Concept explainers

a.

Identify the predictors that could be used in the model to incorporate suppliers and lubrication regimens in addition to blank holder pressure.

a.

Answer to Problem 54E

The predictors that could be used in the model to incorporate suppliers and lubrication regimens in addition to blank holder pressure are given below:

Explanation of Solution

Given info:

The MINITAB output shows that the springback from the wall opening angle being predicted using blank holder pressure, three types of material suppliers and three types of lubrication regimens.

Calculation:

Dummy or indicator variable:

If there a categorical variable has k levels then k–1 dummy variables would be included in the model.

The material suppliers and lubrication regimens are categorical variables with three levels each.

For material suppliers:

Fix the third level as a base and create two dummy variables as shown below:

For lubrication regimens:

Fix the first level (no lubricant) as a base and create two dummy variables as shown below:

b.

Test the hypothesis to conclude whether the model specifies a useful relationship between springback from the wall opening angle and at least one of the five predictor variables.

b.

Answer to Problem 54E

There is sufficient evidence to conclude that the model specifies a useful relationship between the springback from the wall opening angle and at least one of the five predictor variables

Explanation of Solution

Given info:

The MINTAB output was given.

Calculation:

The test hypotheses are given below:

Null hypothesis:

That is, there is no use of linear relationship between springback from the wall opening angle and at least one of the five predictor variables.

Alternative hypothesis:

That is, there is a use of linear relationship between springback from the wall opening angle and at least one of the five predictor variables.

From the MINITAB output, it can be observed that the P-value corresponding to the F-statistic is 0.000.

Rejection region:

If

If

Conclusion:

The P- value is 0.000 and the level of significance is 0.001.

The P- value is lesser than the level of significance.

That is,

Thus, the null hypothesis is rejected,

Hence, there is sufficient evidence to conclude that there is a use of linear relationship between springback from the wall opening angle and at least one of the five predictor variables.

c.

Calculate the 95% prediction interval for the springback from the wall opening angle when BHP is 1,000, material from supplier 1 and no lubrication.

c.

Answer to Problem 54E

The 95% prediction interval for the predicted springback from the wall opening angle when BHP is 1,000, material from supplier 1 and no lubrication is

Explanation of Solution

Given info:

The BHP is 1,000, material from supplier 1 and no lubrication. The corresponding standard deviation for prediction is 0.524.

Calculation:

The prediction value of springback from the wall opening angle when BHP is 1,000, material from supplier 1 and no lubrication is calculated as follows:

Thus, the prediction value of springback from the wall opening angle when BHP is 1,000, material from supplier 1 and no lubrication is 16.4461.

95% prediction interval:

The prediction interval is calculated using the formula:

Where,

n is the total number of observations.

k is the total number of predictors in the model.

Critical value:

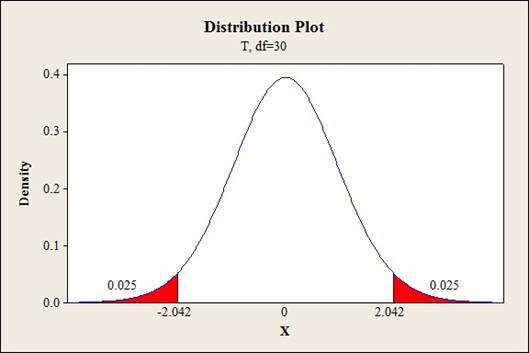

Software procedure:

Step-by-step procedure to find the critical value is given below:

- Click on Graph, select View Probability and click OK.

- Select t, enter 30 as Degrees of freedom, inShaded Area Tab select Probability under Define Shaded Area By and choose Both tails.

- Enter Probability value as 0.05.

- Click OK.

Output obtained from MINITAB is given below:

The 95% confidence interval for the predicted amount of beta carotene is calculated as follows:

Thus, the 95% prediction interval for the predicted springback from the wall opening angle when BHP is 1,000, material from supplier 1 and no lubricationis

d.

Find the coefficient of multiple determination.

Give the conclusion stating the importance of lubrication regimen.

d.

Answer to Problem 54E

The coefficient of multiple determination is 74.1%

The lubrication regimen is not important because there is not much of a difference in the coefficient of multiple determination even after removing the two variables corresponding to lubrication.

The two variables corresponding to lubrication shows no effect and need not be included in the model as long as the other predictors BHP and suppliers were retained.

Explanation of Solution

Given info:

The SSE after removing the variables corresponding to lubrication regimen is 48.426.

Calculation:

Coefficient of determination:

The coefficient of determination tells the total amount of variation in the dependent variable explained by the independent variable. It

Substitute 48.426 as SSE and 186.980 as SST.

Thus, the coefficient of multiple determination is 74.1%

The test hypotheses are given below:

Null hypothesis:

That is, the two dummy variables corresponding to lubrication are not significant to explain the variation in springback from wall opening angle.

Alternative hypothesis:

That is, At least one of the two dummy variables corresponding to lubrication is significant to explain the variation in springback from wall opening angle.

Test statistic:

Where,

n represents the total number of observations,

k represents the number of predictors on the full model.

l represents the number of predictors on the reduced model.

Substitute 48.426for

Critical value:

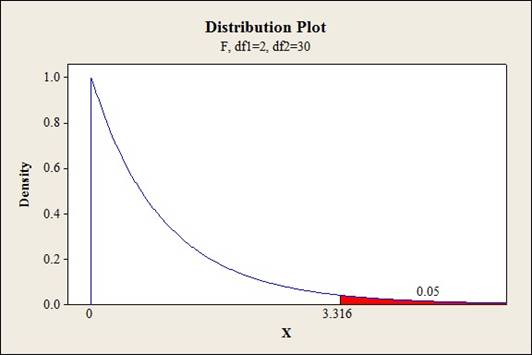

Software procedure:

- Click on Graph, select View Probability and click OK.

- Select F, enter 2 in numerator df and 30 in denominator df.

- Under Shaded Area Tab select Probability under Define Shaded Area By and select Right tail.

- Choose Probability value as 0.05.

- Click OK.

Output obtained from MINITAB is given below:

Conclusion:

Coefficient of determination:

The coefficient of determination for the whole model including the two variables corresponding to lubrication is 77.5% whereas the coefficient of multiple determination after removing the two variables corresponding to lubrication is 74.1%. Thus, there is a slight drop in coefficient of multiple determination.

Testing the hypothesis:

The test statistic value is 2.268 and the critical value is 3.316.

The test statistic is lesser than the critical value.

That is,

Thus, the null hypothesis is not rejected,

Hence, there is sufficient evidence to conclude thatthe two dummy variables corresponding to lubrication are not significant to explain the variation in springback from wall opening angle.

e.

Identify whether the given model has improved than the model specified in part (d).

e.

Answer to Problem 54E

Yes, the given model has improved than the model specified in part (d).

There is sufficient evidence to conclude thatthe addition of interaction terms is significant to explain the variation in springback from wall opening angle at 5% level of significance.

Explanation of Solution

Given info:

A regression model is built with the five predictors and the interactions between BHP and the four dummy variables.

The resulting SSE is 28.216 and the

Calculation:

The test hypotheses are given below:

Null hypothesis:

That is, the addition of interaction terms is not significant to explain the variation in the dependent variable y.

Alternative hypothesis:

That is, at least one of theinteraction terms is significant to explain the variation in the dependent variable y.

The degrees of freedom for the regression would be 4.

The degrees of freedom for the error would be

Test statistic:

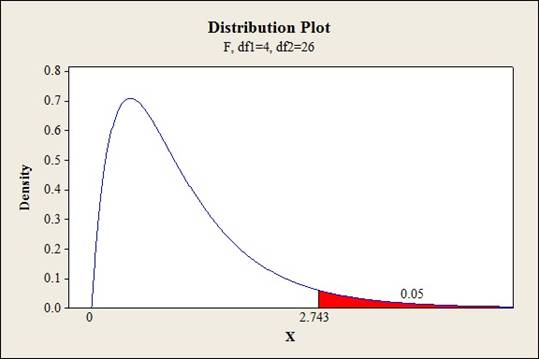

Critical value:

Software procedure:

- Click on Graph, select View Probability and click OK.

- Select F, enter 4 in numerator df and 26 in denominator df.

- Under Shaded Area Tab select Probability under Define Shaded Area By and select Right tail.

- Choose Probability value as 0.05.

- Click OK.

Output obtained from MINITAB is given below:

Conclusion:

The test statistic value is 3.191 and the critical value is 2.743.

The test statistic is greater than the critical value.

That is,

Thus, the null hypothesis is rejected,

Hence, there issufficient evidence to conclude thatthe addition of interaction terms is significant to explain the variation in springback from wall opening angle at 5% level of significance.

Want to see more full solutions like this?

Chapter 13 Solutions

Probability and Statistics for Engineering and the Sciences STAT 400 - University Of Maryland

- Suppose the Internal Revenue Service reported that the mean tax refund for the year 2022 was $3401. Assume the standard deviation is $82.5 and that the amounts refunded follow a normal probability distribution. Solve the following three parts? (For the answer to question 14, 15, and 16, start with making a bell curve. Identify on the bell curve where is mean, X, and area(s) to be determined. 1.What percent of the refunds are more than $3,500? 2. What percent of the refunds are more than $3500 but less than $3579? 3. What percent of the refunds are more than $3325 but less than $3579?arrow_forwardA normal distribution has a mean of 50 and a standard deviation of 4. Solve the following three parts? 1. Compute the probability of a value between 44.0 and 55.0. (The question requires finding probability value between 44 and 55. Solve it in 3 steps. In the first step, use the above formula and x = 44, calculate probability value. In the second step repeat the first step with the only difference that x=55. In the third step, subtract the answer of the first part from the answer of the second part.) 2. Compute the probability of a value greater than 55.0. Use the same formula, x=55 and subtract the answer from 1. 3. Compute the probability of a value between 52.0 and 55.0. (The question requires finding probability value between 52 and 55. Solve it in 3 steps. In the first step, use the above formula and x = 52, calculate probability value. In the second step repeat the first step with the only difference that x=55. In the third step, subtract the answer of the first part from the…arrow_forwardIf a uniform distribution is defined over the interval from 6 to 10, then answer the followings: What is the mean of this uniform distribution? Show that the probability of any value between 6 and 10 is equal to 1.0 Find the probability of a value more than 7. Find the probability of a value between 7 and 9. The closing price of Schnur Sporting Goods Inc. common stock is uniformly distributed between $20 and $30 per share. What is the probability that the stock price will be: More than $27? Less than or equal to $24? The April rainfall in Flagstaff, Arizona, follows a uniform distribution between 0.5 and 3.00 inches. What is the mean amount of rainfall for the month? What is the probability of less than an inch of rain for the month? What is the probability of exactly 1.00 inch of rain? What is the probability of more than 1.50 inches of rain for the month? The best way to solve this problem is begin by a step by step creating a chart. Clearly mark the range, identifying the…arrow_forward

- Client 1 Weight before diet (pounds) Weight after diet (pounds) 128 120 2 131 123 3 140 141 4 178 170 5 121 118 6 136 136 7 118 121 8 136 127arrow_forwardClient 1 Weight before diet (pounds) Weight after diet (pounds) 128 120 2 131 123 3 140 141 4 178 170 5 121 118 6 136 136 7 118 121 8 136 127 a) Determine the mean change in patient weight from before to after the diet (after – before). What is the 95% confidence interval of this mean difference?arrow_forwardIn order to find probability, you can use this formula in Microsoft Excel: The best way to understand and solve these problems is by first drawing a bell curve and marking key points such as x, the mean, and the areas of interest. Once marked on the bell curve, figure out what calculations are needed to find the area of interest. =NORM.DIST(x, Mean, Standard Dev., TRUE). When the question mentions “greater than” you may have to subtract your answer from 1. When the question mentions “between (two values)”, you need to do separate calculation for both values and then subtract their results to get the answer. 1. Compute the probability of a value between 44.0 and 55.0. (The question requires finding probability value between 44 and 55. Solve it in 3 steps. In the first step, use the above formula and x = 44, calculate probability value. In the second step repeat the first step with the only difference that x=55. In the third step, subtract the answer of the first part from the…arrow_forward

- If a uniform distribution is defined over the interval from 6 to 10, then answer the followings: What is the mean of this uniform distribution? Show that the probability of any value between 6 and 10 is equal to 1.0 Find the probability of a value more than 7. Find the probability of a value between 7 and 9. The closing price of Schnur Sporting Goods Inc. common stock is uniformly distributed between $20 and $30 per share. What is the probability that the stock price will be: More than $27? Less than or equal to $24? The April rainfall in Flagstaff, Arizona, follows a uniform distribution between 0.5 and 3.00 inches. What is the mean amount of rainfall for the month? What is the probability of less than an inch of rain for the month? What is the probability of exactly 1.00 inch of rain? What is the probability of more than 1.50 inches of rain for the month? The best way to solve this problem is begin by creating a chart. Clearly mark the range, identifying the lower and upper…arrow_forwardProblem 1: The mean hourly pay of an American Airlines flight attendant is normally distributed with a mean of 40 per hour and a standard deviation of 3.00 per hour. What is the probability that the hourly pay of a randomly selected flight attendant is: Between the mean and $45 per hour? More than $45 per hour? Less than $32 per hour? Problem 2: The mean of a normal probability distribution is 400 pounds. The standard deviation is 10 pounds. What is the area between 415 pounds and the mean of 400 pounds? What is the area between the mean and 395 pounds? What is the probability of randomly selecting a value less than 395 pounds? Problem 3: In New York State, the mean salary for high school teachers in 2022 was 81,410 with a standard deviation of 9,500. Only Alaska’s mean salary was higher. Assume New York’s state salaries follow a normal distribution. What percent of New York State high school teachers earn between 70,000 and 75,000? What percent of New York State high school…arrow_forwardPls help asaparrow_forward

- Solve the following LP problem using the Extreme Point Theorem: Subject to: Maximize Z-6+4y 2+y≤8 2x + y ≤10 2,y20 Solve it using the graphical method. Guidelines for preparation for the teacher's questions: Understand the basics of Linear Programming (LP) 1. Know how to formulate an LP model. 2. Be able to identify decision variables, objective functions, and constraints. Be comfortable with graphical solutions 3. Know how to plot feasible regions and find extreme points. 4. Understand how constraints affect the solution space. Understand the Extreme Point Theorem 5. Know why solutions always occur at extreme points. 6. Be able to explain how optimization changes with different constraints. Think about real-world implications 7. Consider how removing or modifying constraints affects the solution. 8. Be prepared to explain why LP problems are used in business, economics, and operations research.arrow_forwardged the variance for group 1) Different groups of male stalk-eyed flies were raised on different diets: a high nutrient corn diet vs. a low nutrient cotton wool diet. Investigators wanted to see if diet quality influenced eye-stalk length. They obtained the following data: d Diet Sample Mean Eye-stalk Length Variance in Eye-stalk d size, n (mm) Length (mm²) Corn (group 1) 21 2.05 0.0558 Cotton (group 2) 24 1.54 0.0812 =205-1.54-05T a) Construct a 95% confidence interval for the difference in mean eye-stalk length between the two diets (e.g., use group 1 - group 2).arrow_forwardAn article in Business Week discussed the large spread between the federal funds rate and the average credit card rate. The table below is a frequency distribution of the credit card rate charged by the top 100 issuers. Credit Card Rates Credit Card Rate Frequency 18% -23% 19 17% -17.9% 16 16% -16.9% 31 15% -15.9% 26 14% -14.9% Copy Data 8 Step 1 of 2: Calculate the average credit card rate charged by the top 100 issuers based on the frequency distribution. Round your answer to two decimal places.arrow_forward

Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning

Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning