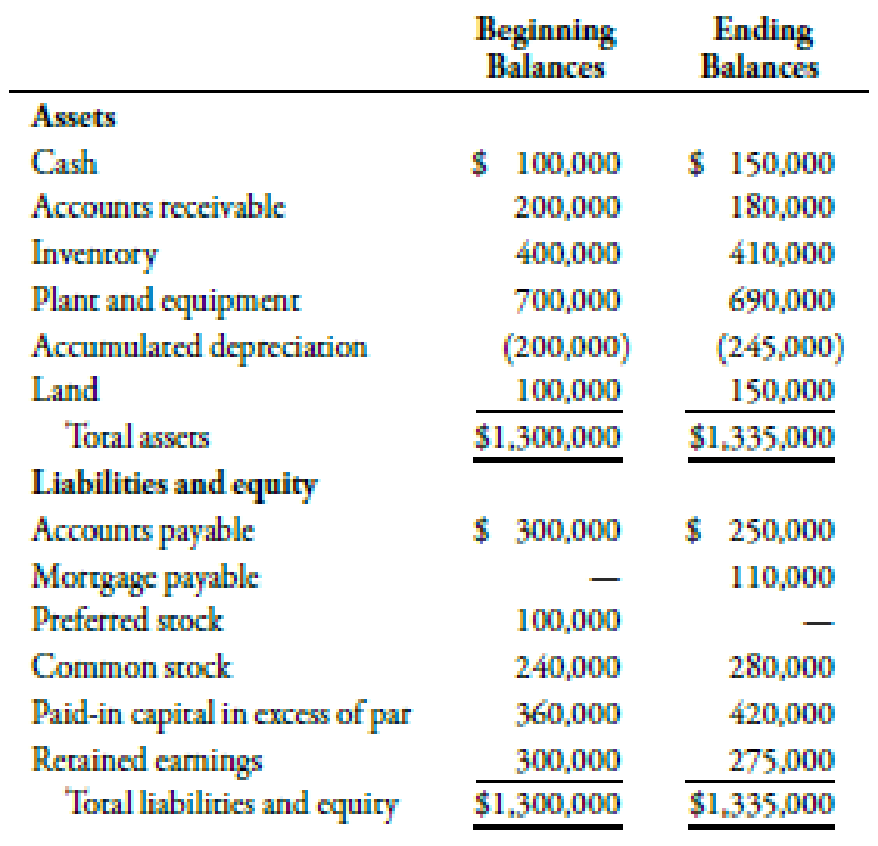

Additional transactions were as follows:

- a. Purchased equipment costing $50,000.

- b. Sold equipment costing $60,000, with a book value of $25,000, for $40,000.

- c. Retired

preferred stock at a cost of $110,000. (The premium is debited toRetained Earnings .) - d. Issued 10,000 shares of common stock (par value, $4) for $10 per share.

- e. Reported a loss of $15,000 for the year.

- f. Purchased land for $50,000.

Required:

Prepare a statement of

Construct a statement of cash flows with the help of a worksheet.

Explanation of Solution

Worksheet:

The chart prepared in a spreadsheet format as a helping tool in accounting is known as worksheet. With the help of worksheet, a cash flow statement can be prepared with less confusion and complexity.

The worksheet for the B Corporation is shown in the table below:

| Worksheet: B Corporation | |||||

| For the year ending | |||||

| Transactions | |||||

| Particulars | Beginning Balance ($) | Debit ($) | Credit ($) | Ending Balance ($) | |

| Assets: | |||||

| Cash | 100,000 | (1) 50,000 | 150,000 | ||

| Accounts receivable | 200,000 | (2) 20,000 | 180,000 | ||

| Inventory | 400,000 | (3) 10,000 | 410,000 | ||

| Plant and equipment | 700,000 | (4) 50,000 | (5) 60,000 | 690,000 | |

| Accumulated depreciation | (200,000) | (5) 35,000 | (6) 80,000 | (245,000) | |

| Land | 100,000 | (7) 50,000 | 150,000 | ||

| Total assets | 1,300,000 | 1,335,000 | |||

| Liabilities and stockholder’s equity: | |||||

| Accounts payable | 300,000 | (8) 50,000 | 250,000 | ||

| Mortgage payable | - | (9) 110,000 | 110,000 | ||

| Preferred stock | 100,000 | (10) 100,000 | - | - | |

| Common stock | 240,000 | (11) 40,000 | 280,000 | ||

| Paid-in capital in excess of par | 360,000 | (11) 60,000 | 420,000 | ||

| Retained earnings | 300,000 | (10) 10,000 | |||

| (12) 15,000 | 275,000 | ||||

| Total liabilities and stockholder’s equity | 1,300,000 | 1,335,000 | |||

| Debit ($) | Credit ($) | ||||

| Cash flows from operating activities: | |||||

| Net loss | (12) 15,000 | ||||

| Decrease in accounts receivable | (2) 20,000 | ||||

| Increase in inventory | (5) 1,800 | (3) 10,000 | |||

| Decrease in accounts payable | (8) 50,000 | ||||

| Depreciation expense | (6) 80,000 | ||||

| Gain on sale of equipment | (5) 15,000 | ||||

| Cash flows from investing activities: | |||||

| Sale of equipment | (5) 40,000 | ||||

| Purchase of equipment | (4) 50,000 | ||||

| Purchase of land | (7) 50,000 | ||||

| Cash flows from financing activities: | |||||

| Retirement of preferred stock | (10) 110,000 | ||||

| Receipt of mortgage | (9) 110,000 | (11) 36,000 | |||

| Issuance of common stock | (11) 100,000 | ||||

| Net increase in cash | (1) 50,000 | ||||

Table (1)

The analysis of transactions is as follows:

(1). Change in cash:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cash | 50,000 | ||

| Net increase in cash | 50,000 | ||

| (Being the change in cash recorded) |

Table (2)

Increase in accrual cash balance by $50,000 from the beginning to the end of the year is recorded.

(2). Change in accounts receivable:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Operating cash | 20,000 | ||

| Accounts receivable | 20,000 | ||

| (Being the decrease in accounts receivable recorded) |

Table (3)

Decrease in accounts receivable by $20,000 is recognized on the income statement but is not collected. This cash inflow should be adjusted in the net income.

(3) Purchase of inventory:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Inventory | 10,000 | ||

| Operating cash | 10,000 | ||

| (Being the purchase value of inventory are recorded) |

Table (4)

The purchase value of inventory is recorded by debiting the inventory account and crediting the operating cash account.

(4) Purchase value of plant and equipment:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Plant and equipment | 50,000 | ||

| Operating cash | 50,000 | ||

| (Being the purchase value of plant and equipment recorded) |

Table (5)

The purchase value of the equipment which is $50,000 is debited and the operating cash account is credited.

(5). Gain on sale of equipment:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cash from investing activities | 40,000 | ||

| Accumulated depreciation | 35,000 | ||

| Plant and equipment | 60,000 | ||

| Gain on sale of equipment | 15,000 | ||

| (Being the gain on sale of equipment recorded) |

Table (6)

The cash from investing activities records the value at which the equipment is sold which is $40,000. The accumulated depreciation is debited to record the expense. The plant and equipment account is credited to record the original cost of the equipment. The gain value on the sale of equipment is credited.

(6). Accumulated depreciation expense:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Depreciation expense | 80,0001 | ||

| Accumulated depreciation | 80,000 | ||

| (Being the accumulated depreciation recorded) |

Table (7)

The accumulated depreciation of $80,000 is credited to record the depreciation expense.

(7). Value of land:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Land | 50,000 | ||

| Operating cash | 50,000 | ||

| (Being the fair value of land recorded) |

Table (8)

The fair value of the land is recorded by debiting the land account and crediting the operating cash.

(8). Accounts payable:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Accounts payable | 50,000 | ||

| Operating cash | 50,000 | ||

| (Being the decrease in accounts payable recorded) |

Table (9)

The decrease in accounts payable by $50,000 shows that all the purchases were not from cash. The increase in accounts payable should be added back to the net income. The decrease in liability is recorded, hence it is debited.

(9). Mortgage payable:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Operating cash | 110,000 | ||

| Mortgage payable | 110,000 | ||

| (Being the increase in mortgage payable recorded) |

Table (10)

The increase in mortgage payable shows that the cash inflow is more than the expense recognized in the year by $110,000. The increase in liability is recorded, hence mortgages payable is credited and operating cash is debited.

(10). Preferred stock:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Preferred stock | 100,000 | ||

| Retained earnings | 10,000 | ||

| Cash flow from financing activities | 110,000 | ||

| (Being the retirement of preference stock recorded) |

Table (11)

The cash flow from financing activities records an outflow with the retirement of preferred stock.

(11). Common stock:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Noncash investing activities | 100,000 | ||

| Common stock | 40,000 | ||

| Paid-in capital in excess of par | 60,000 |

Table (12)

The noncash investing activity is recorded with the fair value of the equipment. The amount which is obtained by issuing the common stock is credited and the excess amount is credited in the paid-in capital stock.

(13). The reporting of loss:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Retained earnings | 15,000 | ||

| Cash flow from financing activities | 15,000 | ||

| (Being the net loss recorded) |

Table (13)

The retained earnings is debited by the amount of the reported loss for the year.

The final step is the cash flow statement which is prepared from the worksheet. The worksheet derived statement is shown in the table below:

| B Corporation | ||

| Statement of Cash Flows | ||

| For the year ending | ||

| Amount ($) | Amount ($) | |

| Cash flows from operating activities: | ||

| Net income | (15,000) | |

| Add/Deduct: | ||

| Decrease in accounts receivable | 20,000 | |

| Increase in inventory | (10,000) | |

| Decrease in accounts payable | (50,000) | |

| Depreciation expense | 80,000 | |

| Gain on sale of equipment | (15,000) | |

| Net cash from operating activities | 10,000 | |

| Cash flows from investing activities: | ||

| Sale of equipment | 40,000 | |

| Purchase of investments | (50,000) | |

| Purchase of land | (50,000) | |

| Net cash from investing activities | (60,000) | |

| Cash flows from financing activities: | ||

| Retirement of mortgage | (110,000) | |

| Issuance of common stock | 100,000 | |

| Receipt of mortgage | 110,000 | |

| Net cash from financing activities | 100,000 | |

| Net increase in cash | 50,000 | |

Table (14)

Working Note:

1.

Calculation of difference in accounts receivable:

2.

Calculation of difference in amount of inventories:

3.

Calculation of difference in accounts payable:

4.

Calculation of depreciation expense:

Want to see more full solutions like this?

Chapter 14 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning