The Midwest Division of the Paibec Corporation manufactures subassemblies that are used in the corporation’s final products. Lynn Hardt of Midwest’s Profit Planning Department has been assigned the task of determining whether a component, MTR–2000, should continue to be manufactured by Midwest or purchased from Marley Company, an outside supplier. MTR–2000 is part of a subassembly manufactured by Midwest.

Marley has submitted a bid to manufacture and supply the 32,000 units of MTR–2000 that Paibec will need for 20x1 at a unit price of $17.30. Marley has assured Paibec that the units will be delivered according to Paibec’s production specifications and needs. While the contract price of $17.30 is only applicable in 20x1, Marley is interested in entering into a long-term arrangement beyond 20x1.

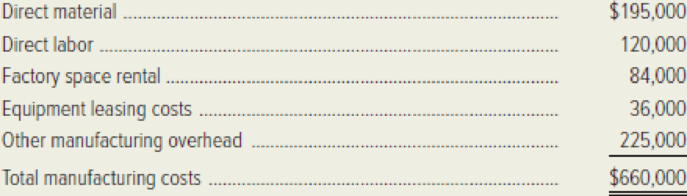

Hardt has gathered the following information regarding Midwest’s

Hardt has collected the following additional information related to manufacturing MTR–2000.

- Direct materials used in the production of MTR–2000 are expected to increase 8 percent in 20x1.

- Midwest’s direct-labor contract calls for a 5 percent increase in 20x1.

- The facilities used to manufacture MTR–2000 are rented under a month-to-month rental agreement. Thus, Midwest can withdraw from the rental agreement without any penalty. Midwest will have no need for this space if MTR–2000 is not manufactured.

- Equipment leasing costs represent special equipment that is used in the manufacture of MTR– 2000. This lease can be terminated by paying the equivalent of one month’s lease payment for each year left on the lease agreement. Midwest has two years left on the lease agreement, through the end of the year 20x2.

- Forty percent of the other manufacturing overhead is considered variable. Variable overhead changes with the number of units produced, and this rate per unit is not expected to change in 20x1. The fixed manufacturing overhead costs are expected to be the same across a relevant range of zero to 50,000 units. Equipment other than the leased equipment can be used in Midwest’s other manufacturing operations.

John Porter, divisional manager of Midwest, stopped by Hardt’s office to voice his concern regarding the outsourcing of MTR–2000. Porter commented, “I am really concerned about outsourcing MTR– 2000. I have a son-in-law and a nephew, not to mention a member of our bowling team, who work on MTR–2000. They could lose their jobs if we buy that component from Marley. I really would appreciate anything you can do to make sure the cost analysis comes out right to show we should continue making MTR–2000. Corporate is not aware of the material increases and maybe you can leave out some of those fixed costs. I just think we should continue making MTR–2000!”

Required:

- a. Prepare an analysis of relevant costs that shows whether or not the Midwest Division of Paibec Corporation should make MTR–2000 or purchase it from Marley Company for 20x1.

- b. Based solely on the financial results, recommend whether the 32,000 units of MTR–2000 for 20x1 should be made by Midwest or purchased from Marley.

- 2. Identify and briefly discuss three qualitative factors that the Midwest Division and Paibec Corporation should consider before agreeing to purchase MTR–2000 from Marley Company.

- 3. By referring to the standards of ethical conduct for

managerial accountants given in Chapter 1, explain why Lynn Hardt would consider the request of John Porter to be unethical.

1. a

Prepare an analysis of relevant costs.

Explanation of Solution

Outsourcing: Outsourcing is a process wherein, Companies choose to outsource products or service and this allows companies to concentrate on its chief function. Outsourcing decisions are generally called “make or buy decisions” since the managers must decide whether to buy a component product or service or product it in-house.

Prepare an analysis of relevant costs:

| Particulars | Amount per unit | Total for 32,000 units |

| Cost to purchase MTR-2000 from Marley: | ||

| Bid price from Marley | (1)$17.30 | $553,600 |

| Equipment lease penalty | $6,000 | |

| Total cost to purchase | $559,600 | |

| Cost for Division M to make MTR-2000: | ||

| Direct material | (2)$7.02 | $224,640 |

| Direct labor | (3)$4.20 | $134,400 |

| Variable manufacturing overhead | (4)$3.00 | $96,000 |

| Factory space rental | $84,000 | |

| Equipment leasing costs | $36,000 | |

| Total cost to make | $575,040 | |

| Cost savings if purchased from Company M | ($15,440) |

Table (1)

Working note:

(1)Calculate equipment lease penalty:

(2)Calculate direct material:

(3)Calculate direct labor:

(4)Calculate variable manufacturing overhead:

b.

Recommend whether the 32,000 units of MTR-2000 must be made or purchased Division M based on the financial results.

Explanation of Solution

The 32,000 units of MTR-2000 must be purchased from Company C, as per the financial results. Total cost from Company m would be $559,600 or $15,440 less that if the units are made by the Division M.

2.

Identify and briefly discuss three qualitative factors that Division M and corporation P must consider before agreeing to purchase MTR-2000 from Company M.

Explanation of Solution

The qualitative factors that Division M and Corporation P must consider before agreeing to purchase MTR-2000 from Company M comprise the following:

- “The quality of the Company M’s component must equalize, or must be better than, the quality of the internally made element, or else the quality of the final product might be negotiated and Corporation P’s reputation gets affected adversely”.

- “Company M’s consistency as an on-time supplier is vital, because delayed deliveries can hamper Corporation P’s production schedule and delivery dates for the final product”.

- “Layoffs can happen if the component is outsourced to Company M. This can affect Division M’s and Corporation P’s other employees and can problems related to labor or influence the position of the company in the community. Moreover, there can be end costs that are not factored into the analysis”.

3.

Explain the reason for which Person L considers the request of Person J to be unethical, by referring to the standards of ethical conduct for managerial accountants.

Explanation of Solution

Person L must consider the request of the person J to be unethical due to the following reasons that are based on the IMA statement of ethical professional practice.

Competence:

- “Maintain an appropriate level of professional expertise by continually developing knowledge and skills”.

- “Provide decision support information and recommendations that are accurate, clear, concise and timely”.

- “Perform professional duties in accordance with laws, rules and regulations”.

Integrity:

- “Mitigate actual conflicts of interest. Regularly communicate with business associates to avoid apparent conflicts of interest. Advise all parties of any potential conflicts”

- “Refrain from engaging in any conduct that would prejudice carrying out duties ethically”.

- “Abstain from engaging in or supporting any activity that might discredit the profession”.

Credibility:

- “Communicate information fairly and objectively”.

- “Disclose all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports, analyses, or recommendations”.

- “Disclose delays or deficiencies in information, timeliness, processing, or internal controls in conformance with organization policy and/or applicable law”.

Want to see more full solutions like this?

Chapter 14 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Nonearrow_forwardFast Answer @ general Accountarrow_forwardThe 2019 annual report for Anglo-American PLC, the world's leading global mining company, shows that the firm had $41.065 billion in non-current assets and $11.670 billion in current assets. It reported $13.120 billion in current liabilities and $9.442 billion in non-current liabilities. How much was the equity of Anglo-American PLC worth? Tutor, please provide step by step correct solution to this financial accounting problem. ?!arrow_forward

- SUBJECT -GENERAL ACCOUNTarrow_forwardA company has net sales of $125,000, cost of goods sold of $50,000, operating expenses of $35,000, and selling expenses of $11,000. What is the gross profit? A. $75,000 B. $40,000 C. $29,000 D. $50,000arrow_forwardCan you please solve this financial account queryarrow_forward

- Need general account answerarrow_forwardMia Steel started the year with total assets of $325,000 and total liabilities of $174,000. During the year the business recorded $360,000 in revenues, $190,000 in expenses, and dividends of $99,000. Stockholders' equity at the end of the year was____. Ansarrow_forwardNeed help this questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education