Concept explainers

The North Valley Real Estate data reports information on homes on the market.

- a. Let selling price be the dependent variable and size of the home the independent variable. Determine the regression equation. Estimate the selling price for a home with an area of 2,200 square feet. Determine the 95% confidence interval for all 2,200 square foot homes and the 95% prediction interval for the selling price of a home with 2,200 square feet.

- b. Let days-on-the-market be the dependent variable and price be the independent variable. Determine the regression equation. Estimate the days-on-the-market of a home that is priced at $300,000. Determine the 95% confidence interval of days-on-the-market for homes with a

mean price of $300,000, and the 95% prediction interval of days-on-the-market for a home priced at $300,000. - c. Can you conclude that the independent variables “days on the market” and “selling price” are

positively correlated ? Are the size of the home and the selling price positively correlated? Use the .05 significance level. Report the p-value of the test. Summarize your results in a brief report.

a.

Find the regression equation.

Find the selling price of a home with an area of 2,200 square feet.

Construct a 95% confidence interval for all 2,200 square foot homes.

Construct a 95% prediction interval for the selling price of a home with 2,200 square feet.

Answer to Problem 62DA

The regression equation is

The selling price of a home with an area of 2,200 square feet is 222,624.423.

The 95% confidence interval for all 2,200 square foot homes is

The 95% prediction interval for the selling price of a home with 2,200 square feet is

Explanation of Solution

Here, the selling price is the dependent variable and size of the home is the independent variable.

Step-by-step procedure to obtain the ‘regression equation’ using MegaStat software:

- In an EXCEL sheet enter the data values of x and y.

- Go to Add-Ins > MegaStat > Correlation/Regression > Regression Analysis.

- Select input range as ‘Sheet1!$B$2:$B$106’ under Y/Dependent variable.

- Select input range ‘Sheet1!$A$2:$A$106’ under X/Independent variables.

- Select ‘Type in predictor values’.

- Enter 2,200 as ‘predictor values’ and 95% as ‘confidence level’.

- Click on OK.

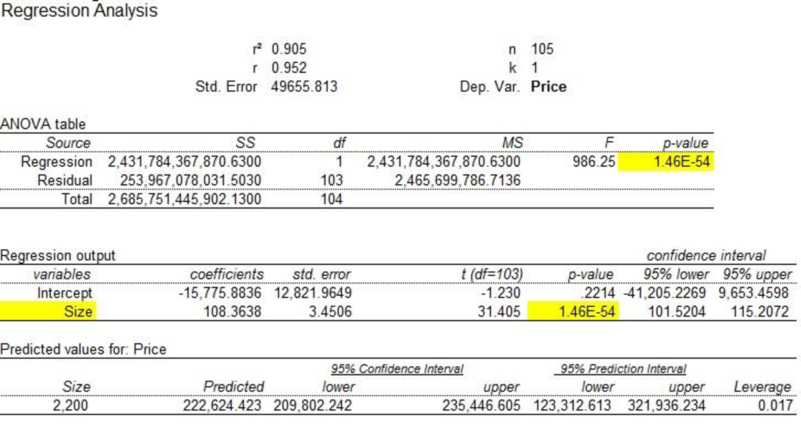

Output obtained using MegaStat software is given below:

From the regression output, it is clear that

The regression equation is

The selling price of a home with an area of 2,200 square feet is 222,624.423.

The 95% confidence interval for all 2,200 square foot homes is

The 95% prediction interval for the selling price of a home with 2,200 square feet is

b.

Find the regression equation.

Find day-on-the-market for homes with a mean price at $300,000.

Construct a 95% confidence interval of day-on-the-market for homes with a mean price at $300,000.

Construct a 95% prediction interval day-on-the-market for a home priced at $300,000.

Answer to Problem 62DA

The regression equation is

The day-on-the-market for homes with a mean price at $300,000 is 28.930.

The 95% confidence interval of day-on-the-market for homes with a mean price at $300,000 is

The 95% prediction interval day-on-the-market for a home priced at $300,000 is

Explanation of Solution

Here, the selling price is the dependent variable and size of the home is the independent variable.

Step-by-step procedure to obtain the ‘regression equation’ using MegaStat software:

- In an EXCEL sheet enter the data values of x and y.

- Go to Add-Ins > MegaStat > Correlation/Regression > Regression Analysis.

- Select input range as ‘Sheet1!$C$2:$C$106’ under Y/Dependent variable.

- Select input range ‘Sheet1!$B$2:$B$106’ under X/Independent variables.

- Select ‘Type in predictor values’.

- Enter 300,000 as ‘predictor values’ and 95% as ‘confidence level’.

- Click on OK.

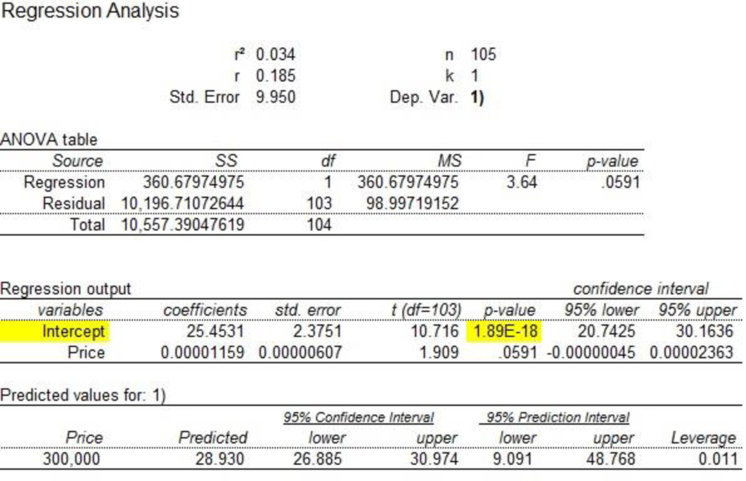

Output obtained using MegaStat software is given below:

From the regression output, it is clear that

The regression equation is

The day-on-the-market for homes with a mean price at $300,000 is 28.930.

The 95% confidence interval of day-on-the-market for homes with a mean price at $300,000 is

The 95% prediction interval day-on-the-market for a home priced at $300,000 is

c.

Check whether the independent variables “day on the market” and “selling price” are positively correlated.

Check whether the independent variables “selling price” and “size of the home” are positively correlated.

Report the p-value of the test and summarize the result.

Answer to Problem 62DA

There is a positive association between “day on the market” and “selling price”.

There is a positive association between “selling price” and “size of the home”.

Explanation of Solution

Denote the population correlation as

Check the correlation between independent variables “day on the market” and “selling price” is positive

The hypotheses are given below:

Null hypothesis:

That is, the correlation between “day on the market” and “selling price” is less than or equal to zero.

Alternative hypothesis:

That is, the correlation between “day on the market” and “selling price” is positive.

Test statistic:

The test statistic is as follows:

Here, the sample size is 105 and the correlation coefficient is 0.185.

The test statistic is as follows:

The degrees of freedom is as follows:

The level of significance is 0.05. Therefore,

Critical value:

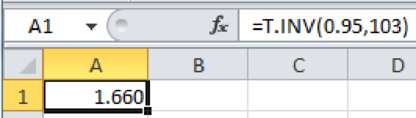

Step-by-step software procedure to obtain the critical value using EXCEL software:

- Open an EXCEL file.

- In cell A1, enter the formula “=T.INV (0.95, 103)”.

Output obtained using EXCEL is given as follows:

Decision rule:

Reject the null hypothesis H0, if

Conclusion:

The value of test statistic is 1.91 and the critical value is 1.660.

Here,

By the rejection rule, reject the null hypothesis.

Thus, there is enough evidence to infer that there is a positive association between “day on the market” and “selling price”.

The p-value of the test is 0.0591.

Check the correlation between independent variables “size of the home” and “selling price” is positive:

The hypotheses are given below:

Null hypothesis:

That is, the correlation between “size of the home” and “selling price” is less than or equal to zero.

Alternative hypothesis:

That is, the correlation between “size of the home” and “selling price” is positive.

Test statistic:

The test statistic is as follows:

Here, the sample size is 105 and the correlation coefficient is 0.952.

The test statistic is as follows:

Decision rule:

Reject the null hypothesis H0, if

Conclusion:

The value of test statistic is 31.56 and the critical value is 1.660.

Here,

By the rejection rule, reject the null hypothesis.

Thus, there is enough evidence to infer that there is a positive association between “size of the home” and “selling price”.

The p-value is approximately 0.

Want to see more full solutions like this?

Chapter 13 Solutions

Gen Combo Ll Statistical Techniques In Business And Economics; Connect Ac

- II Consider the following data matrix X: X1 X2 0.5 0.4 0.2 0.5 0.5 0.5 10.3 10 10.1 10.4 10.1 10.5 What will the resulting clusters be when using the k-Means method with k = 2. In your own words, explain why this result is indeed expected, i.e. why this clustering minimises the ESS map.arrow_forwardwhy the answer is 3 and 10?arrow_forwardPS 9 Two films are shown on screen A and screen B at a cinema each evening. The numbers of people viewing the films on 12 consecutive evenings are shown in the back-to-back stem-and-leaf diagram. Screen A (12) Screen B (12) 8 037 34 7 6 4 0 534 74 1645678 92 71689 Key: 116|4 represents 61 viewers for A and 64 viewers for B A second stem-and-leaf diagram (with rows of the same width as the previous diagram) is drawn showing the total number of people viewing films at the cinema on each of these 12 evenings. Find the least and greatest possible number of rows that this second diagram could have. TIP On the evening when 30 people viewed films on screen A, there could have been as few as 37 or as many as 79 people viewing films on screen B.arrow_forward

- Q.2.4 There are twelve (12) teams participating in a pub quiz. What is the probability of correctly predicting the top three teams at the end of the competition, in the correct order? Give your final answer as a fraction in its simplest form.arrow_forwardThe table below indicates the number of years of experience of a sample of employees who work on a particular production line and the corresponding number of units of a good that each employee produced last month. Years of Experience (x) Number of Goods (y) 11 63 5 57 1 48 4 54 5 45 3 51 Q.1.1 By completing the table below and then applying the relevant formulae, determine the line of best fit for this bivariate data set. Do NOT change the units for the variables. X y X2 xy Ex= Ey= EX2 EXY= Q.1.2 Estimate the number of units of the good that would have been produced last month by an employee with 8 years of experience. Q.1.3 Using your calculator, determine the coefficient of correlation for the data set. Interpret your answer. Q.1.4 Compute the coefficient of determination for the data set. Interpret your answer.arrow_forwardCan you answer this question for mearrow_forward

- Techniques QUAT6221 2025 PT B... TM Tabudi Maphoru Activities Assessments Class Progress lIE Library • Help v The table below shows the prices (R) and quantities (kg) of rice, meat and potatoes items bought during 2013 and 2014: 2013 2014 P1Qo PoQo Q1Po P1Q1 Price Ро Quantity Qo Price P1 Quantity Q1 Rice 7 80 6 70 480 560 490 420 Meat 30 50 35 60 1 750 1 500 1 800 2 100 Potatoes 3 100 3 100 300 300 300 300 TOTAL 40 230 44 230 2 530 2 360 2 590 2 820 Instructions: 1 Corall dawn to tha bottom of thir ceraan urina se se tha haca nariad in archerca antarand cubmit Q Search ENG US 口X 2025/05arrow_forwardThe table below indicates the number of years of experience of a sample of employees who work on a particular production line and the corresponding number of units of a good that each employee produced last month. Years of Experience (x) Number of Goods (y) 11 63 5 57 1 48 4 54 45 3 51 Q.1.1 By completing the table below and then applying the relevant formulae, determine the line of best fit for this bivariate data set. Do NOT change the units for the variables. X y X2 xy Ex= Ey= EX2 EXY= Q.1.2 Estimate the number of units of the good that would have been produced last month by an employee with 8 years of experience. Q.1.3 Using your calculator, determine the coefficient of correlation for the data set. Interpret your answer. Q.1.4 Compute the coefficient of determination for the data set. Interpret your answer.arrow_forwardQ.3.2 A sample of consumers was asked to name their favourite fruit. The results regarding the popularity of the different fruits are given in the following table. Type of Fruit Number of Consumers Banana 25 Apple 20 Orange 5 TOTAL 50 Draw a bar chart to graphically illustrate the results given in the table.arrow_forward

- Q.2.3 The probability that a randomly selected employee of Company Z is female is 0.75. The probability that an employee of the same company works in the Production department, given that the employee is female, is 0.25. What is the probability that a randomly selected employee of the company will be female and will work in the Production department? Q.2.4 There are twelve (12) teams participating in a pub quiz. What is the probability of correctly predicting the top three teams at the end of the competition, in the correct order? Give your final answer as a fraction in its simplest form.arrow_forwardQ.2.1 A bag contains 13 red and 9 green marbles. You are asked to select two (2) marbles from the bag. The first marble selected will not be placed back into the bag. Q.2.1.1 Construct a probability tree to indicate the various possible outcomes and their probabilities (as fractions). Q.2.1.2 What is the probability that the two selected marbles will be the same colour? Q.2.2 The following contingency table gives the results of a sample survey of South African male and female respondents with regard to their preferred brand of sports watch: PREFERRED BRAND OF SPORTS WATCH Samsung Apple Garmin TOTAL No. of Females 30 100 40 170 No. of Males 75 125 80 280 TOTAL 105 225 120 450 Q.2.2.1 What is the probability of randomly selecting a respondent from the sample who prefers Garmin? Q.2.2.2 What is the probability of randomly selecting a respondent from the sample who is not female? Q.2.2.3 What is the probability of randomly…arrow_forwardTest the claim that a student's pulse rate is different when taking a quiz than attending a regular class. The mean pulse rate difference is 2.7 with 10 students. Use a significance level of 0.005. Pulse rate difference(Quiz - Lecture) 2 -1 5 -8 1 20 15 -4 9 -12arrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning