College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

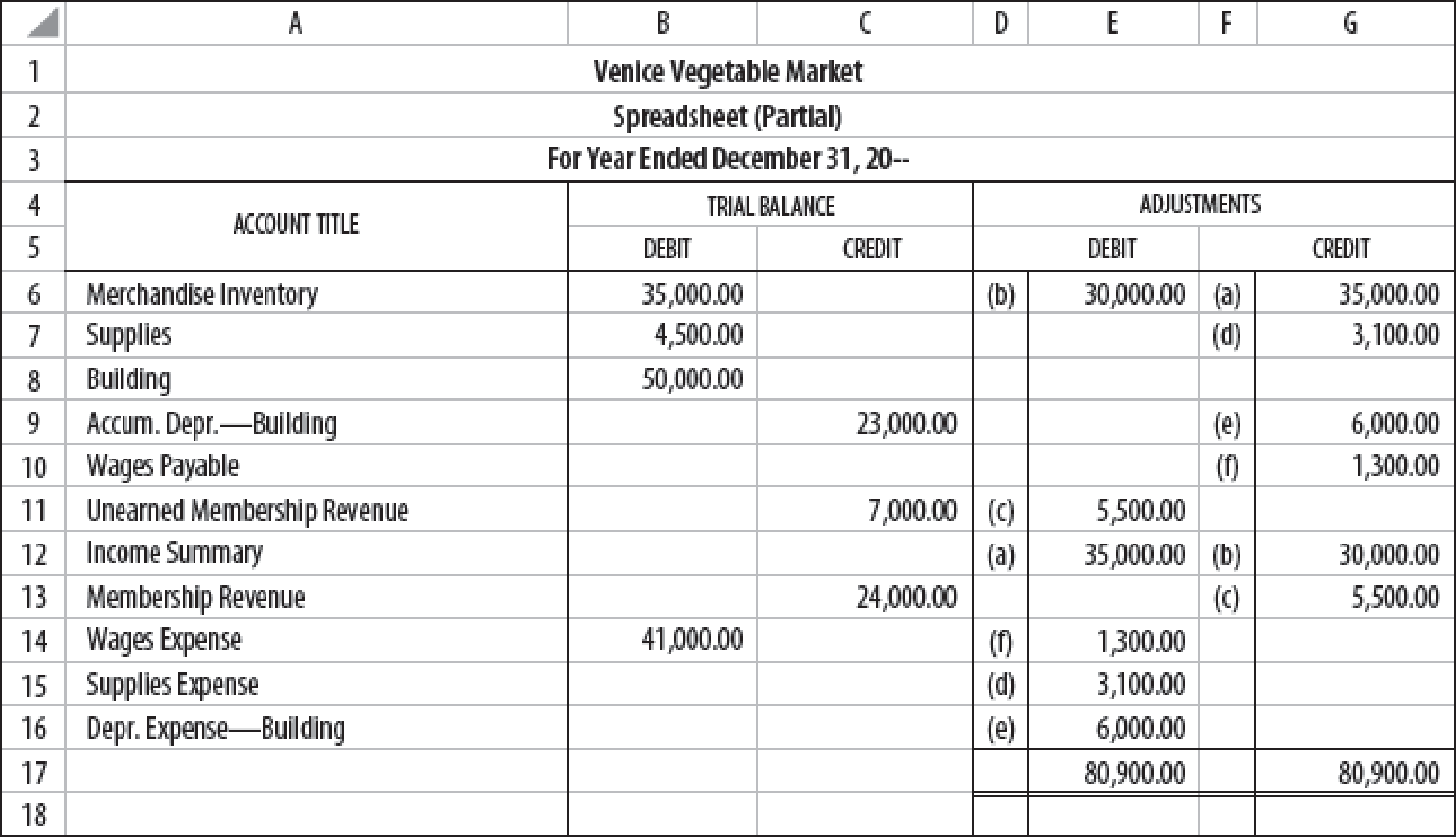

Chapter 14, Problem 8SEB

JOURNALIZE

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

How much will you accumulated after 35 year? General accounting

Given correct answer general Accounting

Hi expert please help me

Chapter 14 Solutions

College Accounting, Chapters 1-27

Ch. 14 - Under the periodic inventory system, the beginning...Ch. 14 - Under the periodic inventory system, the ending...Ch. 14 - The cash received in advance before delivering a...Ch. 14 - Unearned revenue is adjusted into an expense...Ch. 14 - Sales Returns and Allowances is classified as a...Ch. 14 - Under the periodic inventory system, what account...Ch. 14 - Under the periodic inventory system, what account...Ch. 14 - Under the periodic inventory system, what account...Ch. 14 - Unearned revenue is classified as what type of...Ch. 14 - Under the perpetual inventory method, what account...

Ch. 14 - Prepare the cost of goods sold section for Josephs...Ch. 14 - The Venice Theatre sold and collected cash of...Ch. 14 - Information relating to inventory for Janie Par...Ch. 14 - Using the spreadsheet provided below, prepare the...Ch. 14 - Prob. 5CECh. 14 - A firm is preparing to make adjusting entries at...Ch. 14 - What spreadsheet amounts are used to compute cost...Ch. 14 - Why are both the debit and credit amounts in the...Ch. 14 - What is an unearned revenue?Ch. 14 - Give three examples of unearned revenue.Ch. 14 - Prob. 6RQCh. 14 - Prob. 7RQCh. 14 - A firm is preparing to make adjusting entries at...Ch. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - ADJUSTMENT FOR UNEARNED REVENUES USING T ACCOUNTS...Ch. 14 - MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC...Ch. 14 - DETERMINING THE BEGINNING AND ENDING INVENTORY...Ch. 14 - JOURNALIZE ADJUSTING ENTRIES FOR A MERCHANDISING...Ch. 14 - JOURNAL ENTRIES UNDER THE PERPETUAL INVENTORY...Ch. 14 - ADJUSTMENTS FOR A MERCHANDISING BUSINESS:...Ch. 14 - JOURNALIZE ADJUSTING ENTRY FOR INVENTORY...Ch. 14 - PREPARATION OF ADJUSTMENTS ON A SPREADSHEET FOR A...Ch. 14 - WORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO...Ch. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - ADJUSTMENT FOR UNEARNED REVENUES USING T ACCOUNTS...Ch. 14 - MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC...Ch. 14 - DETERMINING THE BEGINNING AND ENDING INVENTORY...Ch. 14 - JOURNALIZE ADJUSTING ENTRIES FOR A MERCHANDISING...Ch. 14 - JOURNAL ENTRIES UNDER THE PERPETUAL INVENTORY...Ch. 14 - ADJUSTMENTS FOR A MERCHANDISING BUSINESS:...Ch. 14 - JOURNALIZE ADJUSTING ENTRY FOR INVENTORY...Ch. 14 - Prob. 12SPBCh. 14 - WORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO...Ch. 14 - A friend of yours recently opened Abracadabra, a...Ch. 14 - Jason Tierro, an inventory clerk at Lexmar...Ch. 14 - John Neff owns and operates Waikiki Surf Shop. A...Ch. 14 - Block Foods, a retail grocery store, has agreed to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- abc general accountingarrow_forwardSub. General accountingarrow_forwardThe Esquire Clothing Company borrowed a sum of cash on October 1, 2024, and signed a note payable. The annual interest rate was 12%. The company's December 31, 2024, income statement reported interest expense of $1,260 related to this note. What was the amount borrowed?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License