Concept explainers

The North Valley Real Estate data reports information on homes on the market.

- a. Let selling price be the dependent variable and size of the home the independent variable. Determine the regression equation. Estimate the selling price for a home with an area of 2,200 square feet. Determine the 95% confidence interval for all 2,200 square foot homes and the 95% prediction interval for the selling price of a home with 2,200 square feet.

- b. Let days-on-the-market be the dependent variable and price be the independent variable. Determine the regression equation. Estimate the days-on-the-market of a home that is priced at $300,000. Determine the 95% confidence interval of days-on-the-market for homes with a mean price of $300,000, and the 95% prediction interval of days-on-the-market for a home priced at $300,000.

- c. Can you conclude that the independent variables “days on the market” and “selling price” are

positively correlated ? Are the size of the home and the selling price positively correlated? Use the .05 significance level. Report the p-value of the test. Summarize your results in a brief report.

a.

Find the regression equation.

Find the selling price of a home with an area of 2,200 square feet.

Construct a 95% confidence interval for all 2,200 square foot homes.

Construct a 95% prediction interval for the selling price of a home with 2,200 square feet.

Answer to Problem 62DA

The regression equation is

The selling price of a home with an area of 2,200 square feet is 222,624.423.

The 95% confidence interval for all 2,200 square foot homes is

The 95% prediction interval for the selling price of a home with 2,200 square feet is

Explanation of Solution

Here, the selling price is the dependent variable and size of the home is the independent variable.

Step-by-step procedure to obtain the ‘regression equation’ using MegaStat software:

- In an EXCEL sheet enter the data values of x and y.

- Go to Add-Ins > MegaStat > Correlation/Regression > Regression Analysis.

- Select input range as ‘Sheet1!$B$2:$B$106’ under Y/Dependent variable.

- Select input range ‘Sheet1!$A$2:$A$106’ under X/Independent variables.

- Select ‘Type in predictor values’.

- Enter 2,200 as ‘predictor values’ and 95% as ‘confidence level’.

- Click on OK.

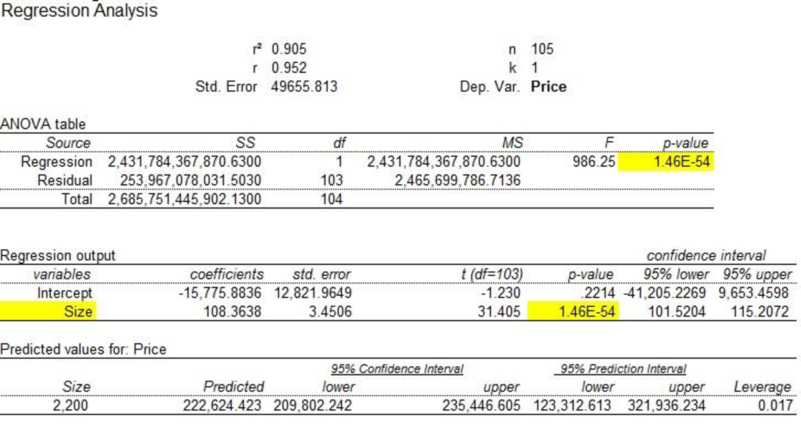

Output obtained using MegaStat software is given below:

From the regression output, it is clear that

The regression equation is

The selling price of a home with an area of 2,200 square feet is 222,624.423.

The 95% confidence interval for all 2,200 square foot homes is

The 95% prediction interval for the selling price of a home with 2,200 square feet is

b.

Find the regression equation.

Find day-on-the-market for homes with a mean price at $300,000.

Construct a 95% confidence interval of day-on-the-market for homes with a mean price at $300,000.

Construct a 95% prediction interval day-on-the-market for a home priced at $300,000.

Answer to Problem 62DA

The regression equation is

The day-on-the-market for homes with a mean price at $300,000 is 28.930.

The 95% confidence interval of day-on-the-market for homes with a mean price at $300,000 is

The 95% prediction interval day-on-the-market for a home priced at $300,000 is

Explanation of Solution

Here, the selling price is the dependent variable and size of the home is the independent variable.

Step-by-step procedure to obtain the ‘regression equation’ using MegaStat software:

- In an EXCEL sheet enter the data values of x and y.

- Go to Add-Ins > MegaStat > Correlation/Regression > Regression Analysis.

- Select input range as ‘Sheet1!$C$2:$C$106’ under Y/Dependent variable.

- Select input range ‘Sheet1!$B$2:$B$106’ under X/Independent variables.

- Select ‘Type in predictor values’.

- Enter 300,000 as ‘predictor values’ and 95% as ‘confidence level’.

- Click on OK.

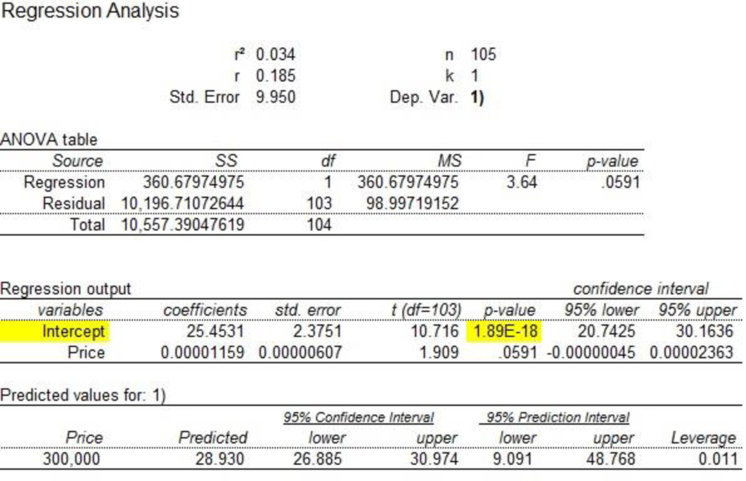

Output obtained using MegaStat software is given below:

From the regression output, it is clear that

The regression equation is

The day-on-the-market for homes with a mean price at $300,000 is 28.930.

The 95% confidence interval of day-on-the-market for homes with a mean price at $300,000 is

The 95% prediction interval day-on-the-market for a home priced at $300,000 is

c.

Check whether the independent variables “day on the market” and “selling price” are positively correlated.

Check whether the independent variables “selling price” and “size of the home” are positively correlated.

Report the p-value of the test and summarize the result.

Answer to Problem 62DA

There is a positive association between “day on the market” and “selling price”.

There is a positive association between “selling price” and “size of the home”.

Explanation of Solution

Denote the population correlation as

Check the correlation between independent variables “day on the market” and “selling price” is positive

The hypotheses are given below:

Null hypothesis:

That is, the correlation between “day on the market” and “selling price” is less than or equal to zero.

Alternative hypothesis:

That is, the correlation between “day on the market” and “selling price” is positive.

Test statistic:

The test statistic is as follows:

Here, the sample size is 105 and the correlation coefficient is 0.185.

The test statistic is as follows:

The degrees of freedom is as follows:

The level of significance is 0.05. Therefore,

Critical value:

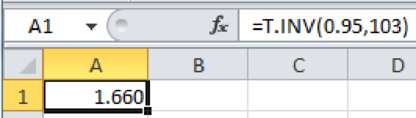

Step-by-step software procedure to obtain the critical value using EXCEL software:

- Open an EXCEL file.

- In cell A1, enter the formula “=T.INV (0.95, 103)”.

Output obtained using EXCEL is given as follows:

Decision rule:

Reject the null hypothesis H0, if

Conclusion:

The value of test statistic is 1.91 and the critical value is 1.660.

Here,

By the rejection rule, reject the null hypothesis.

Thus, there is enough evidence to infer that there is a positive association between “day on the market” and “selling price”.

The p-value of the test is 0.0591.

Check the correlation between independent variables “size of the home” and “selling price” is positive:

The hypotheses are given below:

Null hypothesis:

That is, the correlation between “size of the home” and “selling price” is less than or equal to zero.

Alternative hypothesis:

That is, the correlation between “size of the home” and “selling price” is positive.

Test statistic:

The test statistic is as follows:

Here, the sample size is 105 and the correlation coefficient is 0.952.

The test statistic is as follows:

Decision rule:

Reject the null hypothesis H0, if

Conclusion:

The value of test statistic is 31.56 and the critical value is 1.660.

Here,

By the rejection rule, reject the null hypothesis.

Thus, there is enough evidence to infer that there is a positive association between “size of the home” and “selling price”.

The p-value is approximately 0.

Want to see more full solutions like this?

Chapter 13 Solutions

EBK STATISTICAL TECHNIQUES IN BUSINESS

- Cycles to failure Position in ascending order 0.5 f(x)) (x;) Problem 44 Marsha, a renowned cake scientist, is trying to determine how long different cakes can survive intense fork attacks before collapsing into crumbs. To simulate real-world cake consumption, she designs a test where cakes are subjected to repeated fork stabs and bites, mimicking the brutal reality of birthday parties. After rigorous testing, Marsha records 10 observations of how many stabs each cake endured before structural failure. Construct P-P plots for (a.) a normal distribution, (b.) a lognormal distribution, and (c.) a Weibull distribution (using the information included in the table below). Which distribution seems to be the best model for the cycles to failure for this material? Explain your answer in detail. Observation Empirical cumulative Probability distribution Cumulative distribution Inverse of cumulative distribution F-1 (-0.5) F(x)) (S) n 4 3 1 0.05 9 5 2 0.15 7 7 3 0.25 1 10 4 0.35 3 12 5 0.45 Normal…arrow_forwardProblem 3 In their lab, engineer Daniel and Paulina are desperately trying to perfect time travel. But the problem is that their machine still struggles with power inconsistencies-sometimes generating too little energy, other times too much, causing unstable time jumps. To prevent catastrophic misjumps into the Jurassic era or the far future, they must calibrate the machine's power output. After extensive testing, they found that the time machine's power output follows a normal distribution, with an average energy level of 8.7 gigawatts and a standard deviation of 1.2 gigawatts. The Time Travel Safety Board has set strict guidelines: For a successful time jump, the machine's power must be between 8.5 and 9.5 gigawatts. What is the probability that a randomly selected time jump meets this precision requirement? Daniel suggests that adjusting the mean power output could improve time-travel accuracy. Can adjusting the mean reduce the number of dangerous misjumps? If yes, what should the…arrow_forwardProblem 5 ( Marybeth is also interested in the experiment from Problem 2 (associated with the enhancements for Captain America's shield), so she decides to start a detailed literature review on the subject. Among others, she found a paper where they used a 2"(4-1) fractional factorial design in the factors: (A) shield material, (B) throwing mechanism, (C) edge modification, and (D) handle adjustment. The experimental design used in the paper is shown in the table below. a. Run A B с D 1 (1) -1 -1 -1 1 2 a 1 -1 -1 1 3 bd -1 1 -1 1 4 abd 1 1 -1 1 5 cd -1 -1 1 -1 6 acd 1 -1 1 -1 7 bc -1 1 1 -1 abc 1 1 1 -1 paper? s) What was the generator used in the 2"(4-1) fractional factorial design described in the b. Based on the resolution of this design, what do you think about the generator used in the paper? Do you think it was a good choice, or would you have selected a different one? Explain your answer in detail.arrow_forward

- Suppose we wish to test the hypothesis that women with a sister’s history of breast cancer are at higher risk of developing breast cancer themselves. Suppose we assume that the prevalence rate of breast cancer is 3% among 60- to 64-year-old U.S. women, whereas it is 5% among women with a sister history. We propose to interview 400 women 40 to 64 years of age with a sister history of the disease. What is the power of such a study assuming that the level of significance is 10%? I only need help writing the null and alternative hypotheses.arrow_forward4.96 The breaking strengths for 1-foot-square samples of a particular synthetic fabric are approximately normally distributed with a mean of 2,250 pounds per square inch (psi) and a standard deviation of 10.2 psi. Find the probability of selecting a 1-foot-square sample of material at random that on testing would have a breaking strength in excess of 2,265 psi.4.97 Refer to Exercise 4.96. Suppose that a new synthetic fabric has been developed that may have a different mean breaking strength. A random sample of 15 1-foot sections is obtained, and each section is tested for breaking strength. If we assume that the population standard deviation for the new fabric is identical to that for the old fabric, describe the sampling distribution forybased on random samples of 15 1-foot sections of new fabricarrow_forwardUne Entreprise œuvrant dans le domaine du multividéo donne l'opportunité à ses programmeurs-analystes d'évaluer la performance des cadres supérieurs. Voici les résultats obtenues (sur une échelle de 10 à 50) où 50 représentent une excellente performance. 10 programmeurs furent sélectionnés au hazard pour évaluer deux cadres. Un rapport Excel est également fourni. Programmeurs Cadre A Cadre B 1 34 36 2 32 34 3 18 19 33 38 19 21 21 23 7 35 34 8 20 20 9 34 34 10 36 34 Test d'égalité des espérances: observations pairéesarrow_forward

- A television news channel samples 25 gas stations from its local area and uses the results to estimate the average gas price for the state. What’s wrong with its margin of error?arrow_forwardYou’re fed up with keeping Fido locked inside, so you conduct a mail survey to find out people’s opinions on the new dog barking ordinance in a certain city. Of the 10,000 people who receive surveys, 1,000 respond, and only 80 are in favor of it. You calculate the margin of error to be 1.2 percent. Explain why this reported margin of error is misleading.arrow_forwardYou find out that the dietary scale you use each day is off by a factor of 2 ounces (over — at least that’s what you say!). The margin of error for your scale was plus or minus 0.5 ounces before you found this out. What’s the margin of error now?arrow_forward

- Suppose that Sue and Bill each make a confidence interval out of the same data set, but Sue wants a confidence level of 80 percent compared to Bill’s 90 percent. How do their margins of error compare?arrow_forwardSuppose that you conduct a study twice, and the second time you use four times as many people as you did the first time. How does the change affect your margin of error? (Assume the other components remain constant.)arrow_forwardOut of a sample of 200 babysitters, 70 percent are girls, and 30 percent are guys. What’s the margin of error for the percentage of female babysitters? Assume 95 percent confidence.What’s the margin of error for the percentage of male babysitters? Assume 95 percent confidence.arrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning