Loose Leaf For Introduction To Managerial Accounting

8th Edition

ISBN: 9781260190175

Author: Brewer Professor, Peter C.; Garrison, Ray H; Noreen, Eric

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 12E

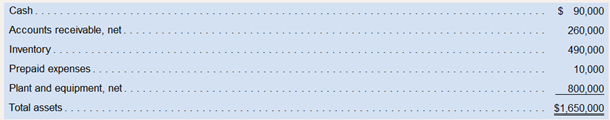

Selected Financial Measures for Assessing Liquidity

Norsk Optronics. ALS, of Bergen, Norway, had a

Required:

1. What was the company's

2. What was the company's acid-test ratio on June 30?

3. The company paid an account payable of $40,000 immediately after June 30.

a. What effect did this transaction have on working capital? Show computations.

b. What effect did this transaction have on the current ratio? Show computations.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

ABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued. Hii tutor give me Answer

ABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued. I want answer

At the beginning of the year

Chapter 14 Solutions

Loose Leaf For Introduction To Managerial Accounting

Ch. 14 - Prob. 1QCh. 14 - What is the basic purpose for examining trends in...Ch. 14 - Prob. 3QCh. 14 - Prob. 4QCh. 14 - What is meant by the dividend yield on a common...Ch. 14 - What is meant by the term financial leverage?Ch. 14 - Prob. 7QCh. 14 - Prob. 8QCh. 14 - Prob. 9QCh. 14 - Markus Company’s common stock sold for $2.75 per...

Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Prob. 11F15Ch. 14 - Prob. 12F15Ch. 14 - Prob. 13F15Ch. 14 - Prob. 14F15Ch. 14 - Prob. 15F15Ch. 14 - Common-Size Income Statement A comparative income...Ch. 14 - Prob. 2ECh. 14 - Prob. 3ECh. 14 - Financial Ratios for Debt Management Refer to the...Ch. 14 - Prob. 5ECh. 14 - Prob. 6ECh. 14 - Prob. 7ECh. 14 - Prob. 8ECh. 14 - Financial Ratios for Assessing Profitability and...Ch. 14 - Prob. 10ECh. 14 - Prob. 11ECh. 14 - Selected Financial Measures for Assessing...Ch. 14 - Effects of Transactions on Various Financial...Ch. 14 - Effects of Transactions on Various Ratios Denna...Ch. 14 - Prob. 15PCh. 14 - Common-Size Financial StatementsRefer to the...Ch. 14 - Interpretation of Financial Ratios Pecunious...Ch. 14 - Common-Size Statements and Financial Ratios for a...Ch. 14 - Financial Ratios for Assessing Profitability and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hii ticher please given correct answer general Accountingarrow_forwardABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued. Financial Accounting problemarrow_forwardGeneral Accountarrow_forward

- Express the answer with 3 decimal placesarrow_forwardABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued. General Accounting problemarrow_forwardABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License