremental revenue-allocation method, with Sublime ranked as the primary product

- d. The Shapley value method

- 2. Of the four methods in requirement 1, which one would you recommend for allocating Couture’s revenues to Smarty and Sublime? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please solve. The screen print is kind of split. Please look carefully.

Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a

commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-

purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of

multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct

labor hours are 96,300 or [1.5 hours x (54,000+10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the

predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for

the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial

models.

The company's managers identified six activity cost pools and related…

Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a

commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-

purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of

multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct

labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the

predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for

the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial

models.

The company's managers identified six activity cost pools and related…

Chapter 15 Solutions

COST ACCOUNTING

Ch. 15 - Prob. 15.1QCh. 15 - Describe how the dual-rate method is useful to...Ch. 15 - How do budgeted cost rates motivate the...Ch. 15 - Give examples of allocation bases used to allocate...Ch. 15 - Why might a manager prefer that budgeted rather...Ch. 15 - To ensure unbiased cost allocations, fixed costs...Ch. 15 - Prob. 15.7QCh. 15 - What is conceptually the most defensible method...Ch. 15 - Distinguish between two methods of allocating...Ch. 15 - What are the challenges of using the incremental...

Ch. 15 - Prob. 15.11QCh. 15 - What is one key way to reduce cost-allocation...Ch. 15 - Describe how companies are increasingly facing...Ch. 15 - Distinguish between the stand-alone and the...Ch. 15 - Identify and discuss arguments that individual...Ch. 15 - Single-rate versus dual-rate methods, support...Ch. 15 - Single-rate method, budgeted versus actual costs...Ch. 15 - Dual-rate method, budgeted versus actual costs and...Ch. 15 - Support-department cost allocation; direct and...Ch. 15 - Support-department cost allocation, reciprocal...Ch. 15 - Direct and step-down allocation. E-books, an...Ch. 15 - Reciprocal cost allocation (continuation of...Ch. 15 - Allocation of common costs. Evan and Brett are...Ch. 15 - Allocation of common costs. Gordon Grimes, a...Ch. 15 - Revenue allocation, bundled products. Couture Corp...Ch. 15 - Allocation of common costs. Jim Dandy Auto Sales...Ch. 15 - Single-rate, dual-rate, and practical capacity...Ch. 15 - Prob. 15.28PCh. 15 - Fixed-cost allocation. Central University...Ch. 15 - Allocating costs of support departments; step-down...Ch. 15 - Support-department cost allocations;...Ch. 15 - Common costs. Tate Inc. and Booth Inc. are two...Ch. 15 - Prob. 15.33PCh. 15 - Support-department cost allocations;...Ch. 15 - Revenue allocation, bundled products. Boca Resorts...Ch. 15 - Support-department cost allocations; direct,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forwardPlease given step by step explanation general accounting questionarrow_forwardDon't use ai solution please given answer general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Profitability index; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Md5ocNqKHq8;License: Standard Youtube License