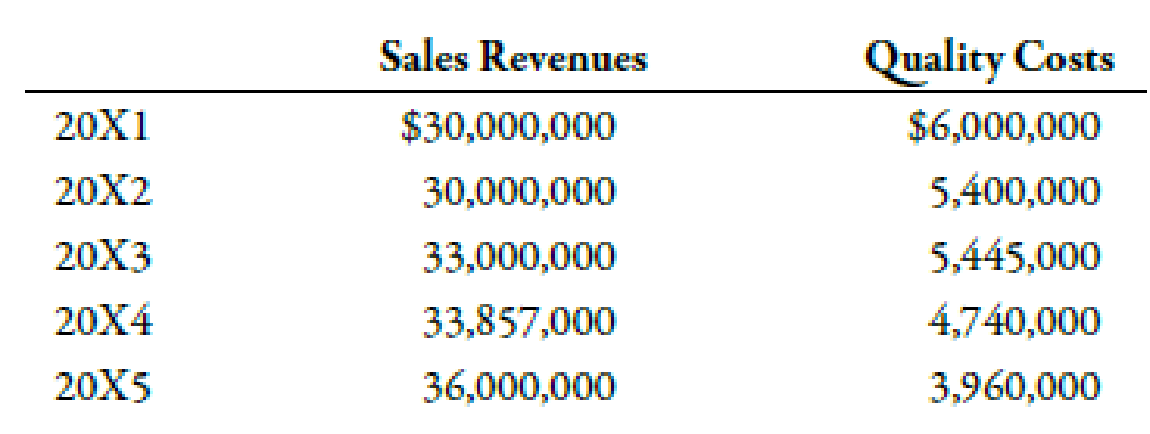

Luna Company is a printing company and a subsidiary of a large publishing company. Luna is in its fourth year of a 5-year, quality improvement program. The program began in 20X1 as a result of a report by a consulting firm that revealed that quality costs were about 20% of sales. Concerned about the level of quality costs, Luna’s top management began a 5-year plan in 20X1 with the objective of lowering quality costs to 10% of sales by the end of 20X5. Sales and quality costs for each year are as follows:

Quality costs by category are expressed as a percentage of sales as follows:

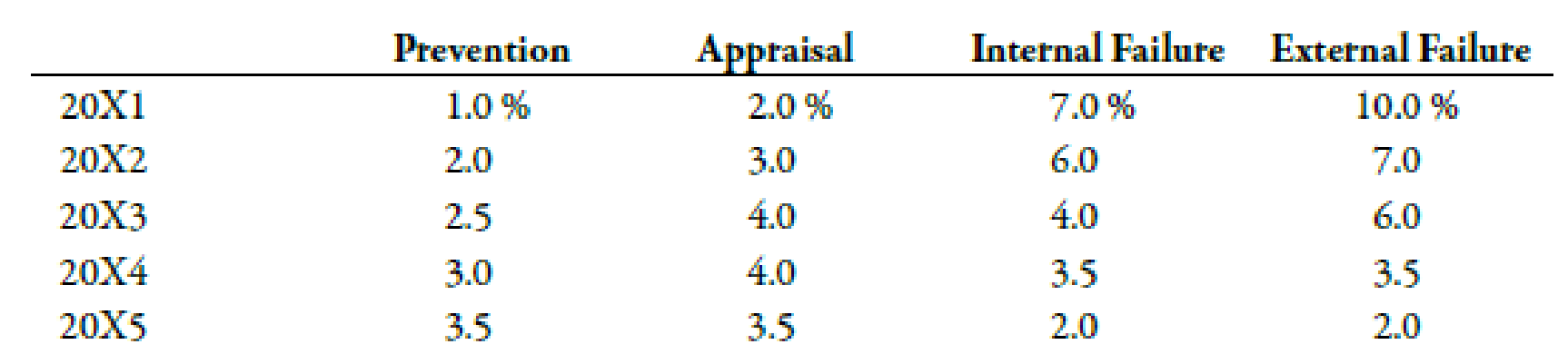

The detail of the 20X5 budget for quality costs is also provided.

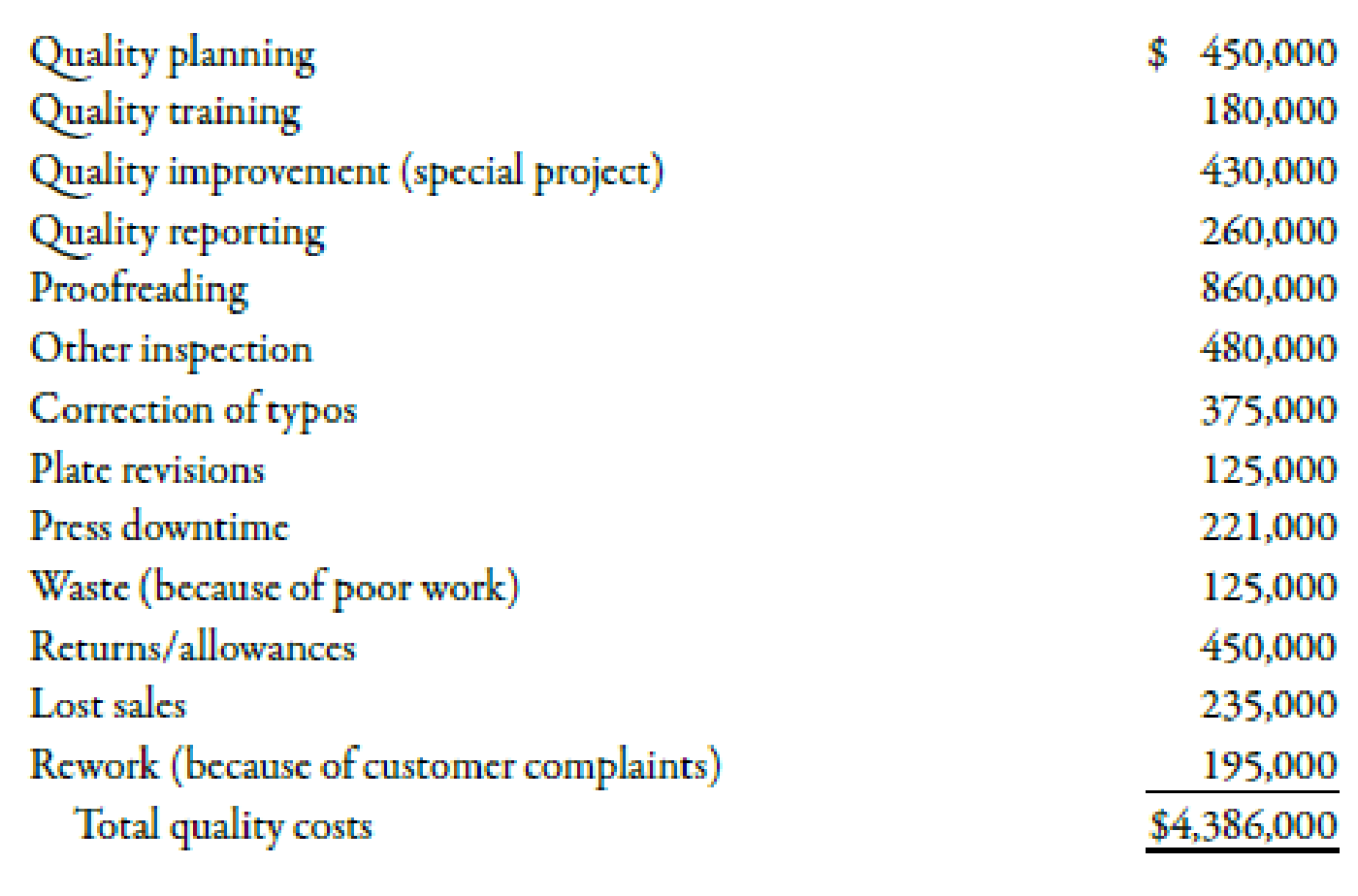

Actual quality costs for 20X4 and 20X5 are as follows:

Required:

- 1. Prepare an interim quality cost performance report for 20X5 that compares actual quality costs with budgeted quality costs. Comment on the firm’s ability to achieve its quality goals for the year.

- 2. Prepare a single-period quality performance report for 20X5 that compares the actual quality costs of 20X4 with the actual costs of 20X5. How much did profits change because of improved quality?

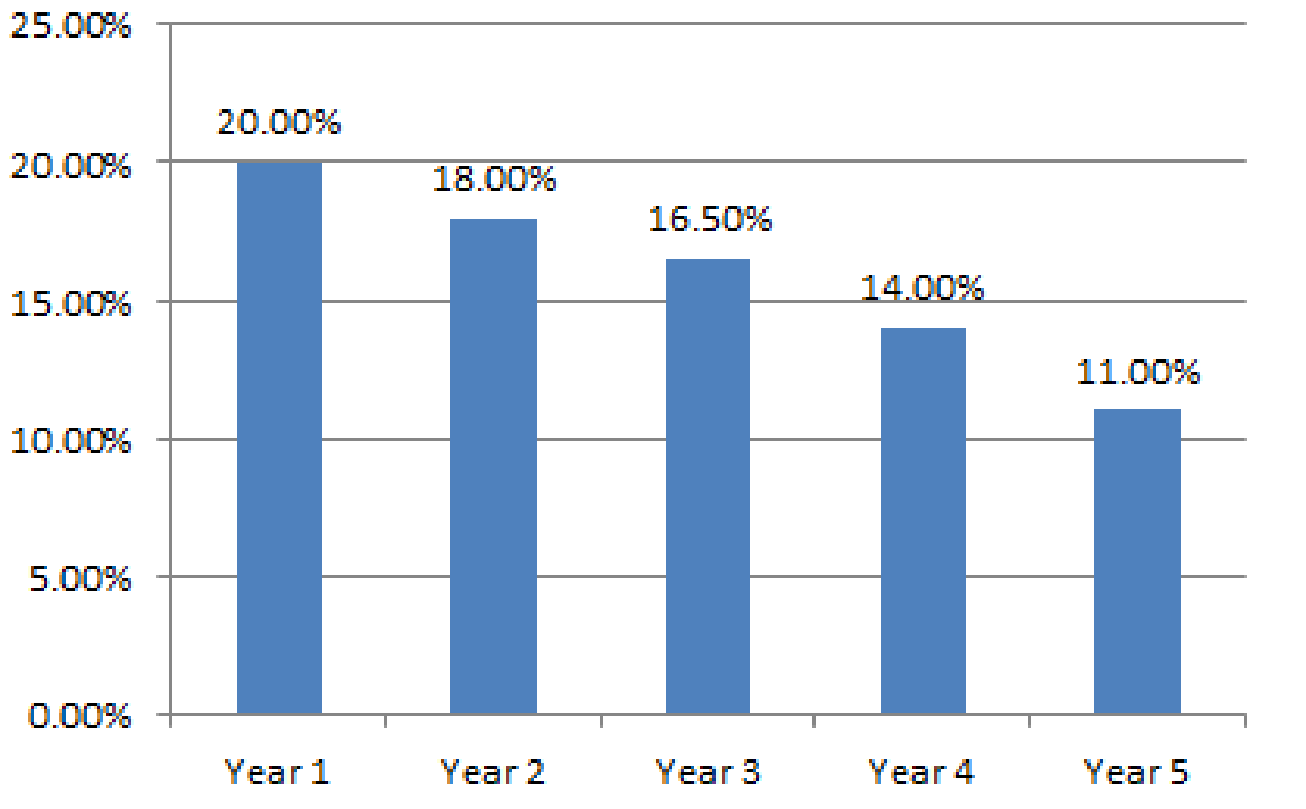

- 3. Prepare a graph that shows the trend in total quality costs as a percentage of sales since the inception of the quality improvement program.

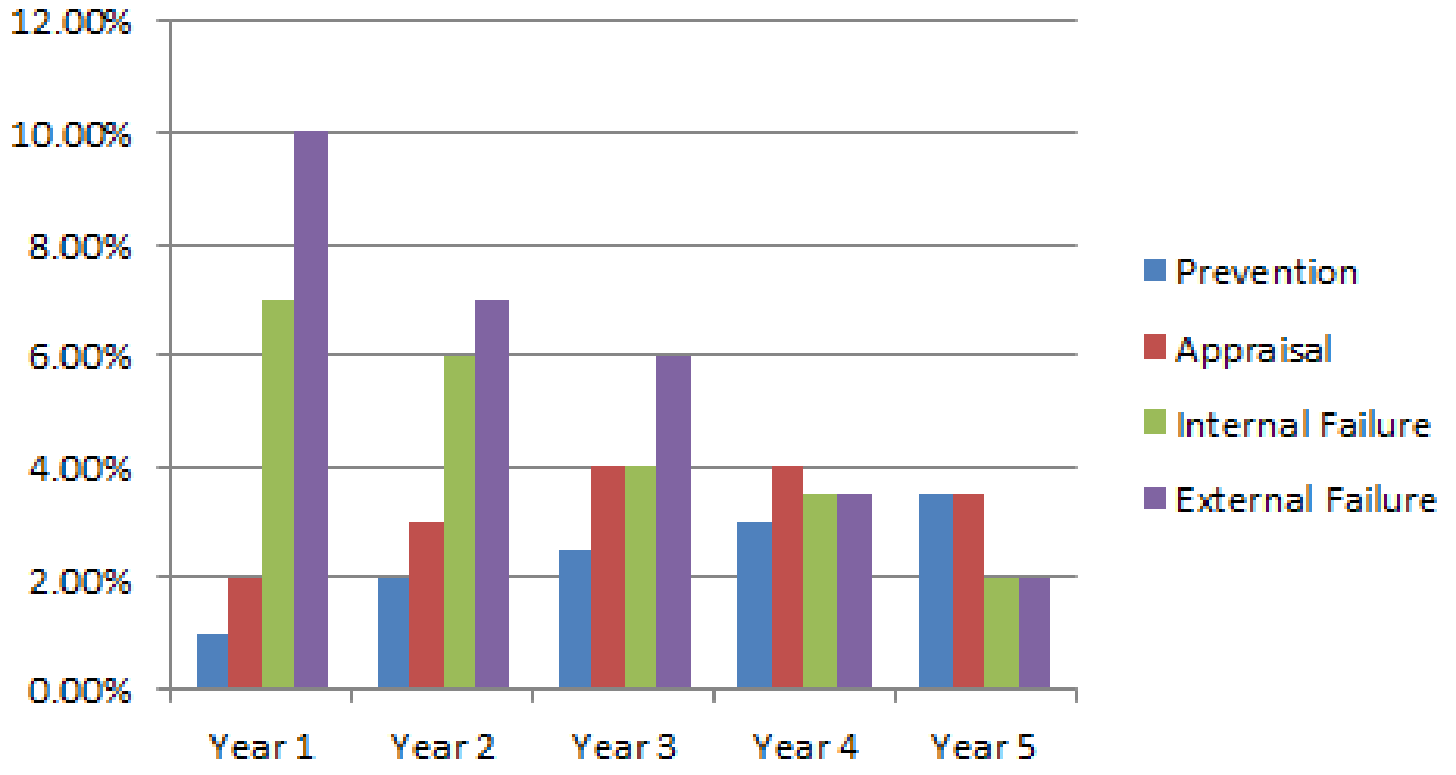

- 4. Prepare a graph that shows the trend for all four quality cost categories for 20X1 through 20X5. How does this graph help management know that the reduction in total quality costs is attributable to quality improvements?

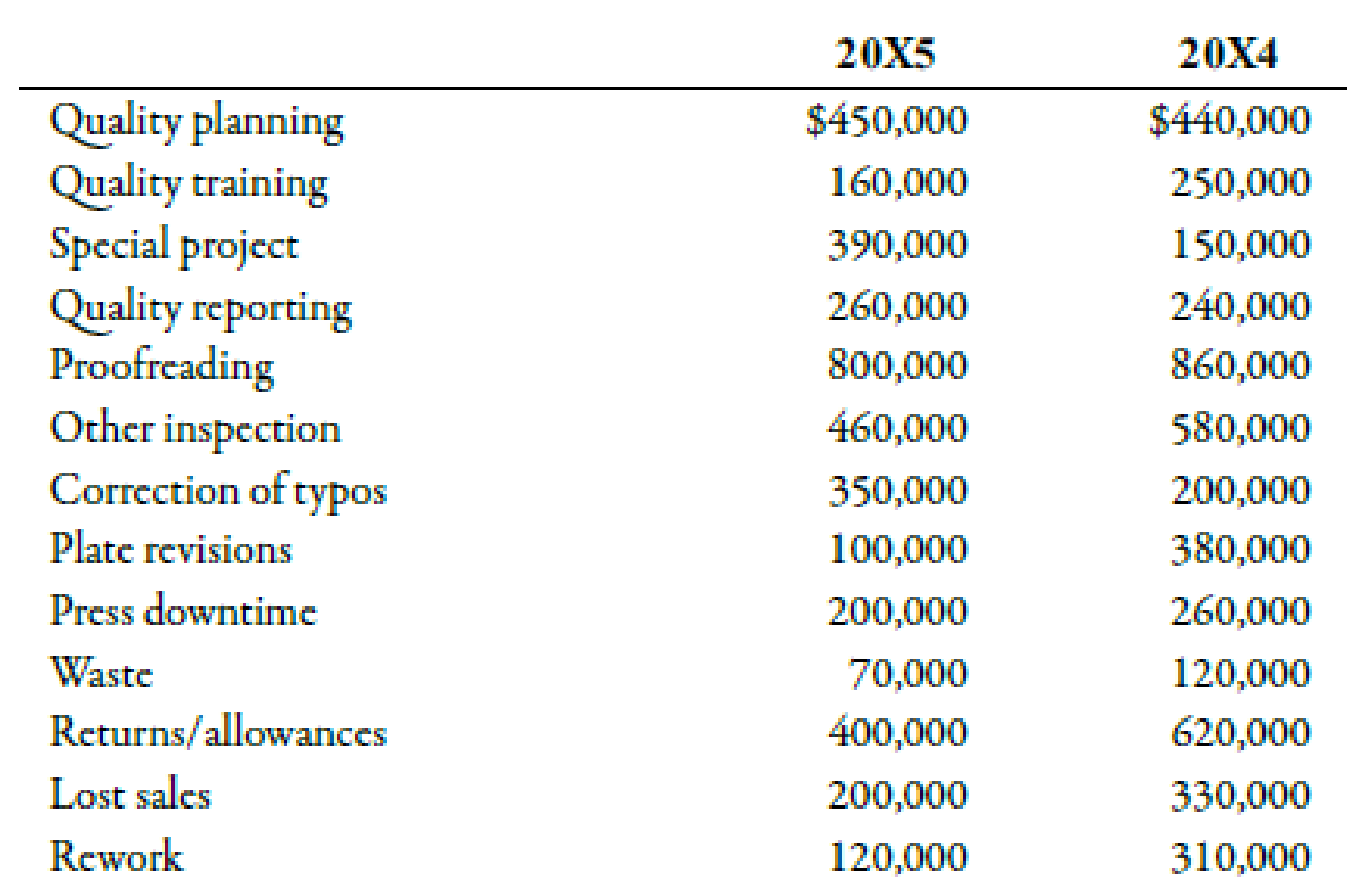

- 5. Assume that the company is preparing a second 5-year plan to reduce quality costs to 2.5% of sales. Prepare a long-range quality cost performance report that compares the costs for 20X5 with those planned for the end of the second 5-year period. Assume sales of $45 million at the end of 5 years. The final planned relative distribution of quality costs is as follows: proofreading, 50%; other inspection, 13%; quality training, 30%; and quality reporting, 7%. Assume that all prevention costs are fixed and all other costs are variable (with respect to sales).

1.

Present interim quality cost performance report.

Explanation of Solution

Quality Cost:

Organizations are required to bear costs due to non-conformity of goods or services with the general specifications. These costs are termed as quality costs. Quality costs can be categorized into preventive costs, detective costs, internal failure costs and external failure costs.

Quality cost performance report:

| Particulars |

Budgeted ($) |

Actual ($) |

Variance ($) |

| Prevention | |||

| Quality planning | 450,000 | 450,000 | 0 |

| Quality training | 180,000 | 160,000 | 20,000 |

| Special project | 430,000 | 390,000 | 40,000 |

| Quality reporting | 260,000 | 260,000 | 0 |

| Total prevention costs(A) | 1,320,000 | 1,260,000 | 60,000 |

| Appraisal | |||

| Proofreading | 860,000 | 800,000 | 60,000 |

| Other inspection | 480,000 | 460,000 | 20,000 |

| Total appraisal costs (B) | 1,340,000 | 1,260,000 | 80,000 |

| Internal Failure | |||

| Correction of typos | 375,000 | 350,000 | 25,000 |

| Plate revisions | 125,000 | 100,000 | 25,000 |

| Press downtime | 221,000 | 200,000 | 21,000 |

| Waste | 125,000 | 70,000 | 55,000 |

| Total internal failure costs (C) | 846,000 | 720,000 | 126,000 |

| External Failure | |||

| Returns/allowances | 450,000 | 400,000 | 50,000 |

| Lost sales | 235,000 | 200,000 | 35,000 |

| Rework | 195,000 | 120,000 | 75,000 |

| Total external failure costs (D) | 880,000 | 720,000 | 160,000 |

|

Total quality cost | 4,386,000 | 3,960,000 | 426,000 |

Table (1)

Total sales in the Year 20X5 are $36,000,000 and quality costs are $3,960,000 which is 11%

Therefore, the company has been able to achieve quality goals for the year.

2.

Compare actual costs of the year 20X4 with the costs of 20X5

Explanation of Solution

Quality cost performance report:

| Particulars |

Actual ($) 20X4 |

Actual ($) 20X5 |

Variance ($) |

| Prevention | |||

| Quality planning | 440,000 | 450,000 | |

| Quality training | 250,000 | 160,000 | 90,000 |

| Special project | 150,000 | 390,000 | |

| Quality reporting | 240,000 | 260,000 | |

| Total prevention costs(A) | 1,080,000 | 1,260,000 | |

| Appraisal | |||

| Proofreading | 860,000 | 800,000 | 60,000 |

| Other inspection | 580,000 | 460,000 | 120,000 |

| Total appraisal costs (B) | 1,440,000 | 1,260,000 | 180,000 |

| Internal Failure | |||

| Correction of typos | 200,000 | 350,000 | |

| Plate revisions | 380,000 | 100,000 | 280,000 |

| Press downtime | 260,000 | 200,000 | 60,000 |

| Waste | 120,000 | 70,000 | 50,000 |

| Total internal failure costs (C) | 960,000 | 720,000 | 240,000 |

| External Failure | |||

| Returns/allowances | 620,000 | 400,000 | 220,000 |

| Lost sales | 330,000 | 200,000 | 130,000 |

| Rework | 310,000 | 120,000 | 190,000 |

| Total external failure costs (D) | 1,260,000 | 720,000 | 540,000 |

|

Total quality cost | 4,740,000 | 3,960,000 | 780,000 |

Table (2)

Profit has been increased by $780,000 due to improved quality and reduction of quality.

3.

Prepare trend graph for total quality costs.

Explanation of Solution

Trend graph for total quality costs.

Fig (1)

4.

Prepare trend graph for the category wise quality costs.

Explanation of Solution

Prepare trend graph for category wise quality costs.

Fig (2)

Analysis of the graph:

- This graph depicts progress in quality costs.

- Prevention and detections costs have increased; whereas, failure costs have decreased, which shows a positive balance of cost incurred amongst the four categories.

- External failure costs have decreased from 10% to around 2% which is a significant progress. Similarly, internal failure costs have decreased from around 7% to 2%.

- Since, failure costs are reduced, this indicates that customers are satisfied with the product and costs like loss of sales and repairs due to poor quality have been reduced. Therefore, it can be concluded that, quality of the products have been improved.

5.

Prepare performance report by comparing actual costs of year 20X5 with costs planned in the next five years.

Explanation of Solution

Quality cost performance report:

| Particulars |

20X5 ($) (A) |

Percentage ($) (B) |

Budgeted ($) (C) |

Variance ($) |

| Prevention; | ||||

| Quality planning | 450,000 | 100% | 450,000 | 0 |

| Quality training | 160,000 | 30% | 48,000 | 112,000 |

| Special project | 390,000 | 100% | 390,000 | 0 |

| Quality reporting | 260,000 | 7% | 18,200 | 241,800 |

| Total prevention costs(A) | 1,260,000 | 906,200 | 353,800 | |

| Appraisal: | ||||

| Proofreading | 800,000 | 50% | 400,000 | 400,000 |

| Other inspection | 460,000 | 13% | 59,800 | 400,200 |

| Total appraisal costs (B) | 1,260,000 | 459,800 | 800,200 | |

| Internal Failure: | ||||

| Correction of typos | 350,000 | 125% | 437,500 | |

| Plate revisions | 100,000 | 125% | 125,000 | |

| Press downtime | 200,000 | 125% | 250,000 | |

| Waste | 70,000 | 125% | 87,500 | |

| Total internal failure costs (C) | 720,000 | 900,000 | ||

| External Failure: | ||||

| Returns/allowances | 400,000 | 125% | 500,000 | |

| Lost sales | 200,000 | 125% | 250,000 | |

| Rework | 120,000 | 125% | 150,000 | |

| Total external failure costs (D) | 720,000 | 900,000 | ||

|

Total quality cost | 3,960,000 | 3,166,000 | 794,000 |

Table (3)

Total quality cost of $3,166,000 is 7.03% of expected sales of $45,000,000

Working Notes:

Sales, for the next period is expected to be $45,000,000 which is 125% of the actual sales of 20X5 of $36,000,000.

Want to see more full solutions like this?

Chapter 13 Solutions

Managerial Accounting

- Bucket's opereting leverage??? General accountingarrow_forwardNonearrow_forwardThe predetermined overhead rate for RON Company is $10, comprised of a variable overhead rate of $6 and a fixed rate of $4. The amount of budgeted overhead costs at a normal capacity of $300,000 was divided by the normal capacity of 30,000 direct labor hours, to arrive at the predetermined overhead rate of $10. Actual overhead for July was $40,000 variable and $28,200 fixed, and the standard hours allowed for the product produced in July was 7,000 hours. The total overhead variance is: A. $6,100 U B. $1,100 U C. $500 U D. $1,800 Farrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning