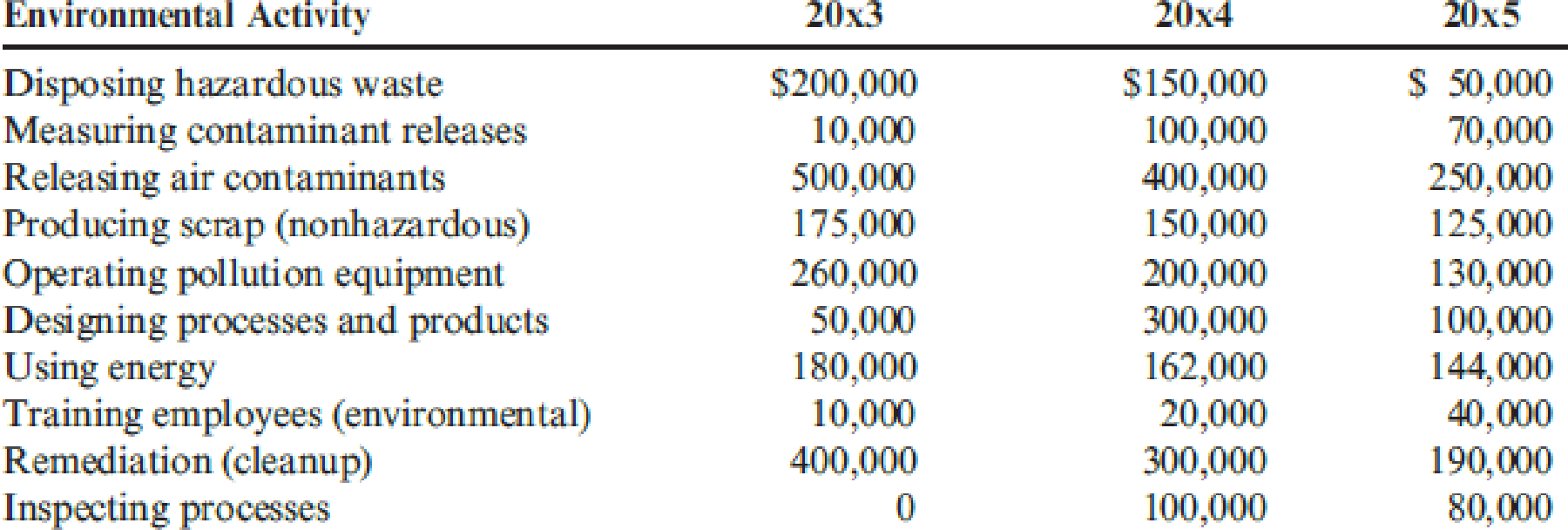

The following environmental cost reports for 20x3, 20x4, and 20x5 (year end December 31) are for the Communications Products Division of Kartel, a telecommunications company. In 2011, Kartel committed itself to a continuous environmental improvement program, which was implemented throughout the company.

At the beginning of 20x5, Kartel began a new program of recycling nonhazardous scrap. The effort produced recycling income totaling $25,000. The marketing vice president and the environmental manager estimated that sales revenue had increased by $200,000 per year since 20x3 because of an improved public image relative to environmental performance. The company’s Finance Department also estimated that Kartel saved $80,000 in 20x5 because of reduced finance and insurance costs, all attributable to improved environmental performance. All reductions in environmental costs from 20x3 to 20x5 are attributable to improvement efforts. Furthermore, any reductions represent ongoing savings.

Required:

- 1. Prepare an environmental financial statement for 20x5 (for the Products Division). In the cost section, classify environmental costs by category (prevention, detection, etc.).

- 2. Evaluate the changes in environmental performance.

Trending nowThis is a popular solution!

Chapter 14 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- Compute production cost per unit under variable costing.arrow_forwardOverhead rate per direct labor cost?arrow_forwardA business has $210,000 total liabilities. At start-up, the owners invested $500,000 in the business. Unfortunately, the business has suffered a cumulative loss of $200,000 up to the present time. What is the amount of its total assets at the present time?arrow_forward

- General Accountingarrow_forwardWhat is the total period cost under variable costing?arrow_forwardSubject: Financial Accounting-The Banner Income Fund's average daily total assets were $100 million for the year just completed. Its stock purchases for the year were $20 million, while its sales were $12.5 million. What was its turnover?arrow_forward

- Subject: Financial Accounting-The Banner Income Fund's average daily total assets were $100 million for the year just completed. Its stock purchases for the year were $20 million, while its sales were $12.5 million. What was its turnover? No AI ANSWERarrow_forwardAccurate answerarrow_forwardI don't need ai answer general accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning