Concept explainers

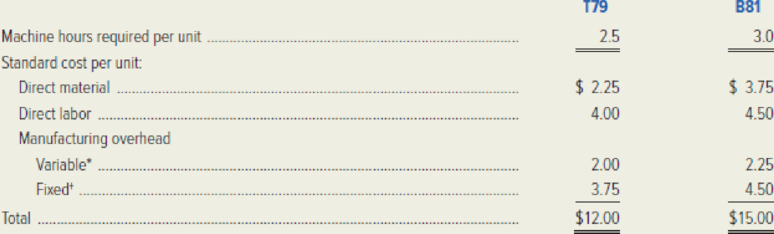

Upstate Mechanical, Inc. has been producing two bearings, components T79 and B81, for use in production. Data regarding these two components follow.

*Variable manufacturing overhead is applied on the basis of direct-labor hours.

†Fixed manufacturing overhead is applied on the basis of machine hours.

Upstate Mechanical’s annual requirement for these components is 8,000 units of T79 and 11,000 units of B81. Recently, management decided to devote additional machine time to other product lines, leaving only 41,000 machine hours per year for producing the bearings. An outside company has offered to sell Upstate Mechanical its annual supply of bearings at prices of $11.25 for T79 and $13.50 for B81. Management wants to schedule the otherwise idle 41,000 machine hours to produce bearings so that the firm can minimize costs (maximize net benefits).

Required:

- 1. Compute the net benefit (loss) per machine hour that would result if Upstate Mechanical accepts the supplier’s offer of $13.50 per unit for component B81.

- 2. Choose the correct answer. Upstate Mechanical will maximize its net benefits by:

- a. purchasing 4,800 units of T79 and manufacturing the remaining bearings.

- b. purchasing 8,000 units of T79 and manufacturing 11,000 units of B81.

- c. purchasing 11,000 units of B81 and manufacturing 8,000 units of T79.

- d. purchasing 4,000 units of B81 and manufacturing the remaining bearings.

- e. purchasing and manufacturing some amounts other than those given above.

- 3. Suppose management has decided to drop product T79. Independently of requirements (1) and (2), assume that the company’s idle capacity of 41,000 machine hours has a traceable, avoidable annual fixed cost of $44,000, which will be incurred only if the capacity is used. Calculate the maximum price Upstate Mechanical should pay a supplier for component B81.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Richard has the following potential liabilities: William, a former employee, has sued Richard for $880,000. Richard contacted his attorney, and the case is believed to be frivolous. Carter sued Richard for an undisclosed amount for a class action lawsuit. Richard thinks it's frivolous, but his attorneys indicate a loss is probable for $88,000. Charles sued Richard because he slipped outside of Richard's store. The claim is $264,000 and Richard is certain he will lose the case but believes Charles will settle. The attorneys agree and based on conversations with Charles's attorneys, have stated that it is remote the claim will be settled for $255,200. Charles's attorneys indicated he would be willing to accept either cash of $242,000 or shares of Richard's closely-held common stock currently valued at $233,200. Richard would prefer not to settle in cash. Richard is suing William for $264,000 because William is in violation of a non-compete agreement he has with Richard. Richard is…arrow_forwardNeed answer the financial accounting question not use aiarrow_forwardHow much were SMS's liabilities on these general accounting question?arrow_forward

- I cannot figure out the account of "Goodwill" or "APIC from Pushdown Accounting." I thought APIC should be $285,000, but it didn't work for some reason. And I didn't know we had goodwill, but we do, and I can't figure out how to get the correct answer. I tried $350,000 for APIC, but that also doesn't work, and I am at a loss of what to do next. Please explain as clearly as possible how to do Goodwill and the APIC from Pushdown Accounting. Thanks so much! :)arrow_forwardNonearrow_forwardHii tutor please given answer general Accounting questionarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning