Effect of proposals on divisional performance

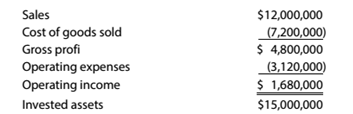

A condensed income statement for the Jet Ski Division of Amazing Rides Inc. for the year ended December 31. 20Y2, is as follows

Assume that the Jet Ski Division received no charges from service departments. The president of Amazing Rides has indicated that the division's

Proposal 1: Transfer equipment with a book value of J3.000.000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by $264,000. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged.

Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $480,000. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional $1,000,000 for the year.

Proposal 5? Reduce invested assets by discontinuing the tandem jet ski line. This action would eliminate sales of $2,280,000, cost of goods sold of $1,400,000, and operating expenses of $463,600. Assets of $4,200,000 would be transferred to other divisions at no gain or loss.

Instructions

Which of the three proposals would meet the required 12%

Trending nowThis is a popular solution!

Chapter 14 Solutions

CengageNOWv2, 1 term Printed Access Card for Warren's Survey of Accounting, 8th

- Question:5arrow_forwardPlease need answer the financial accounting questionarrow_forwardOn March 5, 2010, Yamada Dairy Co. decided to replace its outdated pasteurization system with a more efficient one. The old system had a book value of $10,500 and a fair value of $1,500. Yamada's new pasteurization system has a fair value of $210,000, for which Yamada paid $208,500 after allowing the contractor to keep the old equipment. How much should Yamada capitalize on the cost of the new pasteurization system? Provide answerarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning