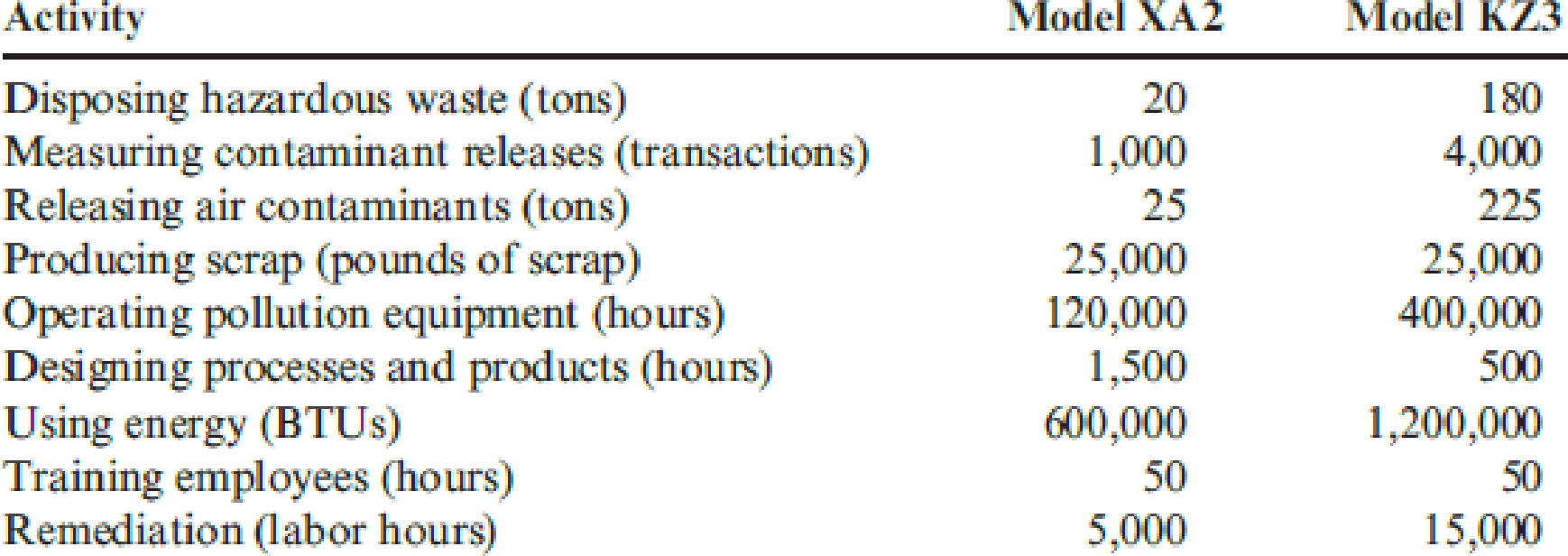

Refer to Problem 14.43. In 20x3, Jack Carter, president of Kartel, requested that environmental costs be assigned to the two major products produced by the company. He felt that knowledge of the environmental product costs would help guide the design decisions that would be necessary to improve environmental performance. The products represent two different models of a cellular phone (Model XA2 and Model KZ3). The models use different processes and materials. To assign the costs, the following data were gathered for 20x3:

During 20x3, Kartel’s division produced 200,000 units of Model XA2 and 300,000 units of Model KZ3.

Required:

- 1. Using the activity data, calculate the environmental cost per unit for each model. How will this information be useful?

- 2. Upon examining the cost data produced in Requirement 1, an environmental engineer made the following suggestions: (1) substitute a new plastic for a material that appeared to be the source of much of the hazardous waste (the new material actually cost less than the contaminating material it would replace), and (2) redesign the processes to reduce the amount of air contaminants produced.

As a result of the first suggestion, by 20x5, the amount of hazardous waste produced had diminished to 50 tons, 10 tons for Model XA2 and 40 tons for Model KZ3. The second suggestion reduced the contaminants released by 50 percent by 20x5 (15 tons for Model XA2 and 110 tons for Model KZ3). The need for pollution equipment also diminished, and the hours required for operating this equipment for Model XA2 and Model KZ3 were reduced to 60,000 and 200,000, respectively. Calculate the unit cost reductions for the two models associated with the actions and outcomes described (assume the same production as in 20x3). Do you think the efforts to reduce the environmental cost per unit were economically justified? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- Exercise 3-12A (Algo) Conducting sensitivity analysis using a spreadsheet LO 3-5 Use the below table to answer the following questions. Selling Price$27.00 Variable 2,100 3,100 Fixed Cost Cost Sales Volume 4,100 Profitability 5,100 6,100 $25,700 8 $14,200 $33,200 $52,200 $71,200 $90,200 25,700 9 12,100 30,100 48,100 66,100 84,100 25,700 10 10,000 27,000 44,000 61,000 78,000 35,700 8 4,200 23,200 42,200 61,200 80,200 35,700 9 2,100 20,100 38,100 56,100 74,100 35,700 10 17,000 34,000 51,000 68,000 45,700 8 (5,800) 13,200 32,200 51,200 70,200 45,700 9 (7,900) 10,100 28,100 46,100 64,100 45,700 10 (10,000) 7,000 24,000 41,000 58,000 Required a. Determine the sales volume, fixed cost, and variable cost per unit at the break-even point. b. Determine the expected profit if Rundle projects the following data for Delatine: sales, 4,100 bottles; fixed cost, $25,700; and variable cost per unit, $10. c. Rundle is considering new circumstances that would change the conditions described in…arrow_forwardWhich of the following would be classified as a current liability ?arrow_forwardProvide correct answer general Accounting questionarrow_forward

- Calculate the firm's annual cash flows associated with the new project?General accountingarrow_forwardThe following balance sheet for the Hubbard Corporation was prepared by the company: HUBBARD CORPORATION Balance Sheet At December 31, 2024 Assets Buildings Land Cash Accounts receivable (net) Inventory Machinery Patent (net) Investment in equity securities Total assets Accounts payable $ 763,000 289,000 73,000 146,000 266,000 293,000 113,000 86,000 Liabilities and Shareholders' Equity Accumulated depreciation Notes payable Appreciation of inventory Common stock (authorized and issued 113,000 shares of no par stock) $ 2,029,000 $ 228,000 268,000 526,000 93,000 452,000 Retained earnings 462,000 Total liabilities and shareholders' equity $ 2,029,000 Additional information: 1. The buildings, land, and machinery are all stated at cost except for a parcel of land that the company is holding for future sale. The land originally cost $63,000 but, due to a significant increase in market value, is listed at $146,000. The increase in the land account was credited to retained earnings. 2. The…arrow_forwardProvide correct answer this general accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning