Common-Size Statements and Financial Ratios for a Loan Application

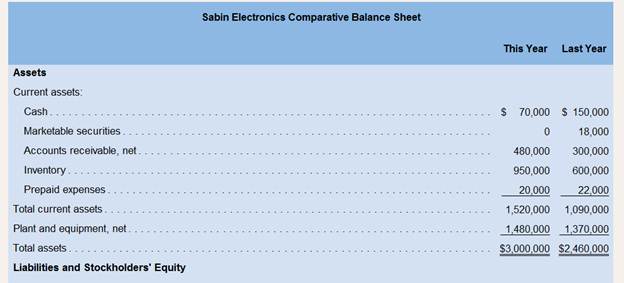

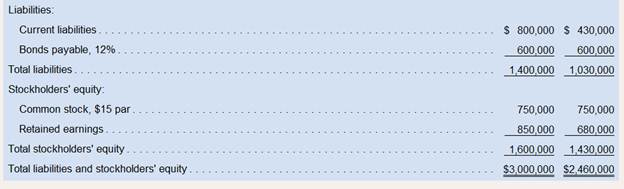

Paul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $500,000 long-term loan from Gulfport State Bank. $100,000 of which will be used to bolster the Cash account and $400,000 of which will be used to modernize equipment. The company's financial statements for the two most recent years follow:

During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines in order to improve its profit margin. The company also hired a new sales manager, who has expanded sales into several new territories. Sales terms are 2/10, n/30. All sales are on account.

Required:

1. To assist in approaching the bank about the loan. Paul has asked you to compute the following ratios for both this year and last year:

a. The amount of

b. The

c. The acid-test ratio.

d. The average collection period. (The

e. The average sale period. (The inventory at the beginning of last year totaled $500,000.)

f The operating cycle.

g. The total asset turnover. (The total assets at the beginning of last year were $2,420,000.)

h. The debt-to-equity ratio.

i. The times interest earned ratio.

j. The equity multiplier. (The total

2. For both this year and last year:

a. Present the

b. Present the income statement in common-size format down through net income.

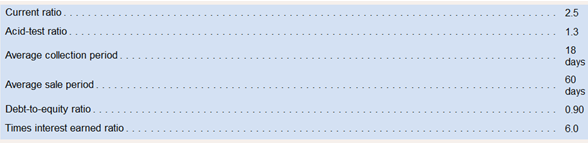

3. Paul Sabin has also gathered the following financial data and ratios that are typical of companies in the electronics industry:

Comment on the results of your analysis in (1) and (2) above and compare Sabin Electronics' performance to the benchmarks from the electronics industry. Do you think that the company is likely to get its loan application approved?

Financial Ratio Analysis:

The process of evaluating the financial ratios is known as financial ratio analysis

1.

Compute the following ratios for both this year and last year.

a. Working Capital

b. Current Ratio

c. Acid-Test Ratio

d. Average Collection Period

e. Average Sale Period

f. Operating Cycle

g. Total Asset Turnover

h. Debt-to-Equity Ratio

i. Times Interest Earned Ratio

j. Equity Multiplier

2.

Prepare balance sheet and income statement in common-size format for both this year and last year.

3.

Comment on the results of your analysis in (1) and (2) above and compare Sabin Electronics’ performance to the benchmarks from the electronics industry. Do you think that the company is likely to get its loan application approved?

Answer to Problem 18P

Solution:

1.

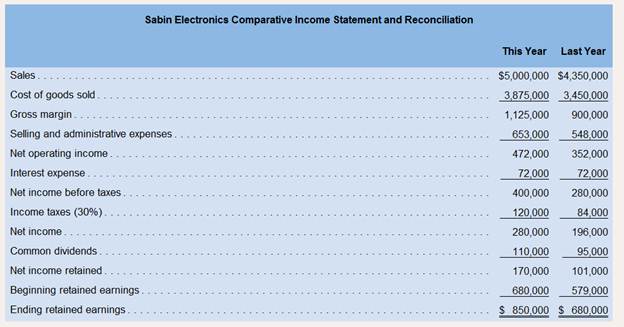

| Ratios | This Year | Last Year |

| Working Capital | $720,000 | $660,000 |

| Current Ratio | 1.90 | 2.53 |

| Acid-Test Ratio | 0.69 | 1.09 |

| Average Collection Period | 28 days | 23 days |

| Average Sale Period | 73 days | 58 days |

| Average Payable Period | 58 days | 45 days |

| Operating Cycle | 43 days | 36 days |

| Total Asset Turnover | 1.83 | 1.78 |

| Debt-to-Equity Ratio | 0.88 | 0.72 |

| Times Interest Earned Ratio | 6.56 | 4.89 |

| Equity Multiplier | 1.80 | 1.71 |

2.

| SABIN ELECTRONICS

Common Size Balance Sheet | ||||

| This Year | Percent | Last Year | Percent | |

| Assets | ||||

| Current assets: | ||||

| Cash | $70,000 | 2.3% | $150,000 | 6.1% |

| Marketable securities | 0 | 0.0% | 18,000 | 0.7% |

| Accounts receivable, net | 480,000 | 16.0% | 300,000 | 12.2% |

| Inventory | 950,000 | 31.7% | 600,000 | 24.4% |

| Prepaid expenses | 20,000 | 0.7% | 22,000 | 0.9% |

| Total current assets | 1,520,000 | 50.7% | 1,090,000 | 44.3% |

| Plant and equipment, net | 1,480,000 | 49.3% | 1,370,000 | 55.7% |

| Total Assets | $3,000,000 | 100% | $2,460,000 | 100% |

| Liabilities and Stockholders’ Equity | ||||

| Liabilities: | ||||

| Current liabilities | $800,000 | 26.7% | $430,000 | 17.5% |

| Bonds payable, 12% | 600,000 | 20% | 600,000 | 24.4% |

| Total Liabilities | 1,400,000 | 46.7% | 1,030,000 | 41.9% |

| Stockholders’ equity | ||||

| Common stock, $15 par | 750,000 | 25% | 750,000 | 30.5% |

| Retained Earnings | 850,000 | 28.3% | 680,000 | 27.6% |

| Total Stockholders’ Equity | 1,600,000 | 53.3% | 1,430,000 | 58.1% |

| Total liabilities and stockholders’ equity | $3,00,000 | 100% | $2,460,000 | 100% |

| SABIN ELECTRONICS

Common Size Income Statement | ||||

| This Year | Percent | Last Year | Percent | |

| Sales | $5,000,000 | 100% | $4,350,000 | 100% |

| Cost of goods sold | 3,875,000 | 77.5% | 3,450,000 | 79.3% |

| Gross margin | 1,125,000 | 22.5% | 900,000 | 20.7% |

| Selling and administrative expenses | 653,000 | 13.1% | 548,000 | 12.6% |

| Net operating income | 472,000 | 9.4% | 352,000 | 8.1% |

| Interest expense | 72,000 | 1.4% | 72,000 | 1.7% |

| Net income before taxes | 400,000 | 8% | 280,000 | 6.4% |

| Income taxes (30%) | 120,000 | 2.4% | 84,000 | 1.9% |

| Net Income | 280,000 | 5.6% | 196,000 | 4.5% |

3.

Considering the financial data and ratios of companies in the electronics industry, Sabin Electronics is likely to get its loan approved because the low debt equity ratio and improving times interest earned ratio which are good signs for the bank. In addition to that, the company is planning to invest 80% of the loan amount into modernizing the equipment which increase the productivity and ultimately resulting in higher profitability.

Explanation of Solution

1.

| a. Computation of Working Capital | ||||

| This Year | Last Year | |||

| Current Assets | $1,520,000 | $1,090,000 | ||

| Less: Current Liabilities | $800,000 | $430,000 | ||

| Working Capital | $720,000 | $660,000 | ||

With 80% of loan amount being invested in modernizing the equipment, the sales and net income of the company is likely to improve with productivity. The current ratio and acid-test ratio and other relevant ratios will probably improve with this investment. Considering all these factors, the bank is likely to approve the loan of the company.

Want to see more full solutions like this?

Chapter 14 Solutions

Loose Leaf For Introduction To Managerial Accounting

- Express the gross profit amount as a percentage of the sales amount for dysonarrow_forwardStereotypes are often depicted in films. Choose any film that portrays some form of stereotypes. In your analysis, complete the following: Briefly summarize the film Discuss three instances of stereotyping in the film. Then, answer the following questions about the stereotypes in the film: How did the stereotypes originate? How did the characters respond to the stereotypes? What are the positive/negative effects of the stereotypes on the communication between the characters?arrow_forwardanswer plzarrow_forward

- BoAt Company had no beginning inventory and adds all materials at the very beginning of its only process. Assume 31,300 units were started, and 14,500 units completed. The ending work in process is 82% complete. The equivalent units for conversion costs is _.arrow_forwardWhat is the total net gain or loss on this transaction? Accountingarrow_forwardCalculate the gross profit ratioarrow_forward

- Need answerarrow_forwardNeed help with this question solution general accountingarrow_forwardYou and your partners want to sell your company's water purification product in underserved international markets. Markets for water purification devices are nearly unlimited since one-third of people in the world do not have access to safe drinking water (World Health Organization, 2019). The following resources offer more information on this topic: Allied Analytics, LLP. (2023, June 18). Water purifier market size at $92.1 (2031) is set to witness a growth rate of 10.1%Links to an external site.. EIN Presswire. Fortune Business Insights. (2023, April 24). Water purifier market to worth USD 50.66 billion by 2029Links to an external site.. Globe NewsWire. United States Mission to the United Nations. (2023, March 22). Fact sheet: United States announces $49 billion in commitments to global water security and sanitation.Links to an external site. Identify a market in an underserved country and analyze the opportunities and challenges associated with this country's market. In…arrow_forward

- Vicco Incarrow_forwardExplain how this theory can help individuals in at least two fields (business, medical, education, etc.) better work in intercultural settings. Create a 2-page draft that responds to each question. If you use artificial intelligence (such as ChatGPT), include a paragraph explaining how you crafted the prompt, what you learned from the artificial intelligence-derived material, and what points from the artificial intelligence-provided answer make you the most curious. Define the theory based on credible sources Discuss the development of the theory: how it originated and came to its current status.arrow_forwardhello teacher please solve questionsarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT