Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 14.1E

• LO14–2

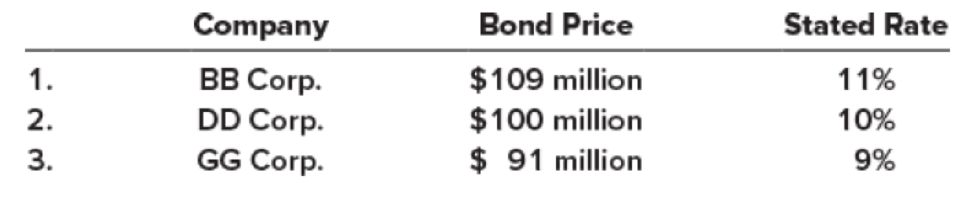

Your investment department has researched possible investments in corporate debt securities. Among the available investments are the following $100 million bond issues, each dated January 1, 2018. Prices were determined by underwriters at different times during the last few weeks.

Each of the bond issues matures on December 31, 2037, and pays interest semiannually on June 30 and December 31. For bonds of similar risk and maturity, the market yield at January 1, 2018, is 10%.

Required:

Other things being equal, which of the bond issues offers the most attractive investment opportunity if it can be purchased at the prices stated? The least attractive? Why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hii ticher please given answer general Accounting question

Need answer financial accounting question ?

General Accounting question

Chapter 14 Solutions

Intermediate Accounting

Ch. 14 - How is periodic interest determined for...Ch. 14 - As a general rule, how should long-term...Ch. 14 - How are bonds and notes the same? How do they...Ch. 14 - What information is contained in a bond indenture?...Ch. 14 - On January 1, 2018, Brandon Electronics issued 85...Ch. 14 - How is the price determined for a bond (or bond...Ch. 14 - A zero-coupon bond pays no interest. Explain.Ch. 14 - Prob. 14.8QCh. 14 - Compare the two commonly used methods of...Ch. 14 - Prob. 14.10Q

Ch. 14 - When a notes stated rate of interest is...Ch. 14 - How does an installment note differ from a note...Ch. 14 - Prob. 14.13QCh. 14 - Prob. 14.14QCh. 14 - Air Supply issued 6 million of 9%, 10-year...Ch. 14 - Both convertible bonds and bonds issued with...Ch. 14 - Prob. 14.17QCh. 14 - Cordova Tools has bonds outstanding during a year...Ch. 14 - If a company prepares its financial statements...Ch. 14 - (Based on Appendix 14A) Why will bonds always sell...Ch. 14 - Prob. 14.21QCh. 14 - Prob. 14.22QCh. 14 - Prob. 14.23QCh. 14 - Bank loan; accrued interest LO132 On October 1,...Ch. 14 - Non-interest-bearing note; accrued interest LO132...Ch. 14 - Determining the price of bonds LO142 A company...Ch. 14 - Determining the price of bonds LO142 A company...Ch. 14 - Effective interest on bonds LO142 On January 1, a...Ch. 14 - Effective interest on bonds LO142 On January 1, a...Ch. 14 - Straight-line interest on bonds LO142 On January...Ch. 14 - Investment in bonds LO142 On January 1, a company...Ch. 14 - Note issued for cash; borrower and lender LO143...Ch. 14 - Note with unrealistic interest rate LO143 On...Ch. 14 - Installment note LO143 On January 1, a company...Ch. 14 - Prob. 14.12BECh. 14 - Bonds with detachable warrants LO145 Hoffman...Ch. 14 - Convertible bonds LO145 Hoffman Corporation...Ch. 14 - Reporting bonds at fair value LO146 AI Tool and...Ch. 14 - Bond valuation LO142 Your investment department...Ch. 14 - Determine the price of bonds in various situations...Ch. 14 - Determine the price of bonds; issuance; effective...Ch. 14 - Investor; effective interest LO142 (Note: This is...Ch. 14 - Bonds; issuance; effective interest; financial...Ch. 14 - Bonds; issuance; effective interest LO142 The...Ch. 14 - Prob. 14.7ECh. 14 - Investor; straight-line method LO142 (Note: This...Ch. 14 - Issuance of bonds; effective interest;...Ch. 14 - Issuance of bonds; effective interest;...Ch. 14 - Bonds; effective interest; adjusting entry LO142...Ch. 14 - Prob. 14.12ECh. 14 - Issuance of bonds; effective interest LO142...Ch. 14 - Prob. 14.14ECh. 14 - Error correction; accrued interest on bonds LO142...Ch. 14 - Error in amortization schedule LO143 Wilkins Food...Ch. 14 - Prob. 14.17ECh. 14 - Note with unrealistic interest rate; lender;...Ch. 14 - Prob. 14.19ECh. 14 - Prob. 14.20ECh. 14 - Installment note LO143 LCD Industries purchased a...Ch. 14 - Prob. 14.22ECh. 14 - Early extinguishment LO145 The balance sheet of...Ch. 14 - Convertible bonds LO145 On January 1, 2018, Gless...Ch. 14 - Prob. 14.25ECh. 14 - Convertible bonds; induced conversion LO145 On...Ch. 14 - Prob. 14.27ECh. 14 - Bonds with detachable warrants LO145 On August 1,...Ch. 14 - Reporting bonds at fair value LO146 (Note: This...Ch. 14 - Reporting bonds at fair value LO146 On January 1,...Ch. 14 - Reporting bonds at fair value; calculate fair...Ch. 14 - Prob. 14.32ECh. 14 - Troubled debt restructuring; debt settled ...Ch. 14 - Prob. 14.34ECh. 14 - Troubled debt restructuring; modification of...Ch. 14 - Prob. 14.36ECh. 14 - Determining the price of bonds; discount and...Ch. 14 - Effective interest; financial statement effects ...Ch. 14 - Prob. 14.3PCh. 14 - Bond amortization schedule LO142 On January 1,...Ch. 14 - Issuer and investor; effective interest;...Ch. 14 - Prob. 14.6PCh. 14 - Prob. 14.7PCh. 14 - Bonds; effective interest; partial period...Ch. 14 - Zero-co upon bonds LO142 On January 1, 2018,...Ch. 14 - Prob. 14.10PCh. 14 - Prob. 14.11PCh. 14 - Prob. 14.12PCh. 14 - Note and installment note with unrealistic...Ch. 14 - Prob. 14.14PCh. 14 - Early extinguishment; effective interest LO145...Ch. 14 - Prob. 14.16PCh. 14 - Prob. 14.17PCh. 14 - Early extinguishment LO145 The long-term...Ch. 14 - Convertible bonds; induced conversion; bonds with...Ch. 14 - Convertible bonds; zero coupon; potentially...Ch. 14 - Prob. 14.21PCh. 14 - Determine bond price; record interest; report...Ch. 14 - Report bonds at fair value; quarterly reporting ...Ch. 14 - Prob. 14.24PCh. 14 - Prob. 14.25PCh. 14 - Troubled debt restructuring Appendix B At January...Ch. 14 - Prob. 14.1BYPCh. 14 - Real World Case 142 Zero-coupon debt; HP Inc. ...Ch. 14 - Prob. 14.4BYPCh. 14 - Prob. 14.5BYPCh. 14 - Prob. 14.6BYPCh. 14 - Prob. 14.8BYPCh. 14 - Prob. 14.9BYPCh. 14 - Research Case 1410 FASB codification research;...Ch. 14 - Prob. 14.11BYP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License