Holiday Entertainment Corporation (HHC), a subsidiary of New Age Industries, manufactures go-carts and other recreational vehicles. Family recreational centers that feature not only go-cart tracks but miniature golf, batting cages, and arcade games as well have increased in popularity. As a result, HEC has been receiving some pressure from New Age’s management to diversify into some of these other recreational areas. Recreational Leasing, Inc. (RLI), one of the largest firms that bases arcade games to family recreational centers, is looking for a friendly buyer. New Age’s top management believes that RLI’s assets could be acquired for an investment of $3.2 million and has strongly urged Bill Grieco, division manager of HEC, to consider acquiring RLI.

Grieco has reviewed RLI’s financial statements with his controller. Marie Donnelly, and they believe the acquisition may not be in the best interest of HEC. “If we decide not to do this, the New Age people are not going to be happy.” said Greco. “If we could convince them to base our bonuses on something other than

New Age Industries traditionally has evaluated all of its divisions on the basis of return on investment. The desired

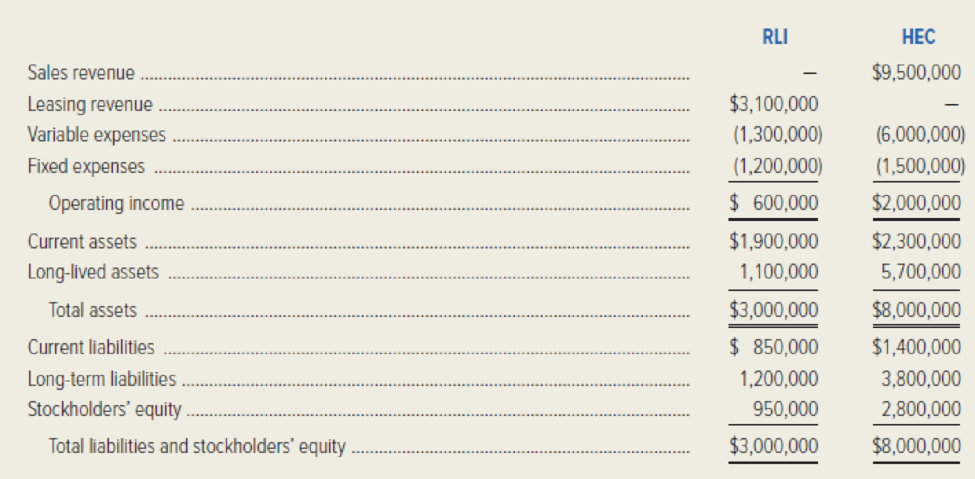

In the following table are condensed financial statements for both HEC and RLI for the most recent year.

Required:

- 1. If New Age Industries continues to use ROI as the sob measure of divisional performance, explain why Holiday Entertainment Corporation would be reluctant to acquire Recreational Leasing, Inc.

- 2. If New Age Industries could be persuaded to use residual income to measure the performance of HEC, explain why HEC would be more willing to acquire RLI.

- 3. Discuss how the behavior of division managers is likely to be affected by the use of the following performance measures: (a) return on investment and (b) residual income.

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Provide correct answer with accounting questionarrow_forwardOn August 31, Hiroshi Mart has the following financial information relating to August: Sales $12,500 Sales Returns & Allowances $1,200 Purchases $5,200 Freight-in $600 Purchase Returns & Allowances $500 Purchase Discounts $300 What are the Net Purchases for the month of August?arrow_forwardaccounting question answerarrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub