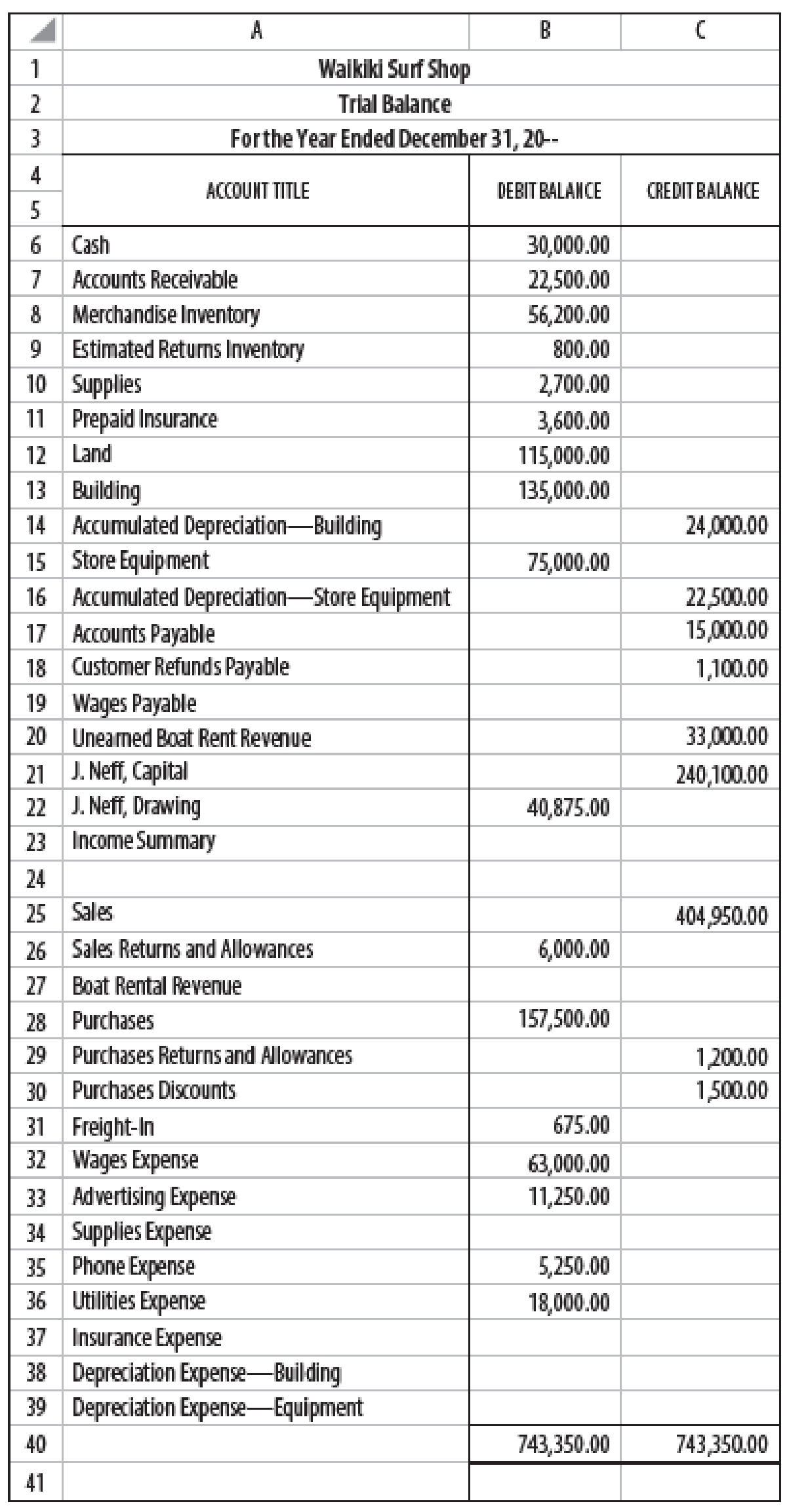

John Neff owns and operates Waikiki Surf Shop. A year-end

Neff uses the periodic inventory system. Year-end adjustment data are as follows:

(a, b) A physical count shows that merchandise inventory costing $51,800 is on hand as of December 31, 20--.

(c, d, e) Neff estimates that customers will be granted $2,000 in refunds of this year’s sales next year and the merchandise expected to be returned will have a cost of $1,200.

(f) Supplies remaining at the end of the year, $600.

(g) Unexpired insurance on December 31, $2,600.

(h)

(i) Depreciation expense on the store equipment for 20--, $3,000.

(j) Wages earned but not paid as of December 31, $1,800.

(k) Neff also offers boat rentals which clients pay for in advance. Unearned boat rental revenue as of December 31 is $3,000.

Required

- 1. Prepare a year-end spreadsheet.

- 2. Journalize the

adjusting entries . - 3. Compute cost of goods sold using the spreadsheet prepared for part (1).

Trending nowThis is a popular solution!

Chapter 14 Solutions

College Accounting, Chapters 1-27

- Please give me true answer this financial accounting questionarrow_forwardRefer to the Hartley Ltd statement of cash flows for the year ended 31 December 2022 and answer the following questions: 1.1 Calculate the following: 1.1.1 Depreciation 1.1.2 Interest paid 1.1.3 Net increase (decrease) in cash 1.1.4 Cash balance as at 31 December 2022. 1.2 Comment on the following: 1.2.1 Cash flows from operating activities of (R390 000) 1.2.2 Cash flows from investing activities of R150 000 1.2.3 Increase in inventory of (R700 000) 1.2.4 Increase in receivables of (R500 000).arrow_forwardAbcarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College