Withdrawal of a Partner under Various Alternatives

The

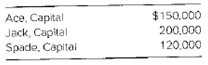

The partners allocate partnership income and loss in the ratio 20:30:50, respectively.

Required

Record Spade’s withdrawal under each of the following independent situations.

- Jack acquired Spade’s capital interest for $150,000 in a personal transaction. Partnership assets were not revalued, and partnership

goodwill was not recognized. - Assume the same facts as in part a except that partnership goodwill applicable to the entire business was recognized by the partnership.

- Spade received $180,000 of partnership cash upon retirement. Capital of the partnership after Spade’s retirement was $290,000.

- Spade received $60,000 of cash and partnership land with a fair value of $120,000. The carrying amount of the land on the partnership books was $100,000. Capital of the partnership after Spade’s retirement was $310,000.

- Spade received $150,000 of partnership cash upon retirement. The partnership recorded the portion of goodwill attributable to Spade.

- Assume the same facts as in part e except that partnership goodwill attributable to all partners was recorded.

- Because of limited cash n the partnership, Spade received land with a fair value of $100,000 and a partnership note payable for $50,000. The land’s carrying amount on the partnership books was $60,000. Capital of the partnership after Spade’s retirement was $360,000.

Disassociation of a partner: when a partner withdraws or retire from a partnership, that partner is disassociated from the partnership. In most cases the partnership purchases the disassociated partner’s interest in the partnership for a buyout price. Section 701 of UPA 1997 states that the buyout price is the estimated amount if, the partnership assets were sold at a price equal to the higher of the liquidation value or the value based on a sale of entire business as a going concern without the disassociated partner and the partnership was wound up and all partnership obligations settled. The partnership must pay interest to the disassociated partner from the date of disassociation to date of payment.

Requirement 1

The entry when J acquired S capital interest for $150,000 no assets were revalued.

Answer to Problem 15.15P

| Debit | Credit | |

| S Capital Account | 120,000 | |

| J Capital Account | 120,000 |

Explanation of Solution

J acquired S interest in a personal transaction as no assets were revalued the excess amount is treated as personal transaction, hence will not be recognized. Only the S capital balance will be transferred to J.

Disassociation of a partner: when a partner withdraws or retire from a partnership, that partner is disassociated from the partnership. In most cases the partnership purchases the disassociated partner’s interest in the partnership for a buyout price. Section 701 of UPA 1997 states that the buyout price is the estimated amount if, the partnership assets were sold at a price equal to the higher of the liquidation value or the value based on a sale of entire business as a going concern without the disassociated partner and the partnership was wound up and all partnership obligations settled. The partnership must pay interest to the disassociated partner from the date of disassociation to date of payment.

Requirement 2

The entry when J acquired S capital interest for $150,000 no assets were revalued but goodwill is recogized.

Answer to Problem 15.15P

| Debit | Credit | |

| Goodwill | 60,000 | |

| A’s capital | 12,000 | |

| J’s capital | 18,000 | |

| S’s capital | 30,000 | |

| S capital | 150,000 | |

| J capital | 150,000 |

Explanation of Solution

Valuation of goodwill:

| Amount $ | |

| Amount Paid by J for S capital | 150,000 |

| Less: S capital interest | (120,000) |

| Goodwill attributed to S | 30,000 |

Implied value of goodwill:

As S share of profit and loss is 50%

Implied value of total goodwill will be $30,000 / .50 =

$60,000

A’s share of goodwill $60,000 x .20 =

$12,000

J’s share of goodwill $60,000 x .30 =

$18,000

S capital will be debited with $150,000($120,000 + 30,000).

Disassociation of a partner: when a partner withdraws or retire from a partnership, that partner is disassociated from the partnership. In most cases the partnership purchases the disassociated partner’s interest in the partnership for a buyout price. Section 701 of UPA 1997 states that the buyout price is the estimated amount if, the partnership assets were sold at a price equal to the higher of the liquidation value or the value based on a sale of entire business as a going concern without the disassociated partner and the partnership was wound up and all partnership obligations settled. The partnership must pay interest to the disassociated partner from the date of disassociation to date of payment.

Requirement 3

The entry when S received $180,000 upon retirement. Capital of partnership after S retirement is 290,000.

Answer to Problem 15.15P

| Debit | Credit | |

| S capital | 180,000 | |

| A’s capital | 24,000 | |

| J’s capital | 36,000 | |

| Cash | 180,000 |

Explanation of Solution

Calculation of bonus paid to S

| Amount $ | |

| Amount paid to S, on retirement | 180,000 |

| Less: S capital interest | (120,000) |

| Bonus paid − to be allocated to A and J in 40:60 ratio | 60,000 |

Allocation of bonus:

60,000 x .40

= 24,000

60,000 x .60

= 36,000

Capital balance after retirement

| Amount $ | |

| A’s capital account ($150,000 − 24,000) | 126,000 |

| J’s capital account ($150,000 - $36,000) | 164,000 |

| Total capital | 290,000 |

Disassociation of a partner: when a partner withdraws or retire from a partnership, that partner is disassociated from the partnership. In most cases the partnership purchases the disassociated partner’s interest in the partnership for a buyout price. Section 701 of UPA 1997 states that the buyout price is the estimated amount if, the partnership assets were sold at a price equal to the higher of the liquidation value or the value based on a sale of entire business as a going concern without the disassociated partner and the partnership was wound up and all partnership obligations settled. The partnership must pay interest to the disassociated partner from the date of disassociation to date of payment.

Requirement 4

The entry when S received $60,000 of cash and partnership land with fair value of $120,000. The carrying amount of land is $100,000. Capital after S retirement was $310,000

Answer to Problem 15.15P

| Debit | Credit | |

| Land revaluation entry | ||

| Land | 20,000 | |

| A capital ($20,000 x .20) | 4,000 | |

| J’s capital ($20,000 x .30) | 6,000 | |

| S’s capital ($20,000 x .50) | 10,000 | |

| S capital | 130,000 | |

| A capital | 20,000 | |

| J capital | 30,000 | |

| Cash | 60,000 | |

| Land | 120,000 |

Explanation of Solution

Calculation of bonus to S

| A | J | S | |

| Profit ratio | 20% | `30% | 50% |

| Capital balance before S retirement | $150,000 | 200,000 | 120,000 |

| Gain recognized on transfer of land | 4,000 | 6,000 | 10,000 |

| Capital balance | 154,000 | 206,000 | 130,000 |

| S | |

| Amount paid to S 60,000 + 120,000 | 180,000 |

| S capital interest after revaluation of land | (130,000) |

| Bonus | 50,000 |

A’s share of bonus to S $20,000 ($50,000 x .40)

J’s share of bonus to S $30,000 ($50,000 x.60)

Balance of capital after retirement:

| S | |

| A’s capital ($154,000 - $20,000) | 134,000 |

| J’s capital ($206,000 - $30,000) | 176,000 |

| Total capital | 310,000 |

Disassociation of a partner: when a partner withdraws or retire from a partnership, that partner is disassociated from the partnership. In most cases the partnership purchases the disassociated partner’s interest in the partnership for a buyout price. Section 701 of UPA 1997 states that the buyout price is the estimated amount if, the partnership assets were sold at a price equal to the higher of the liquidation value or the value based on a sale of entire business as a going concern without the disassociated partner and the partnership was wound up and all partnership obligations settled. The partnership must pay interest to the disassociated partner from the date of disassociation to date of payment.

Requirement 5

The entry when S received $150,000 cash and partnership recorded portion of goodwill attributable to S

Answer to Problem 15.15P

| Debit | Credit | |

| S capital | 120,000 | |

| Goodwill | 30,000 | |

| Cash | 150,000 |

Explanation of Solution

Valuation of goodwill:

| Amount $ | |

| Amount Paid to S | 150,000 |

| Less: S capital interest | (120,000) |

| Goodwill attributed to S | 30,000 |

Amount of goodwill debited to S capital and cash paid to S credited

Disassociation of a partner: when a partner withdraws or retire from a partnership, that partner is disassociated from the partnership. In most cases the partnership purchases the disassociated partner’s interest in the partnership for a buyout price. Section 701 of UPA 1997 states that the buyout price is the estimated amount if, the partnership assets were sold at a price equal to the higher of the liquidation value or the value based on a sale of entire business as a going concern without the disassociated partner and the partnership was wound up and all partnership obligations settled. The partnership must pay interest to the disassociated partner from the date of disassociation to date of payment.

Requirement 6

The entry when S was given $150,000 goodwill applicable to entire business was recorded.

Answer to Problem 15.15P

| Debit | Credit | |

| Goodwill | 60,000 | |

| A’s capital | 12,000 | |

| J’s capital | 18,000 | |

| S’s capital | 30,000 | |

| S capital | 150,000 | |

| J capital | 150,000 |

Explanation of Solution

Valuation of goodwill:

| Amount $ | |

| Amount Paid by J for S capital | 150,000 |

| Less: S capital interest | (120,000) |

| Goodwill attributed to S | 30,000 |

Implied value of goodwill:

As S share of profit and loss is 50%

Implied value of total goodwill will be $30,000 / .50 =

$60,000

A’s share of goodwill $60,000 x .20 =

$12,000

J’s share of goodwill $60,000 x .30 =

$18,000

S capital will be debited with $150,000($120,000 + 30,000).

Disassociation of a partner: when a partner withdraws or retire from a partnership, that partner is disassociated from the partnership. In most cases the partnership purchases the disassociated partner’s interest in the partnership for a buyout price. Section 701 of UPA 1997 states that the buyout price is the estimated amount if, the partnership assets were sold at a price equal to the higher of the liquidation value or the value based on a sale of entire business as a going concern without the disassociated partner and the partnership was wound up and all partnership obligations settled. The partnership must pay interest to the disassociated partner from the date of disassociation to date of payment.

Requirement 7

The entry when S received land at fair value of $100,000 and notes payable of $50,000. Carrying amount of land was $60,000. Capital after S retirement was $360,000

Answer to Problem 15.15P

| Debit | Credit | |

| Land | 40,000 | |

| A’s capital ($40,000 x .20) | 8,000 | |

| J’s capital ($40,000 x .30) | 12,000 | |

| S’s capital ($40,000 x .50) | 20,000 | |

| S capital | 140,000 | |

| A capital ($10,000 x .40) | 4,000 | |

| J capital ($10,000 x 60) | 6,000 | |

| Land | 100,000 | |

| Notes payable | 50,000 |

Explanation of Solution

Calculation of bonus paid to S

| A | J | S | |

| Profit ratio | 20% | `30% | 50% |

| Capital balance before S retirement | 150,000 | 200,000 | 120,000 |

| Allocation of gain on transfer of land | 8,000 | 12,000 | 20,000 |

| Capital balance | 158,000 | 212,000 | 140,000 |

Bonus paid to S $10,000 (150,000 − 140,000)

Capital balance after S retirement

| Amount $ | |

| A’s capital ($158,000 − 4,000) | 154,000 |

| J’s capital (212,000 − 6,000) | 206,000 |

| Total capital | 360,000 |

Want to see more full solutions like this?

Chapter 15 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

- Return on assets general accountingarrow_forwardZephyr Enterprises projected current year sales of 60,000 units at a unit sale price of $25.00. Actual current year sales were 65,000 units at $27.00 per unit. Actual variable costs, budgeted at $18.00 per unit, totaled $16.50 per unit. Budgeted fixed costs totaled $500,000, while actual fixed costs amounted to $520,000. What is the sales volume variance for total revenue?arrow_forwardAccounting problem with correct answerarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College